Bitcoin price today: muted near $114k amid Fed rate, independence concerns

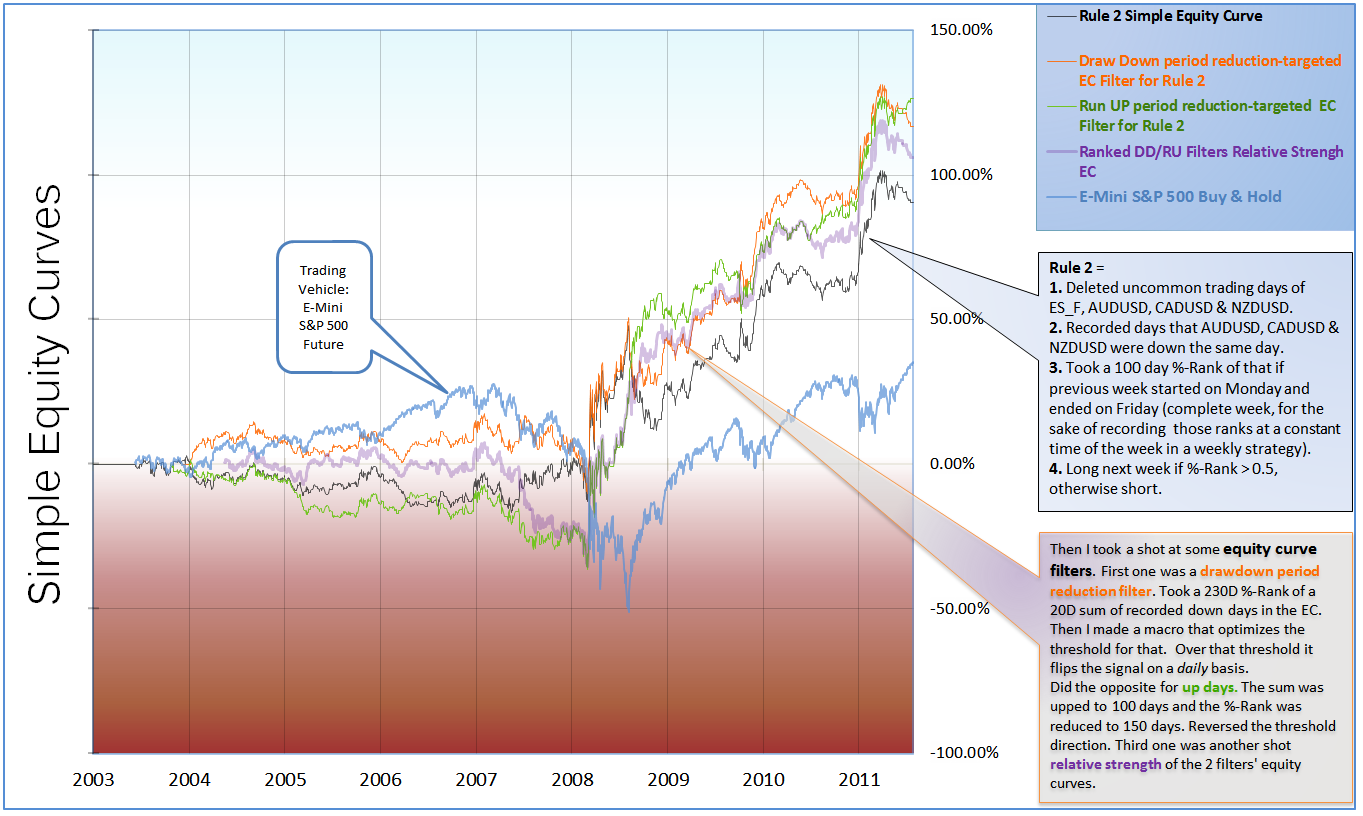

I’ve been working on bigger projects till about a week ago then I got real curious about a trading idea: what happens to S&P 500 next week when commodity currencies are aligned up or down the same day? What happens if I want to reduce the drawdown periods and increase the run-up periods? what happens if I apply Relative Strength to a strategy’s risk management by using it as a Equity Curve “Surfing” method ? (thanks to Market Rewind for introducing me to inter-market analysis and Relative Strength).

So I just ran with it.

In the process I learned several new things:

- This type of specific correlation condition doesn’t work during bull markets most of the time.

- It does work during bear markets. Probably because of seasonal increase in asset correlations.

- How equity curve filters that reduce drawdown periods and increase run-up periods affect the strategy in a total lookback period of 250 days: Run-up periods need more time to run and drawdown periods need to be cut much more quickly.

- How Relative Strength looks like within the context of equity curve risk reduction.

- How to apply newly (to me) used programming methods like arrays, an In-Sample optimization method and even a nice Autofill by user’s referenced column macro in Excel that saves a lot of time in the algo-building process.

- Filters have parameters with lookback periods that reduce the degrees of freedom.

- There’s a significant increase in complexity from these filters’ conditions that also reduce Expected Returns.

- The back testing window is 8 years or 1/2 way through to the threshold in the number of years it takes for a strategy’s Expected Returns to flatten out – about 15 years of daily data. Until that threshold there’s a convex slope of % points that one needs to reduce from the arithmetic mean of returns in the back test to adjust for a realistic figure of Expected Returns.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI