Trump slaps 30% tariffs on EU, Mexico

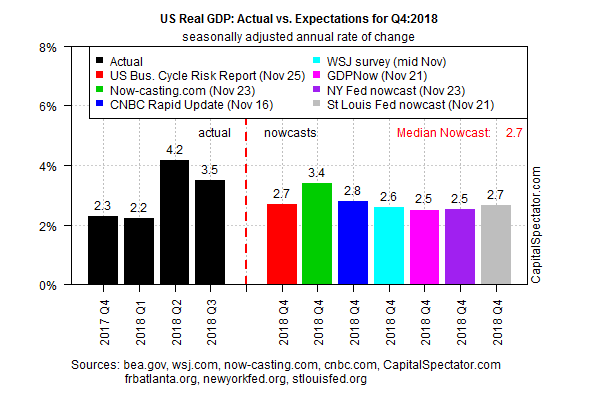

Economic activity for the US appears headed for a second quarterly slowdown in the final three months of this year. The projection is based on a set of nowcasts compiled by The Capital Spectator. The current median estimate: a 2.7% increase in real growth (seasonally adjusted annual rate), which is slightly below the previous outlook published in early November.

If the current median forecast is correct, US growth is on track to decelerate for the second straight quarter and reinforce the view that the economy peaked in this year’s Q2, when GDP expanded at a strong 4.2% pace.

Bloomberg highlights the macro headwinds that may be strengthening in the months ahead, noting that the blowback from a trade war with China and the fading stimulus from tax cuts are weighing on the outlook.

These challenges will test corporate America’s appetite to invest in the kind of faster-growth, higher-productivity future the Trump administration has promised. While such spending picked up in early 2018 after plodding along for years, a string of weak reports raises questions about the outlook. With firms using tax savings for buybacks and dividends rather than investment, the best gains may already be over.

Ian Shepherdson, chief economist for Pantheon Macroeconomics, recently wrote in a research note: “We’d be very surprised to see output growth picking up further from here; all the manufacturing cyclical indicators we follow have peaked, and some are declining.”

Last week’s preliminary estimate of the US Composite PMI for November, a survey based reading of economic activity, points to “warning flags” that support the case for anticipating a softer expansion. “In particular, growth of hiring has waned as companies grew somewhat less optimistic about the outlook,” said Chris Williamson, chief business economist at IHS Markit.

Goods exports also appear to also be coming under increasing pressure, often linked to trade wars having dampened demand. However, it should also be remembered that some pull back in growth was to be expected after October’s numbers were boosted by a post-hurricane rebound, especially given the historically high levels of production, order books and employment

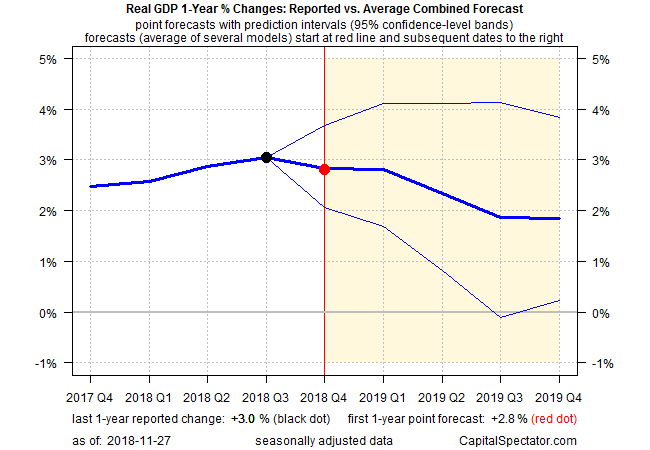

Projecting GDP in terms of year-over-year changes also suggests that growth has peaked. The chart below shows estimates for one-year GDP comparisons, based on the average forecast of seven models (including ARIMA, VAR and neural net applications). The outlook anticipates that the 3.0% annual increase in real GDP in the third quarter will edge lower over the next year.

The good news is that the anticipated slowdown is expected to be gradual and so the probability remains low that a new recession is on the immediate horizon, as last week’s economic profile advised.

Meantime the incoming numbers continue to suggest that nine-year-old expansion will slow.

“Growth is likely to slow significantly next year, from a recent pace of 3.5 percent-plus to roughly our 1.75 percent estimate of potential by end-2019,” according to Jan Hatzius, chief economist for the investment bank, in a note published earlier this month. “We expect tighter financial conditions and a fading fiscal stimulus to be the key drivers of the deceleration.”

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.