IFR: Romney’s intention to not re-appoint Fed Chairman Ben Bernanke when his term runs out in 2014 could upset the supportive backdrop for risk assets that has resulted from ongoing quantitative easing, noted Barclays strategists Maneesh Deshpande and Rajiv Setia.

“Given how deeply the ‘Fed on hold till 2014’ view is entrenched into the market, any re-pricing of this probability could have significant repercussions.”

The assumption that a new Fed Chairman under Romney would be more hawkish and less accommodating to markets would provide additional headwinds against economic growth. The market has already started pricing in an expected change to Fed policy at the end of 2014, with the expected Fed funds rate for December 2015 rising roughly 20bp since Romney’s performance in the first debate on October 3.

This assertion is nonsense - IFR needs to do their homework. And given the resources the publication has it is surprising they haven't. First of all it is not even clear if Romney is actually going to replace Bernanke with a hawk or if this is simply part of the campaign rhetoric to grab the Ron Paul supporters' vote.

DB: Governor Romney’s criticism of monetary policy could have simply been campaign rhetoric intended to win over more conservative voters during the primary season. Governor Romney, in the end, might prove that he has campaigned to the more partisan elements of his party base, but would govern as more of a centrist. ... given the governor’s markets background, if elected he might temper any call for abrupt policy changes to avoid potential negative reactions from risk markets and knock-on effects on household or corporate savings or investment behavior.

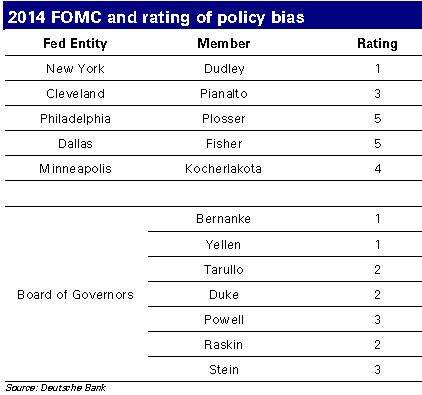

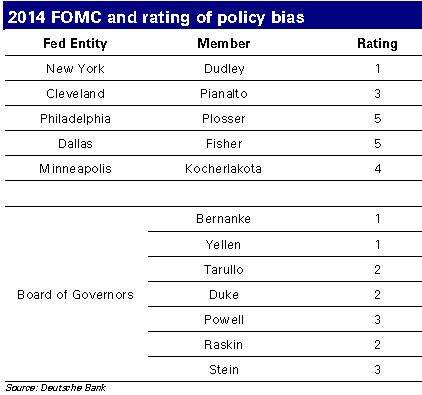

Furthermore, the removal of Bernanke will have little impact on Fed's policy - even if the new chairman is a hawk, like John Taylor for example (see discussion). Below is the 2014 FOMC lineup and a rating from DB. A score of 1 indicates an ultra-dovish member and a 5 - an ultra-hawkish one. Even by replacing Bernanke with someone that has a rating of 5 does not create a hawkish majority among the voting members.

DB: ... given the rotation of voting seats amongst the regional Fed presidents, and presuming that the Board of Governors maintains its current members, even if Bernanke were to leave in January 2014, it appears to be a stretch to presume that a majority could be crafted that was sufficiently to materially change policy, given current fundamentals.

IFR is simply wrong in this assessment - the risk of the Fed shifting policy due to the outcome of this election is minimal (whether we like it or not).

“Given how deeply the ‘Fed on hold till 2014’ view is entrenched into the market, any re-pricing of this probability could have significant repercussions.”

The assumption that a new Fed Chairman under Romney would be more hawkish and less accommodating to markets would provide additional headwinds against economic growth. The market has already started pricing in an expected change to Fed policy at the end of 2014, with the expected Fed funds rate for December 2015 rising roughly 20bp since Romney’s performance in the first debate on October 3.

This assertion is nonsense - IFR needs to do their homework. And given the resources the publication has it is surprising they haven't. First of all it is not even clear if Romney is actually going to replace Bernanke with a hawk or if this is simply part of the campaign rhetoric to grab the Ron Paul supporters' vote.

DB: Governor Romney’s criticism of monetary policy could have simply been campaign rhetoric intended to win over more conservative voters during the primary season. Governor Romney, in the end, might prove that he has campaigned to the more partisan elements of his party base, but would govern as more of a centrist. ... given the governor’s markets background, if elected he might temper any call for abrupt policy changes to avoid potential negative reactions from risk markets and knock-on effects on household or corporate savings or investment behavior.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Furthermore, the removal of Bernanke will have little impact on Fed's policy - even if the new chairman is a hawk, like John Taylor for example (see discussion). Below is the 2014 FOMC lineup and a rating from DB. A score of 1 indicates an ultra-dovish member and a 5 - an ultra-hawkish one. Even by replacing Bernanke with someone that has a rating of 5 does not create a hawkish majority among the voting members.

DB: ... given the rotation of voting seats amongst the regional Fed presidents, and presuming that the Board of Governors maintains its current members, even if Bernanke were to leave in January 2014, it appears to be a stretch to presume that a majority could be crafted that was sufficiently to materially change policy, given current fundamentals.

IFR is simply wrong in this assessment - the risk of the Fed shifting policy due to the outcome of this election is minimal (whether we like it or not).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.