If ever there was a case for a fixed-income allocation, 2020 has delivered the goods in no uncertain terms in 2020. As the coronavirus crisis derailed equity markets around the world, bonds – government bonds, in particular – have providing critical support for portfolio strategies. But for US investors, the fixed-income edge has been primarily a domestic phenomenon. Foreign bonds, by contrast, have posted weak gains at best so far this year (through June 11), based on a set of proxy ETFs.

Corporates and intermediate governments in the foreign space are up modestly in 2020. But due to foreign-exchange risk and other factors, most of the offshore-bond realm has lost ground year to date from the perspective of US-based investors measuring results through a select group of ETFs.

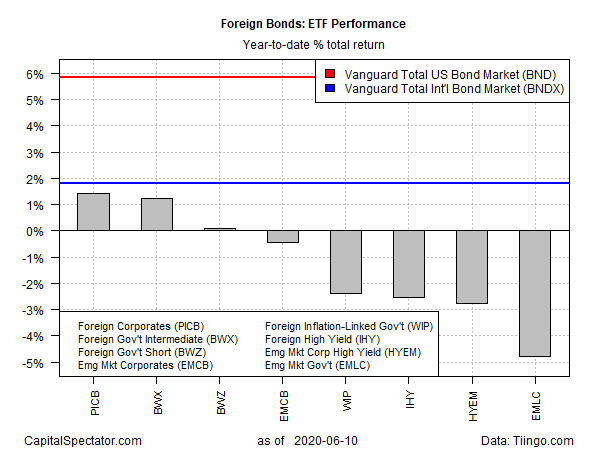

By contrast, the US fixed-income benchmark has posted a solid gain so far in 2020. The Vanguard Total Bond Market ETF (NASDAQ:BND) is ahead 5.8% through Wednesday’s close (red line). As the chart below shows, that’s well ahead of the broadly defined international bond category.

The foreign-bond benchmark is also in positive terrain year to date. But even after hedging out forex risk, the Vanguard Total International Bond ETF (NASDAQ:BNDX) has posted a weak gain – a relatively soft 1.8% total return through June 10 (blue line).

Although BNDX hedges out forex risk, it’s not obvious that exposing a foreign bond portfolio to the currency factor has been helpful this year from a US-investor perspective. The rest of the bond funds in the chart above (other than BNDX) are mostly unhedged bond portfolios.

The strongest year-to-date performer (other than the international benchmark fund) is Invesco International Corporate Bond ETF (NYSE:PICB), which is up 1.4% so far this year. The second-best performer: SPDR® Bloomberg Barclays International Treasury Bond ETF (NYSE:BWX), ahead by 1.2% this year.

The biggest year-to-date loser: VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC), which is down 4.8%.

In theory, holding foreign bonds denominated in local currencies offers a diversification tool relative to US assets denominated in dollars. There’s merit in that view, at least in some cases, depending on how a portfolio is designed and managed. Nonetheless, for US investors tapping ETFs to access foreign bond risk, 2020 so far hasn’t been an encouraging year.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI