Analyst flags 9 bargain stocks in a ‘Black Friday’-style dip

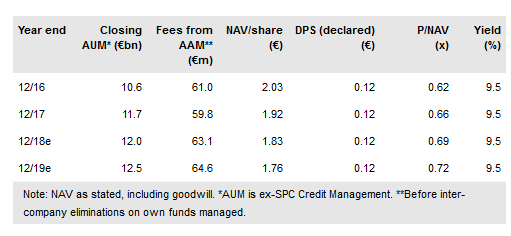

Over the past year, DeA Capital (BS:DEAm) has continued to make good progress in implementing the growth strategy for its alternative asset management (AAM) platform, comprising private equity, real estate and non-performing loans (NPLs). New fund launches have contributed to assets under management (AUM) growth of c 10% since end-FY16. Meanwhile, cash flow from its significant asset portfolio has remained strong, more than sufficient to fund co-investment in new fund launches, new direct investments and a continued high dividend distribution. After recent volatility in Italian markets, the yield is again more than 9% and the discount to our fair value of €1.72 per share is c 26%.

Focus on AAM growth

DeA is a leader in AAM within Italy, providing an integrated platform comprising private equity, real estate and NPLs, with AUM of more than €11.6bn. Its strategic focus is to consolidate this strong domestic market position while selectively exploring opportunities for expansion into other European markets. The latter would be targeted at taking advantage at the ongoing growth in the alternative asset subsector within the wider asset management industry, further expanding DeA’s base of investors, as well as broadening its product range. DeA also seeks to expand its presence in the NPL segment.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 2 out of 3 global portfolios are beating their benchmark indexes, with 88% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?