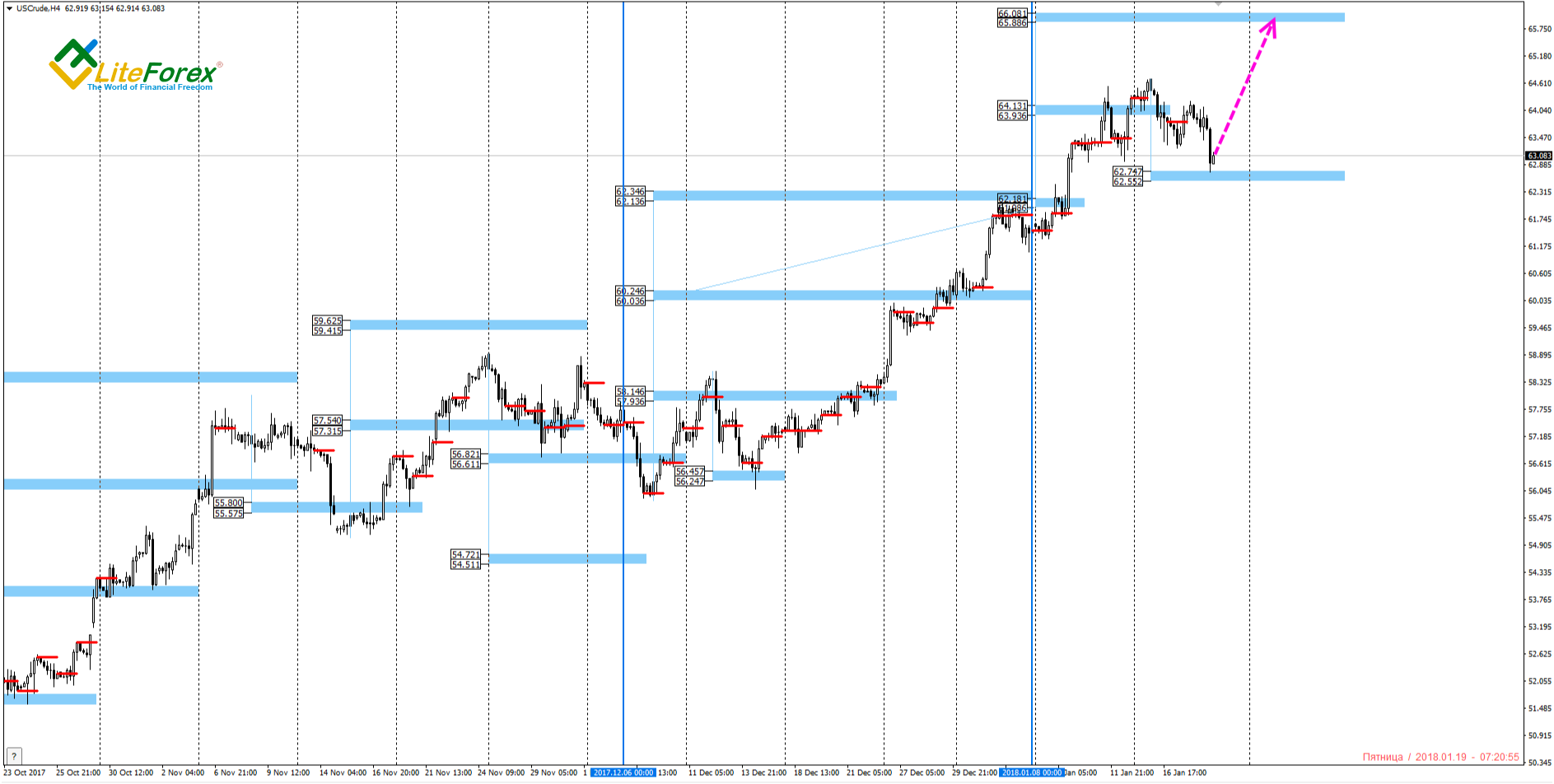

Oil trend reversed downwards, and the middle-term support was reached WTI

Oil price is testing the key support to the middle-term uptrend at [62.74 – 62.55]. As long as this range is held, we look for middle-term buys with the target in the range of [66.08 – 65.88].

Short-term trend reversed downwards: oil price started to move according to the alternative scenario, described in yesterday’s article. Today the quotes have reached Target Zone [62.74 - 62.55].

Further decrease will depend on bears ability to close the price below TZ.

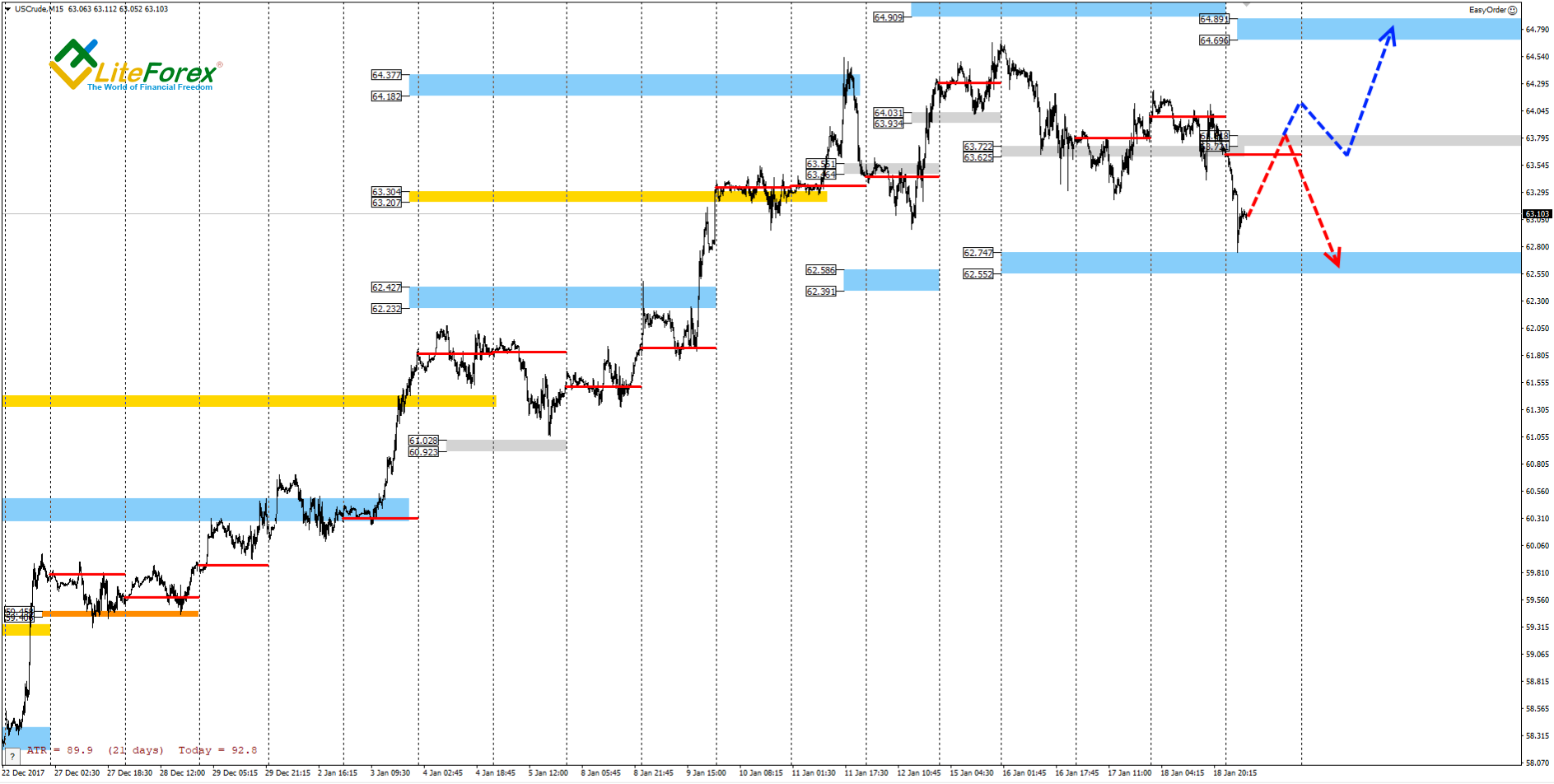

In case of correction, the key resistance will be Intermediary Zone [63.81 – 63.72]. When the zone is reached, we will primarily look for sells. It is broken out, we will resume buying in the short term.

Today's trading tips for oil:

Sell in Intermediary Zone [63.81 – 63.72]. TakeProfit: Target Zone [62.74 - 62.55]. StopLoss: 64.14.

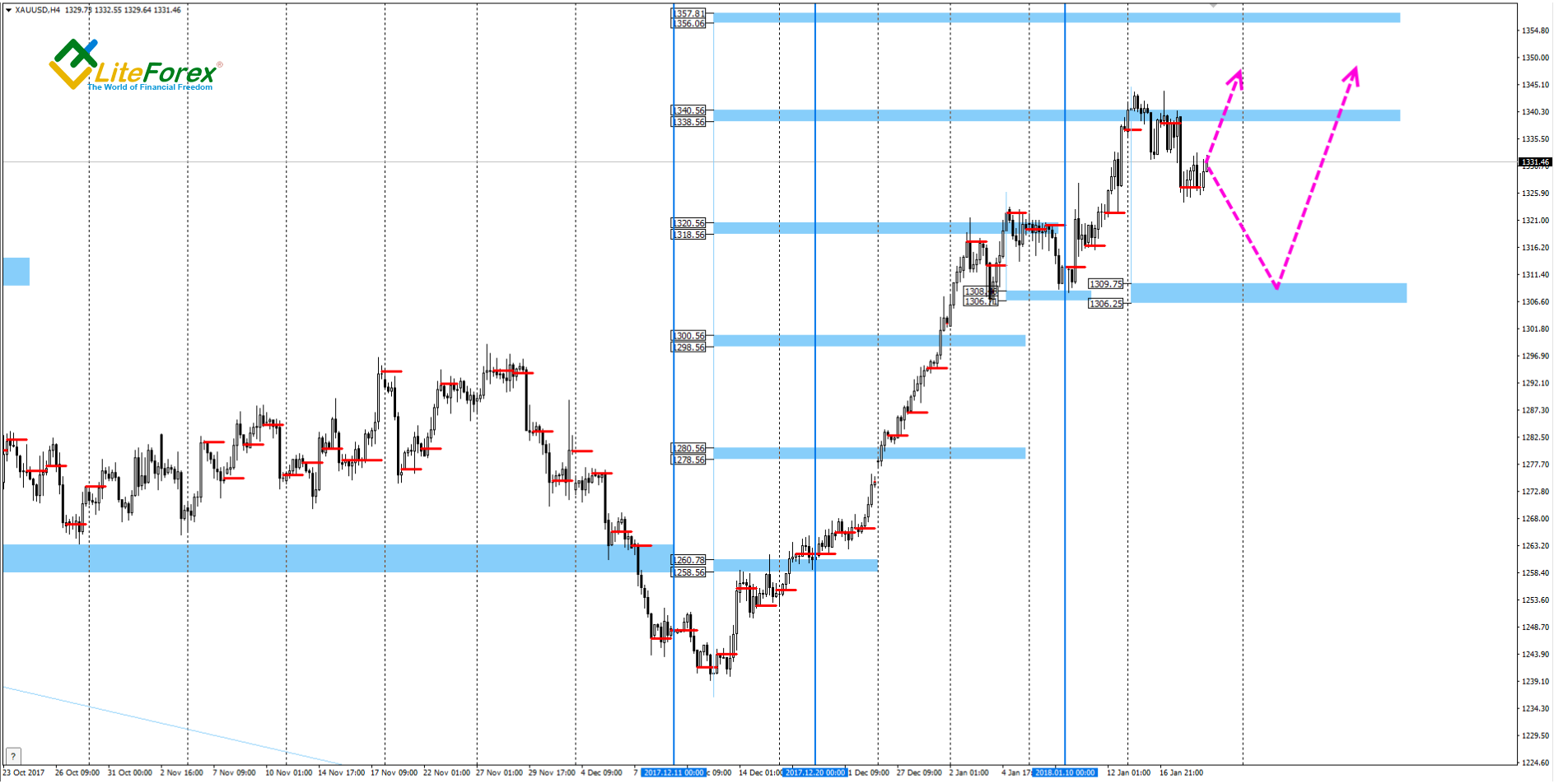

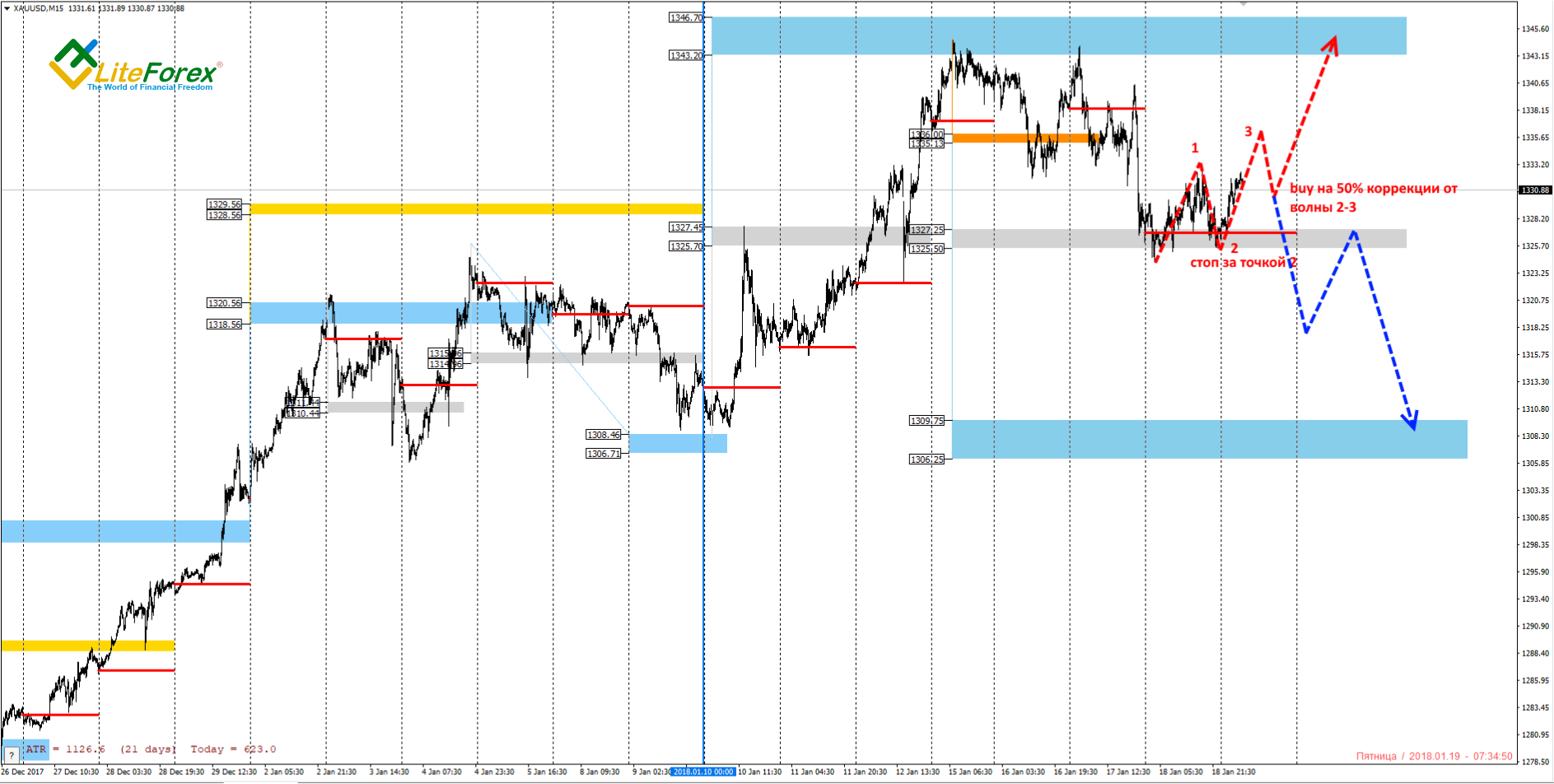

XAU/USD

Gold quotes are being corrected to the global uptrend. Strong middle-term support is Target Zone [1309.7 – 1306.2], where we can look for new buys.

The short-term trend remains upward. Now, the price curve is forming a candlestick pattern, similar to «1-2-3». If it is completely formed, I recommend buying the metal during the correction. The target will be January 15th’s renewal.

Alternative scenario: sell gold down to lower Target Zone [1309.7 – 1306.2]. It will be relevant if the key support at [1327.2 – 1325.5] is broken out and the American session closes below the zone.

Today’s trading tips for gold:

Buy according to the pattern in Intermediary Zone [1327.2 – 1325.5]. TakeProfit: Target Zone [1346.7 – 1343.2]. StopLoss: according to the pattern rules.XAG/USD

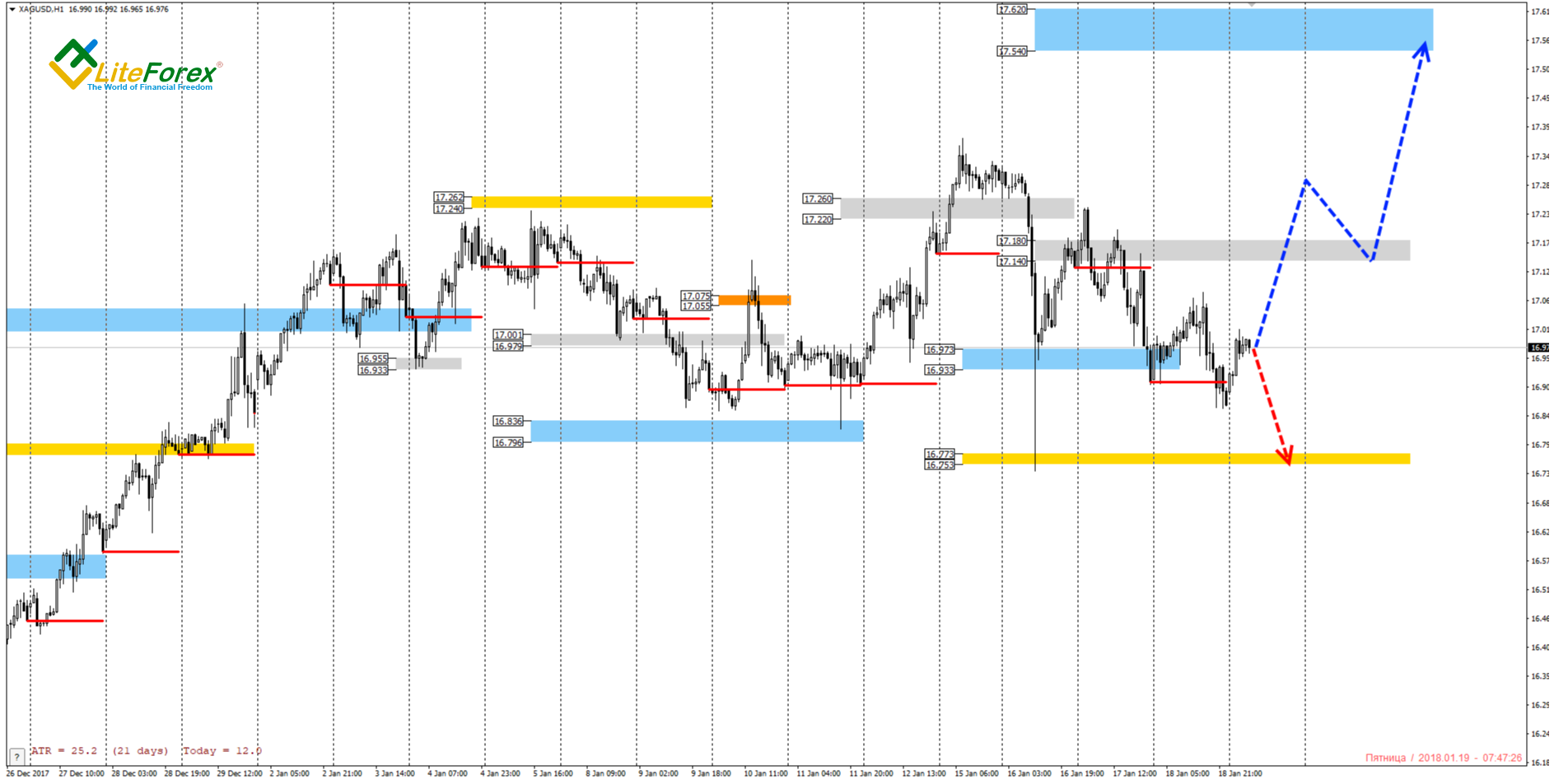

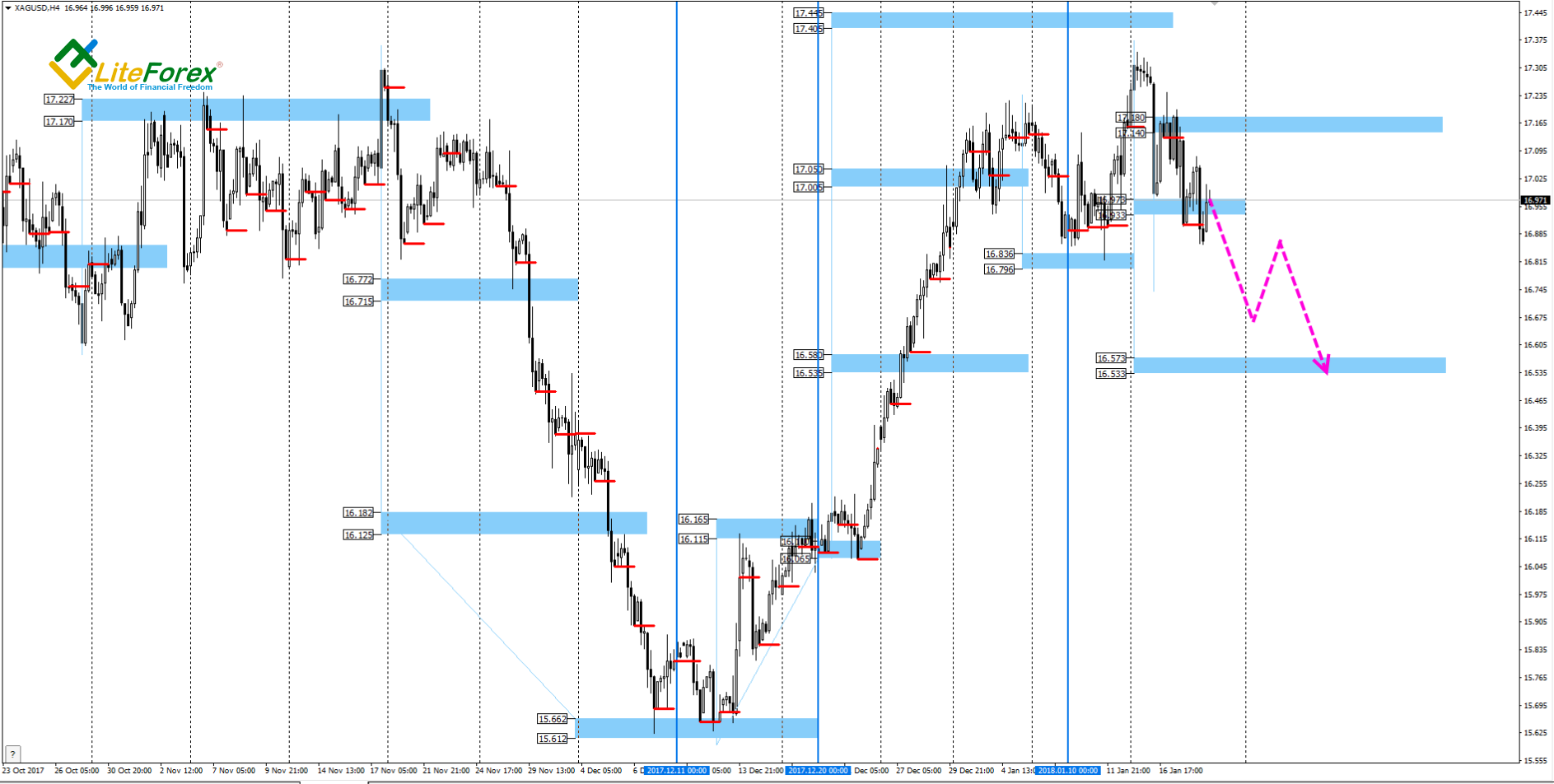

Silver, unlike gold, is trading in the middle-term downtrends, according to marginal zones. The middle-term sell target is Target Zone 2 [16.57 – 16.53].

Let’s detail the situation for intraday trading in the chart with additional marginal zones. On January 17th Target Zone [16.97 – 16.93] was broken out, so the next downward target will be Gold Zone [16.77 – 16.75]. According the trading tips, traders should also have positions in IZ [17.26 – 17.22] at breakeven. You can add to sells or open new ones during the local corrections.

Buying will be relevant if there is a buy impulse that breaks out IZ and consolidates the price above. If so, the target will be upper TZ [17.62 – 17.54].