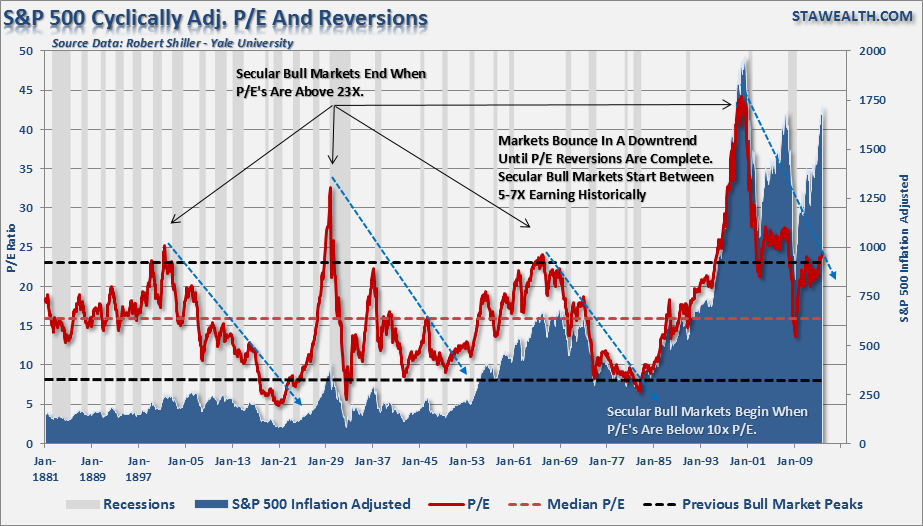

Just recently Nobel Prize winning economist Robert Shiller warned that the U.S. stock market and Brazilian property market were areas of concern. Specifically he stated:

"I am not yet sounding the alarm. But in many countries stock exchanges are at a high level and prices have risen sharply in some property markets that could end badly.

I am most worried about the boom in the U.S. stock market. Also because our economy is still weak and vulnerable.

Bubbles look like this. And the world is still very vulnerable to a bubble."

Bubbles are created when investors do not recognize when rising asset prices get detached from underlying fundamentals, which I showed is currently the case in "The Market In Pictures."

However, just recently the Mercenary Trader blog reminded me of George Soros' take on bubbles.

"First, financial markets, far from accurately reflecting all the available knowledge, always provide a distorted view of reality. The degree of distortion may vary from time to time. Sometimes it's quite insignificant, at other times it is quite pronounced. When there is a significant divergence between market prices and the underlying reality I speak of far from equilibrium conditions.

I have developed a rudimentary theory of bubbles along these lines. Every bubble has two components: an underlying trend that prevails in reality and a misconception relating to that trend. When a positive feedback develops between the trend and the misconception, a boom-bust process is set in motion. The process is liable to be tested by negative feedback along the way, and if it is strong enough to survive these tests, both the trend and the misconception will be reinforced. Eventually, market expectations become so far removed from reality that people are forced to recognize that a misconception is involved. A twilight period ensues during which doubts grow and more and more people lose faith, but the prevailing trend is sustained by inertia. As Chuck Prince, former head of Citigroup, said, 'As long as the music is playing, you've got to get up and dance. We are still dancing.' Eventually a tipping point is reached when the trend is reversed; it then becomes self-reinforcing in the opposite direction.

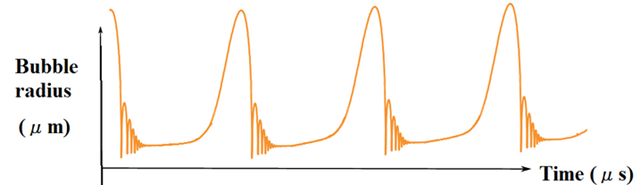

Typically bubbles have an asymmetric shape. The boom is long and slow to start. It accelerates gradually until it flattens out again during the twilight period. The bust is short and steep because it involves the forced liquidation of unsound positions."

The chart below is an example of asymmetric bubbles.  Soros' view on the pattern of bubbles is interesting because it changes the argument from a fundamental view to a technical view. Prices reflect the psychology of the market which can create a feedback loop between the markets and fundamentals. As Soros stated:

Soros' view on the pattern of bubbles is interesting because it changes the argument from a fundamental view to a technical view. Prices reflect the psychology of the market which can create a feedback loop between the markets and fundamentals. As Soros stated:

"Financial markets do not play a purely passive role; they can also affect the so-called fundamentals they are supposed to reflect. These two functions, that financial markets perform, work in opposite directions. In the passive or cognitive function, the fundamentals are supposed to determine market prices. In the active or manipulative function market, prices find ways of influencing the fundamentals. When both functions operate at the same time, they interfere with each other. The supposedly independent variable of one function is the dependent variable of the other, so that neither function has a truly independent variable. As a result, neither market prices nor the underlying reality is fully determined. Both suffer from an element of uncertainty that cannot be quantified."

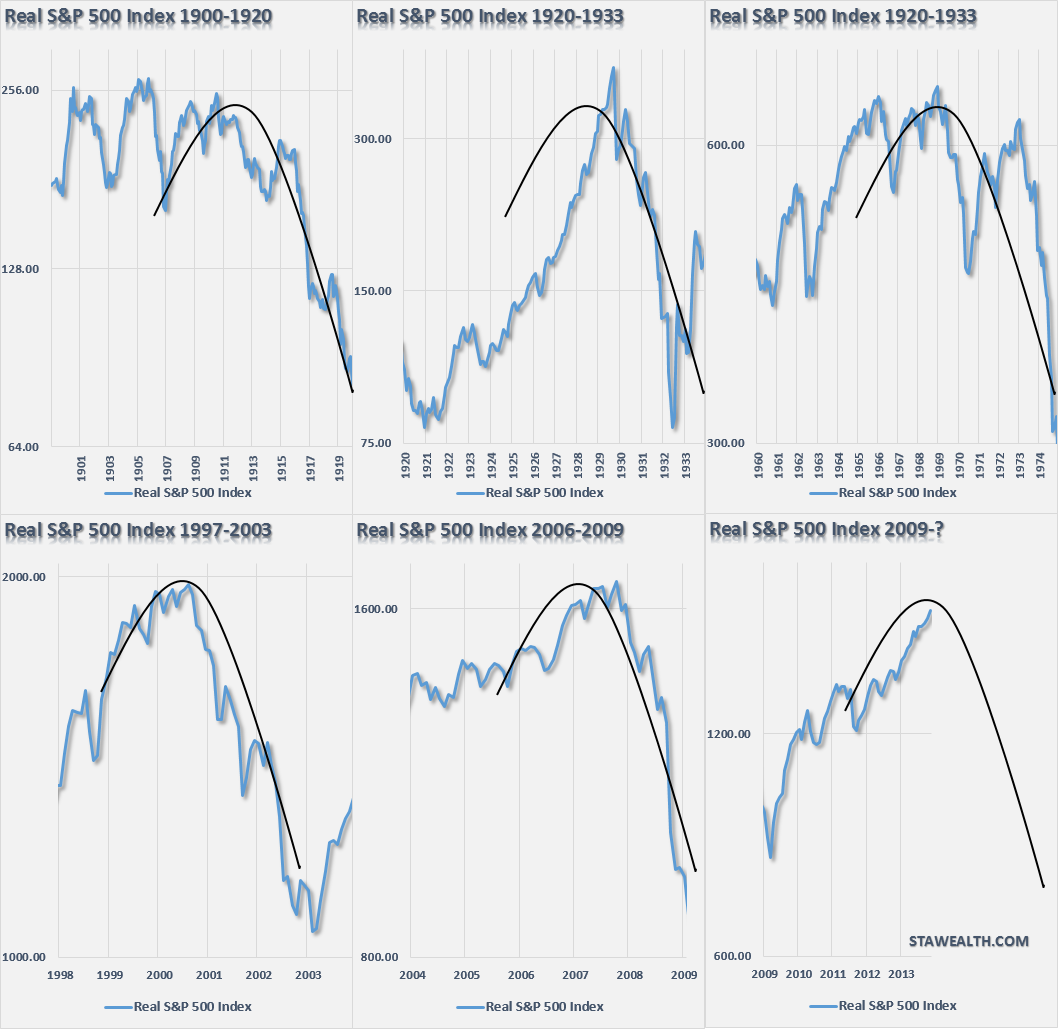

The chart below utilizes Dr. Robert Shiller's stock market data going back to 1900 on an inflation-adjusted basis. I then took a look at the markets prior to each major market correction and overlaid the asymmetrical bubble shape as discussed by George Soros.

There is currently a strong belief that the financial markets are not in a bubble despite much evidence to the contrary. However, it is likely that prices are currently driving fundamentals particularly given the artificial interventions of the Federal Reserve, which is something that I discussed back in March in "There Is No Asset Bubble?"

"The speculative appetite combined with the Fed’s liquidity is a powerful combination in the short term. However, the increase in speculative risks combined with excess leverage leave the markets vulnerable to a sizable correction at some point in the future.

The only missing ingredient for such a correction currently is simply a catalyst to put 'fear' into an overly complacent marketplace.

In the long term, it will ultimately be the fundamentals that drive the markets. Currently, the deterioration in the growth rate of earnings, and economic strength, are not supportive of the speculative rise in asset prices or leverage. The idea of whether, or not, the Federal Reserve, along with virtually every other central bank in the world, are inflating the next asset bubble is of significant importance to investors who can ill afford to, once again, lose a large chunk of their net worth.

It is all reminiscent of the market peak of 1929 when Dr. Irving Fisher uttered his now famous words: 'Stocks have now reached a permanently high plateau.' The clamoring of voices that the bull market is just beginning is telling much the same story. History is replete with market crashes that occurred just as the mainstream belief made heretics out of anyone who dared to contradict the bullish bias."

The Mercenary Trader blog imparted some excellent words of wisdom in this regard:

In other words, you don’t have to be theoretically correct in your reasoning. You just need to have the right positions on at the right time. If you are in this game to win, then it is not about being right, but making money.

Yet at the same time, as a general rule you want to be theoretically sound if at all possible… because if your portfolio is anchored to a foundation of false beliefs, or not anchored to anything at all, that increases the likelihood of getting your head handed to you.

And thus, for traders especially, the ideal is to have the best of both worlds:

The ability to maintain general theoretical correctness, i.e. the chops to recognize a false trend for what it is, coupled with the flexibility and the means to profitably exploit false trends regardless, while keeping risk under control.

There are at least three levels to the game:

- That which is real

- That which is believed

- The market’s reaction to both

And so we would argue that, right now, it is more important than ever to understand the nature of false trends, feedback loops, bubbles and the like — and the proper means of handling them all.

Does an asset bubble currently exist? Ask anyone and they will tell you "NO." However, maybe it is exactly that tacit denial that might just be an indication of its existence.

Originally posted at Lance's blog: STA Wealth Management

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI