What a surprise. The ECB is now signaling it will delay the periphery bond purchases that everyone is waiting for.

Bloomberg: European Central Bank President Mario Draghi may wait until Germany’s Constitutional Court rules on the legality of Europe’s permanent bailout fund before unveiling full details of his plan to buy government bonds, two central bank officials said.

With the court set to rule on September 12, investors looking for Draghi to announce a definitive purchase program at his September 6 press conference might be disappointed, according to the officials, who spoke on condition of anonymity because the deliberations are not public. The program is still being worked on and staff may not be able to finalize it by then, said the officials, who are familiar with thinking on the ECB Governing Council. An ECB spokesman in Frankfurt declined to comment.

Is this the excuse they are coming up with? Germany’s Constitutional Court is widely expected to approve the ESM, even if it decides to attach some strings to ESM's implementation. But now the ECB's decision is somehow tied to that approval? The reality is that there simply is no agreement on the asset purchase plan. The detail has not been worked out and the ECB is buying time.

Bloomberg: While Draghi is likely to give a progress report on the bond plan after the September 6 rate decision, the ultimate design of the ECB’s program may depend on the uncertainty over the permanent bailout fund being resolved, so the officials said it makes sense to wait for the German ESM court ruling.

Full details of the ECB’s plan could be a month away, they said. While the Bundesbank opposes ECB bond purchases, it expects to be outvoted, one of the officials said. Here is JPMorgan's take on the delay:

JPM: We regard [waiting for German Constitutional Court decision] as something of a smokescreen. Very few think there is a high probability that the German Constitutional Court will deem the ESM unconstitutional and prevent its progress into law at this stage. While the Court may express some misgivings about the legislation and suggest modifications as it is put into practise, it is most unlikely to be blocked. We would not expect the ECB to delay its actions on the basis on what remains a low probability event at this stage. Rather, we would expect them to take the German Government at its word that it can deliver on the political undertakings it has made, until it discovers otherwise.

The “excuse” of the ruling on September 12 only has any substance to the extent that [the ECB is not ready with the asset purchase plan] is true – that work on the design of the plan is incomplete. The idea that work “is not complete” may also be a euphemism for the fact agreement on the contours of the policy is proving elusive. Even allowing for the summer break in August, an institution with the resources of the ECB has the ability to complete the technical issues in policy design over the period between meetings if it is minded too.

Draghi has already “played for time” once with his sketch of policies still to be designed at the last meeting. Ultimately, we suspect Draghi and others at the ECB will recognise that continued delay in finalising its policy decisions contributes to the sense that opinion on the Governing Council is deeply divided, and hence its commitment to any policy intervening in markets will not run deep. That, in turn, could undermine the effectiveness of policy interventions themselves.

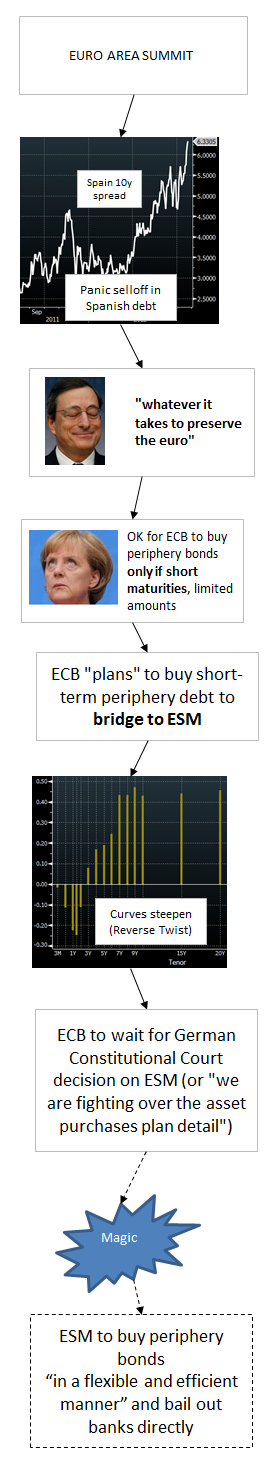

How many times have we seen this scenario play out? The Eurozone leadership declares that it has the ultimate solution that ends up failing at the implementation stage. This certainly feels like one of those situations. Here is the "revised" chain of eurozone events (discussed earlier).

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI