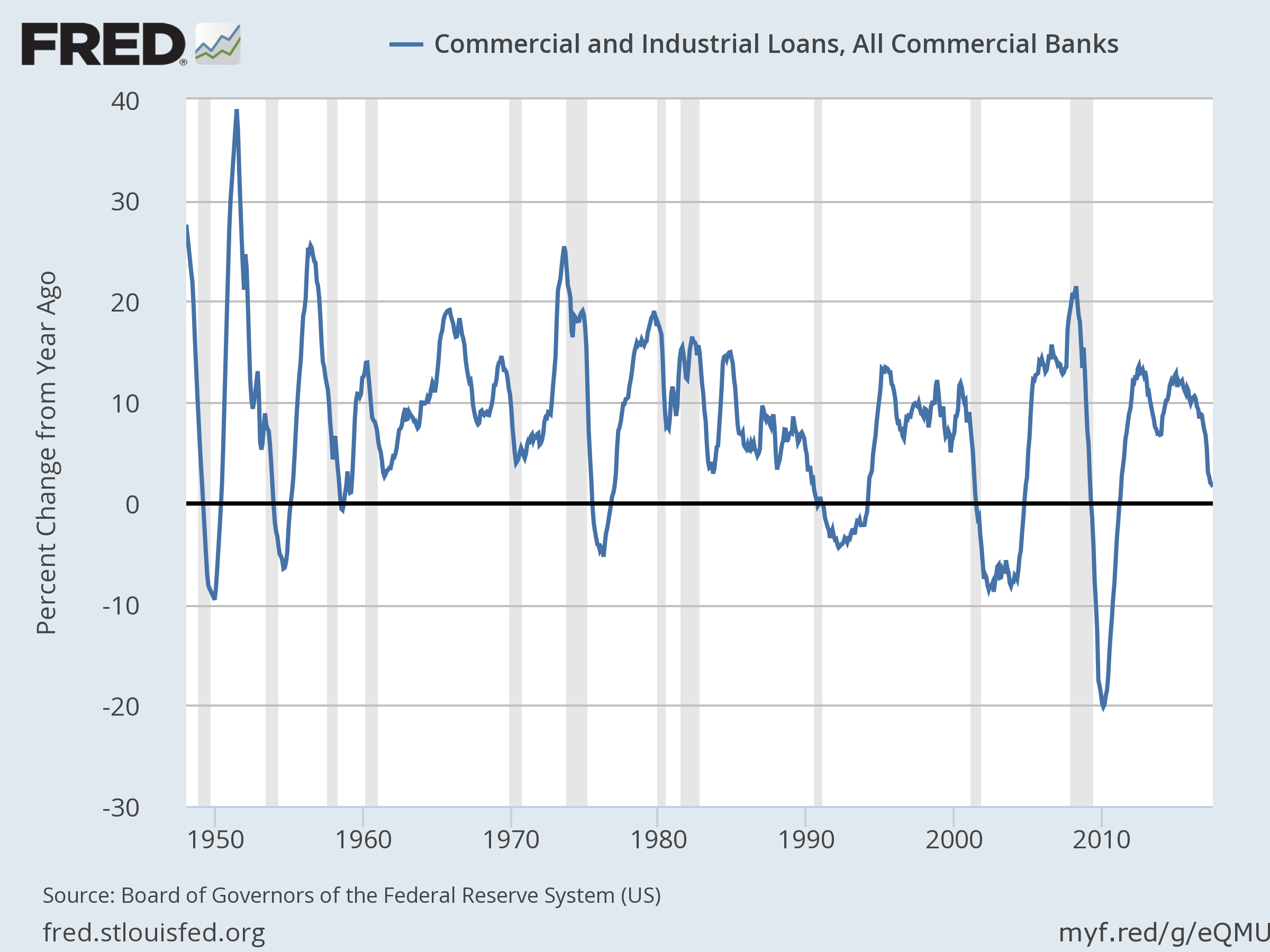

The year-over-year growth rate for commercial and industrial loans eased to 1.6% in July, according to last week’s update by the Federal Reserve. The deceleration, the slowest pace since April 2011, looks worrisome in the eyes of some analysts.

Jeffrey Gundlach, manager of the Double Line Total Return Bond Fund, told CNBC on Tuesday that he’s monitoring the sluggish increase in commercial lending. He noted that historically the Fed had started to “ease interest-rate conditions with this drop in loan growth of this magnitude … But this time the Fed wants to raise rates.”

Looking at loan growth in isolation as a business-cycle indicator, however, has a mixed record at best. As discussed recently by The Capital Spectator, business lending has been slow to signal rising recession risk since the 1950s. The main exception is the 1990-91 downturn, when the growth rate for loans fell sharply in the months before the NBER-defined recession began.

The challenge for economists and investors now: deciding if the weak rate of loan growth is a reliable signal this for macro trouble ahead. One reason for skepticism is the generally upbeat profile for the US macro trend, based on data published to date. Last month’s business-cycle review, for instance, reflected a low probability that a new downturn had started.

The latest estimates for third-quarter GDP growth also paint an upbeat profile for the near term. The September 8 GDPNow estimate via the Atlanta Fed projects that output will hold at a solid 3.0% pace in Q3, unchanged from Q2. The New York Fed’s Q3 nowcast, which uses a different methodology, is weaker at 2.1% (as of September 8), but that’s still firm enough to keep economic activity humming.

Wall Street economists are expecting that the GDP will rise at a healthy rate in the current quarter. CNBC’s Sep. 8 survey reflects a median forecast of 2.9%, which is only fractionally below Q2’s 3.0% rise.

If the soft rate of business-loan growth is an early warning sign, perhaps the August data on retail sales and industrial production due this Friday (September 15) will offer a degree of confirmation. Using Econoday.com’s consensus forecasts as a guide suggests that the monthly growth rate for both indicators will decelerate vs. the previous month, but that looks like noise by way of the implied year-over-year gains. Indeed, in both cases the annual pace of growth is on track to tick higher for August, a forecast that undercuts the case for expecting an economic slowdown based on the sluggish lending activity.

Forecasts can be wrong, of course, and so weaker-than-expected results for industrial activity and retail spending would raise new questions about what’s in store for the US macro trend in the final months of 2017. Based on what we know right now, however, it’s still reasonable to treat the weak pace of business-loan growth as an outlier.