Asia stocks climb tracking Wall St rally; Japan shares set new record

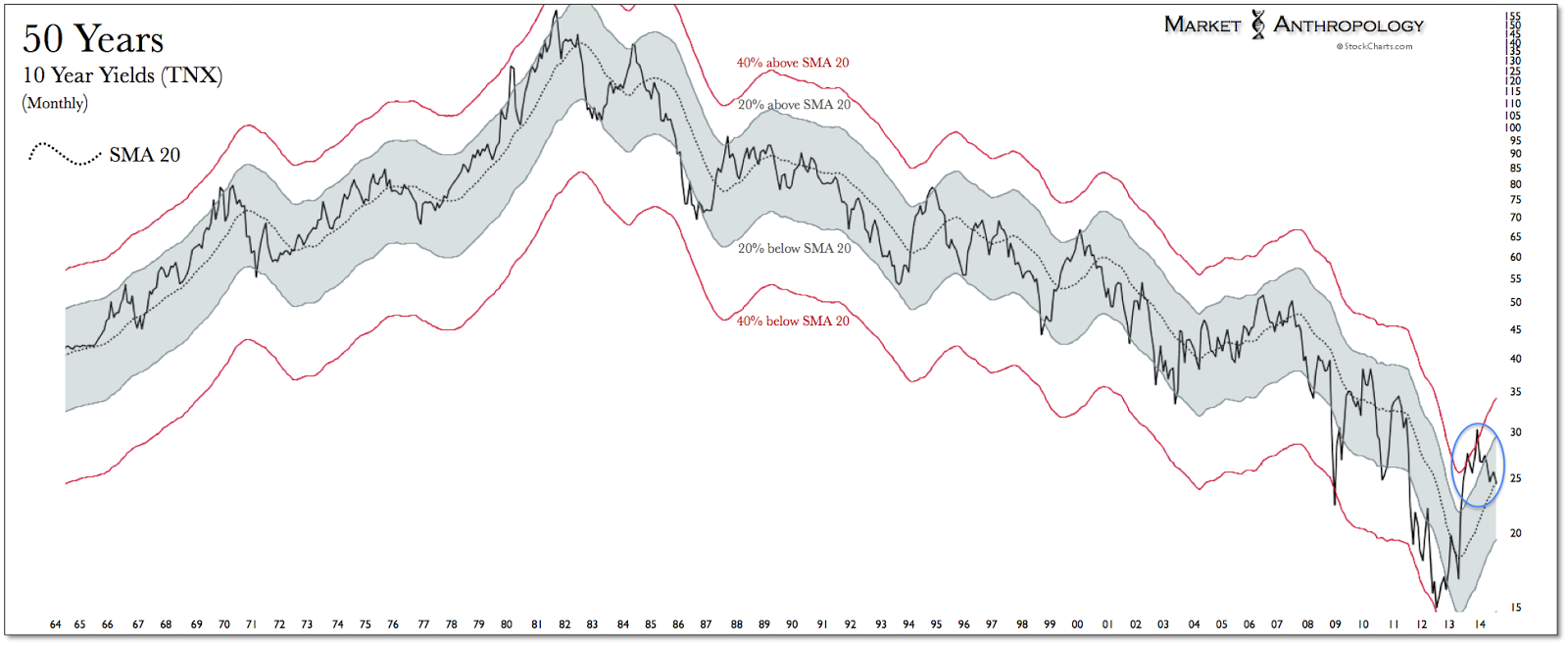

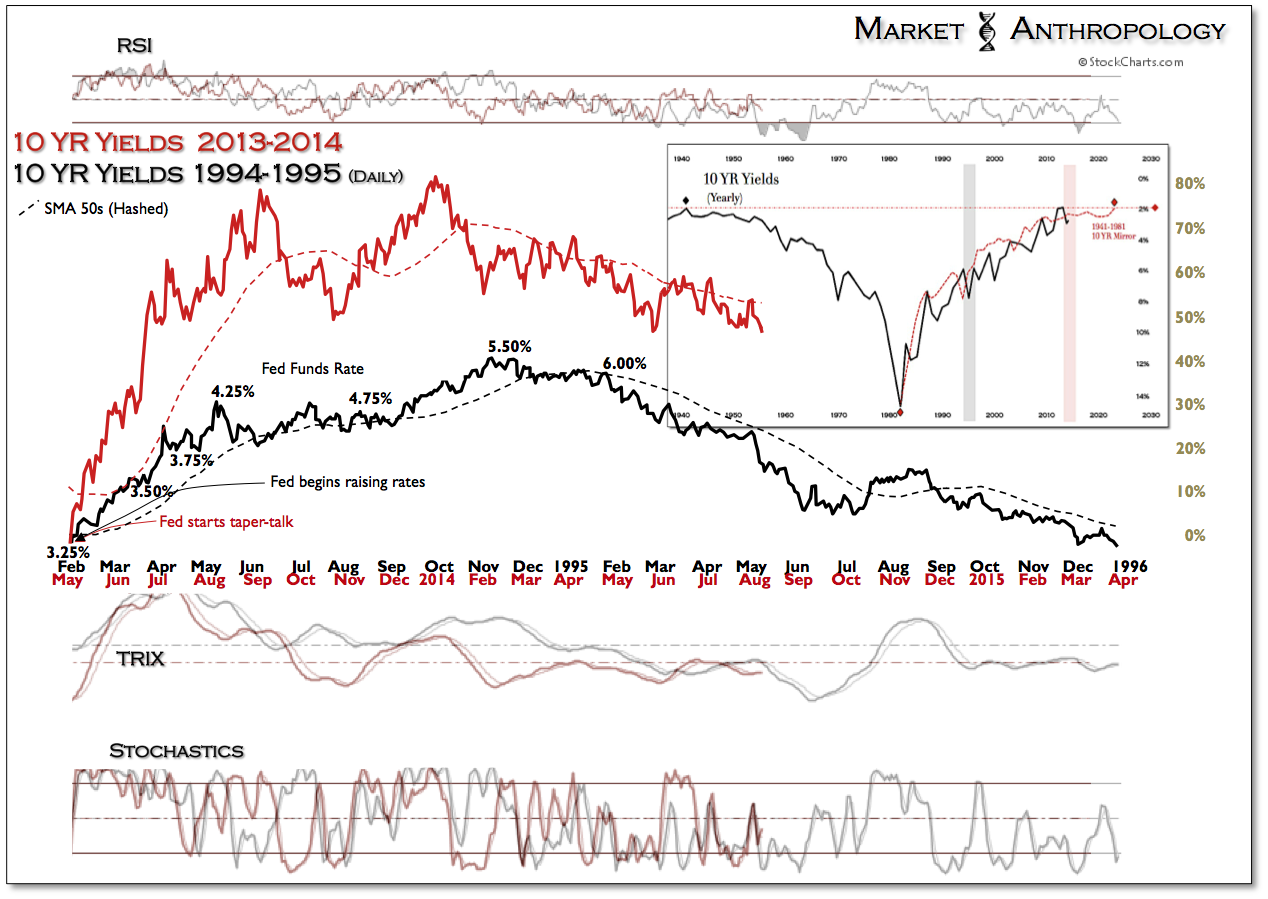

Despite indications of short-term momentum and sentiment extremes, 10-year yields continue to follow the arc of the 1994/1995 rate tightening cycle and are currently hovering around the break-zone of the May 28th lows.

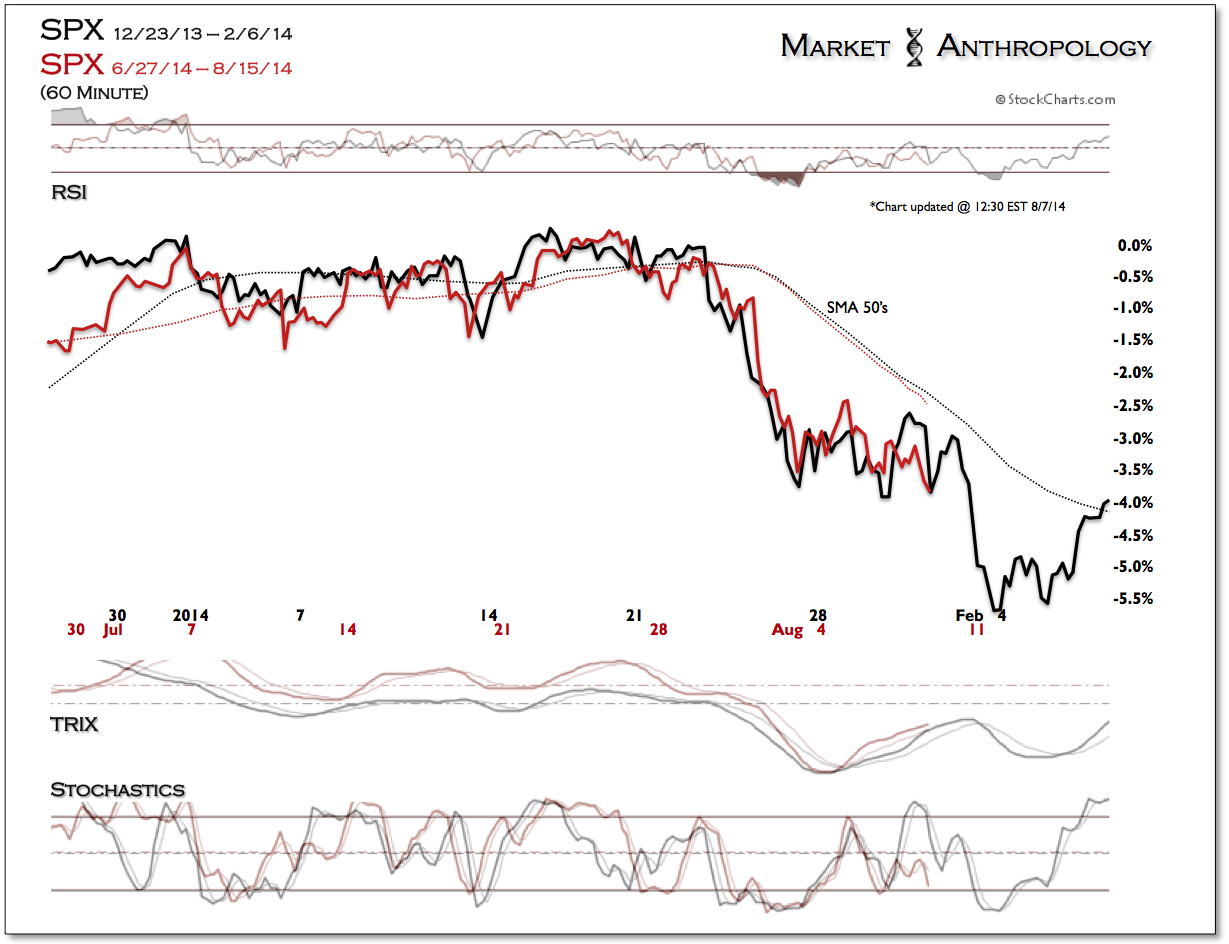

Broadly speaking, the current dynamic has maintained pressures on the equity markets, specifically the critical financial sector -- which exhibits a positive correlation with 10-year yields over the long-term. Conversely, Gold and the precious metals space should continue to benefit from the unwind in long-term yields that were stretched at a relative historic extreme coming into the year.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI