Stock market today: S&P 500 ekes out gain as Trump says open to deals on tariffs

Precious metals have gained momentum of late. Especially Silver (NYSE:SLV), which had been lagging Gold (NYSE:GLD) for some time.

This is good news for metals heads, as the precious-metals industry loves it when silver leads.

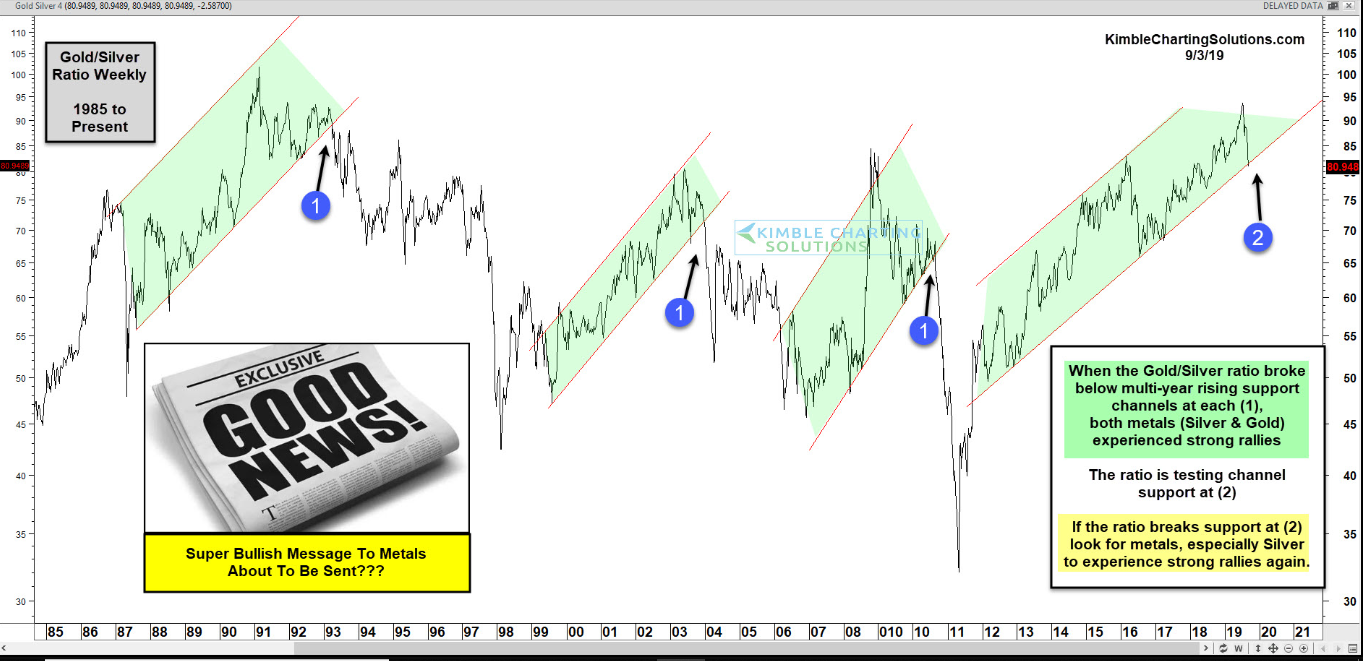

In today’s chart, we look at the Gold to Silver price ratio. With silver leading the way, the ratio is testing important support at (2).

Metals bulls want this support to give way. Why?

In the past, when the Gold to Silver ratio broke multi-year support at each (1), it has lead to strong rallies for both silver and gold.

So if a breakdown takes place once again, it should be good news for precious metals – and especially silver. Stay tuned!

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.