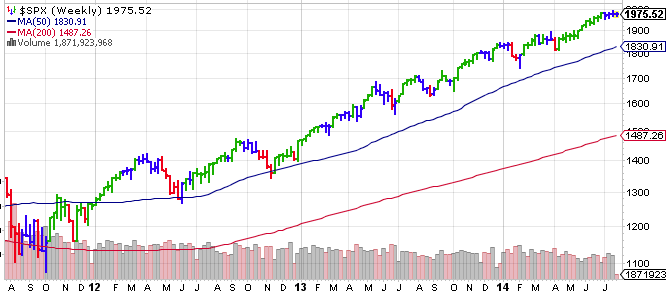

The Elder Impulse indicator now has four blue bars. In the past this condition has usually preceded a down turn. This is one more ancillary indicator that is stalling. Remember, tops are a process and we usually see indicators fall one at a time until they reach critical mass and cause the market to fall. We’re still a long way away from any warning from the totality of indicators I watch, but every day it seems one more caution sign appears. It’s time to make a list of stocks you wouldn’t want to hold during a down trend…and think about other methods to hedge your portfolio.

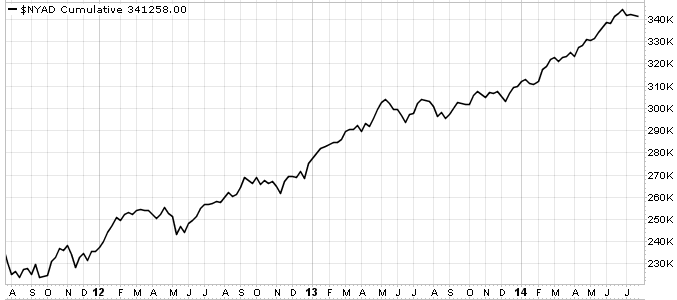

The NYSE Advance/Decline (NYAD) line is painting the largest divergence in nearly a year, but still isn’t at a critical level. As I’ve stated many times before, I don’t think the market can suffer a substantial decline unless breadth breaks down. Keep an eye on NYAD, stocks above their 200 dma, and the bullish index.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.