Apple (AAPL) broke support, Thursday, which made us rethink possible downside scenarios and what bulls should watch for.

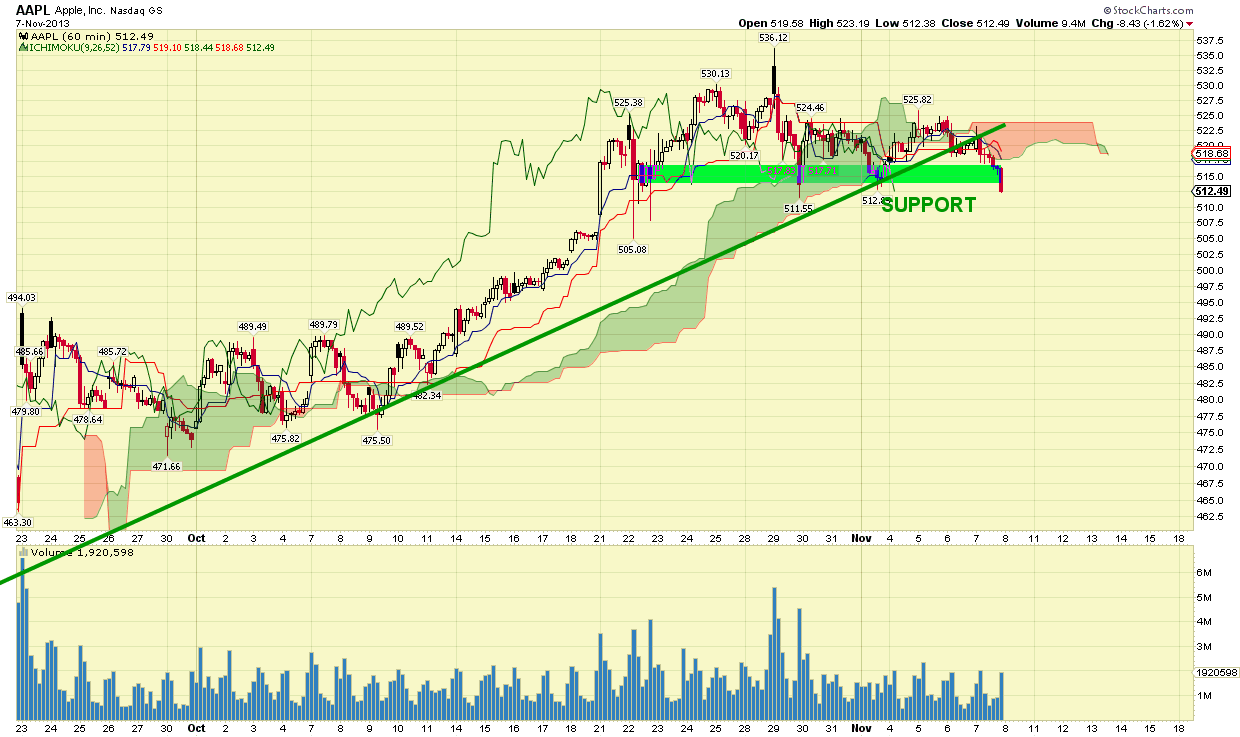

Opportunities are ample for trading both the downside and upside so we should be flexible and follow the trend. Currently, prices have broken the Ichimoku cloud support and the upward-sloping trend line in the one-hour chart.

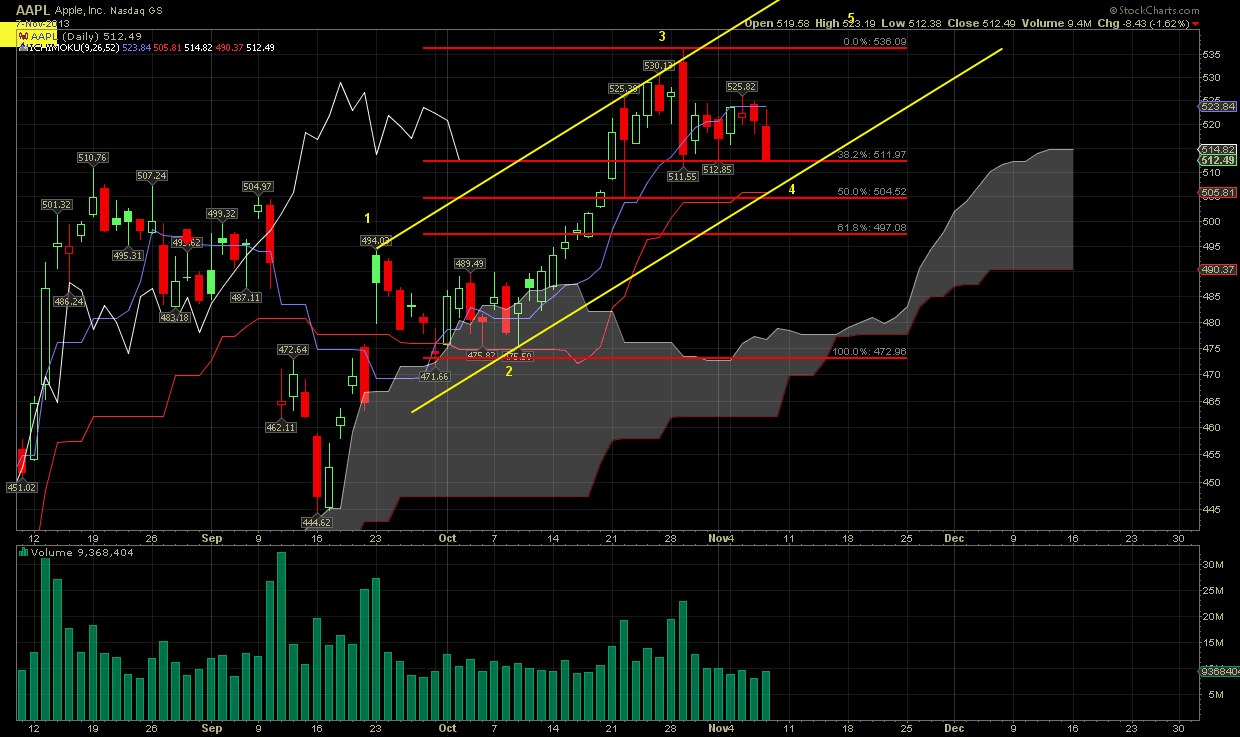

According to the 60-minute chart above, we're bearish with $525 as a stop. The above chart also shows that prices could free fall to $490 at least, where the previous consolidation area is. However, if we look at the daily chart below, we could see a bullish alternative for Apple that sees price reaching $550-$570.

Also on the daily chart above, we can clearly see the upward-sloping yellow channel. We have drawn a parallel of the line that connects waves 1 and 3 and started it from wave 2 in order to see where wave 4 could end. Prices have corrected 38% of wave 3 up and the downward correction is possible and valid according to EWT to even reach $504 -- or a 50% retracement exactly on the lower channel boundaries.

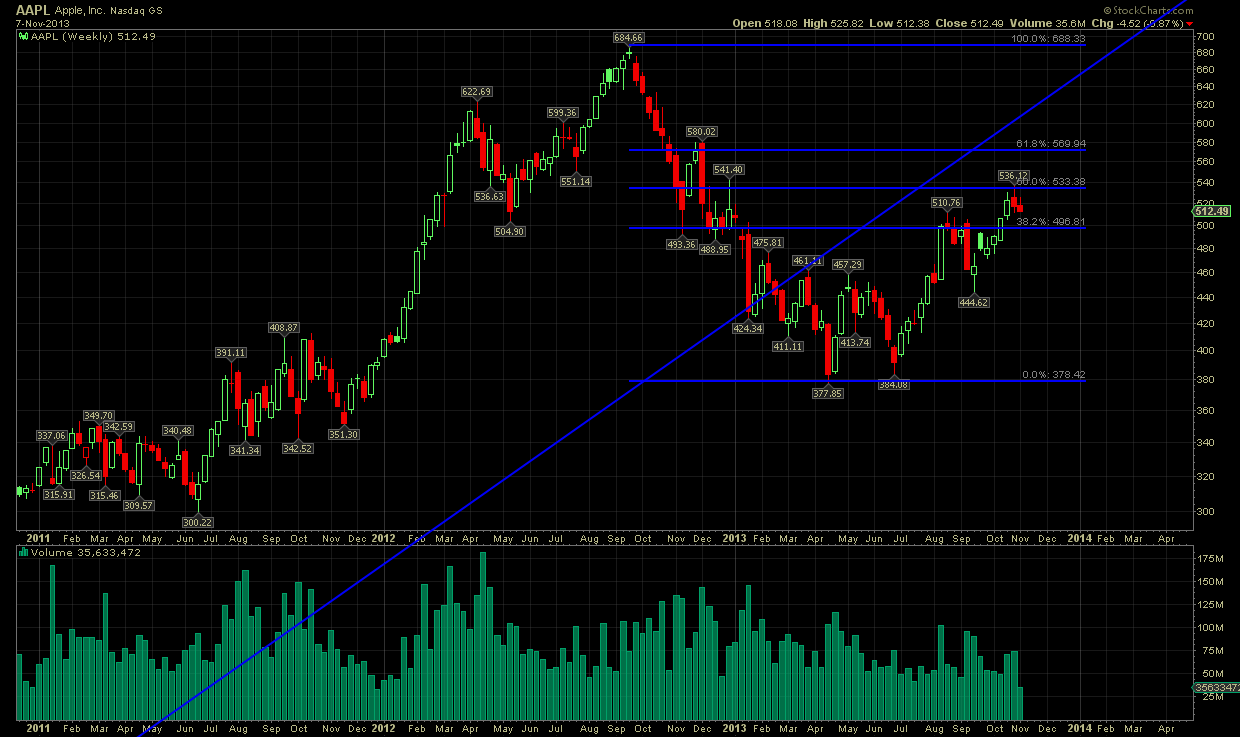

The weekly chart above shows that prices have reached the 50% retracement from the highs. If Apple is in its final corrective wave up -- or in a new upward move -- we should expect the current wave to unfold and complete 5 waves up from above $504. So bulls could use that level as a stop. Important resistance level as shown in the weekly chart is $569, where the 61,8% Fibonacci retracement is. So the next couple of sessions are important for Apple as far as its intermediate-term trend. It could target $570 and higher or confirm a top and start a new downward move toward $400.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI