BofA warns Fed risks policy mistake with early rate cuts

My fundamental review of Array Biopharma (ARRY) is available on the Motley Fool; it didn't go down too well with some shareholders...

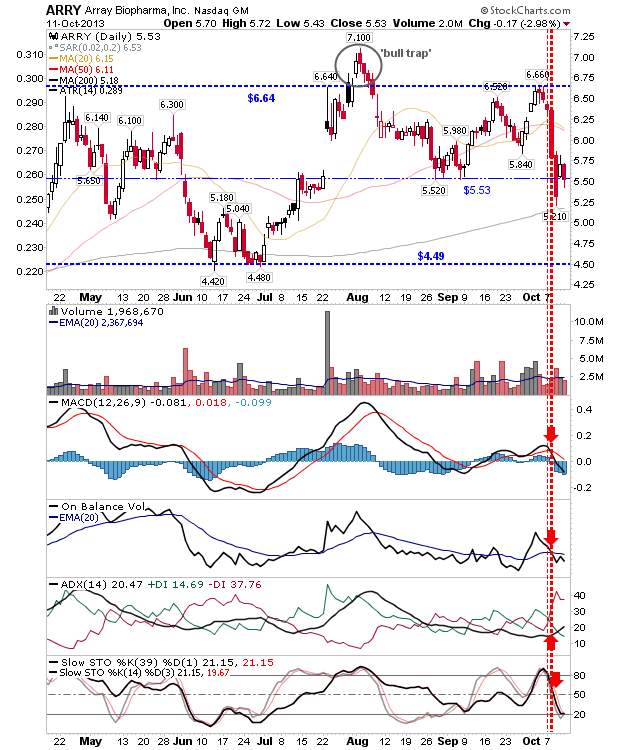

My initial assessment (not the publish date of the article), was "bullish", but the last few days have tempered this somewhat. My original opinion was for a stock which had handily cleared $6.00 resistance on big volume, and (successfully) backtested the breakout gap at $5.50 before recovering.

However, last week saw a rapid drop back to $5.50, and an eventual undercut of $5.50 which managed to hold at the 200-day MA. This drop was enough to break the bullish technical picture, which is now net bearish.

Bulls are not entirely out of the picture: $5.50 is still a point of support as of Friday's close, and the 200-day MA currently at $5.18 can't be excluded as a defense point.

Should the 200-day MA break, then the next level of support is $4.49.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.