Talking Points

- Spread between Brent and WTI increases in this month’s STEO report

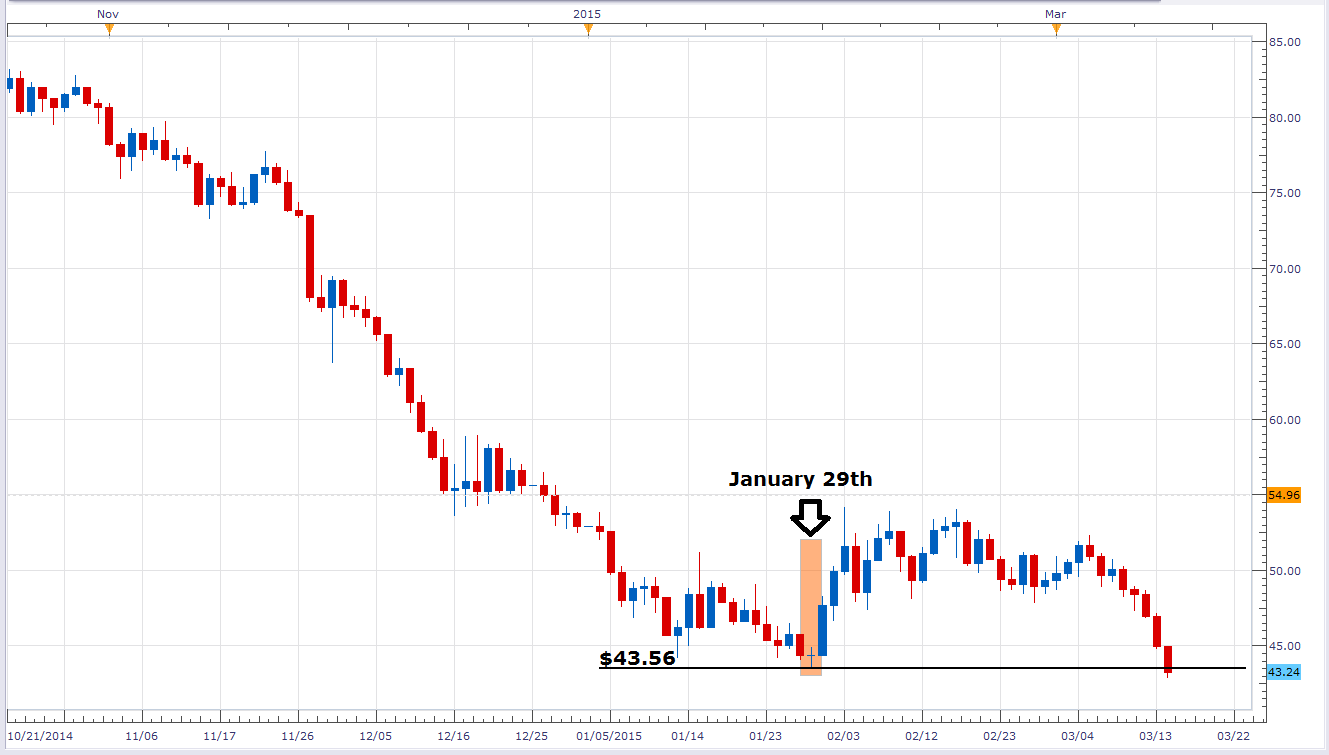

- Crude stocks increase in Oklahoma, as nuclear talks with Iran progress

- In surpassing the January 29th low, oil trades at $42.84/barrel

During Monday’s New York trading session, US Oil traded as low as $42.84/b, surpassing the low from January 29. The energy commodity continues its slide as the debate between crude production and storage capacity heightens and nuclear talks with Tehran grow in prominence. Concurrently, price forecasts remain mixed as the spread between Brent and WTI widens.

In their most recent Short-Term Energy Outlook, the EIA forecasts that Brent Crude will average $59/barrel in 2015, which is $2/barrel higher than their projection in last month’s STEO release. Simultaneously, WTI is to average $52/barrel, doubling the spread reported in February. This phenomenon, where domestic prices lag behind the international benchmark, may be explained in part by the continued increase in U.S. commercial inventories, particularly at the site in Cushing, Oklahoma.

As a delivery point and one of the world’s largest oil storage facilities, activity in Cushing is notable to investors. For the week ending March 6th, total U.S. crude inventories increased by 4.5 m/b with a substantial contribution stemming from the Oklahoma facility; crude stocks in Cushing rose to 51.4M barrels from the previous week’s 49.22M barrels. The addition, up 67% from a year ago, brings the volume to 72%. The question now arises, what happens to prices if capacity is reached?

Compounding this week’s question of a supply glut, nuclear talks with Tehran. As negotiators look to reach an agreement on Iran’s nuclear program, investors question the effects on the price of oil. If a satisfactory agreement can be established, previously imposed sanctions may be lifted, allowing for additional oil exports originating in Iran. Since 2012 daily petroleum exports have been halved sending Iran down from 3rd to 9th in terms of the OPEC rankings for value of petroleum exports. Thus, any change in political stances could alter the supply structure and consequently prices.

Chart Created Using MarketScope2.0

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI