U.S. inflation data ahead; Trump nominates new BLS head - what’s moving markets

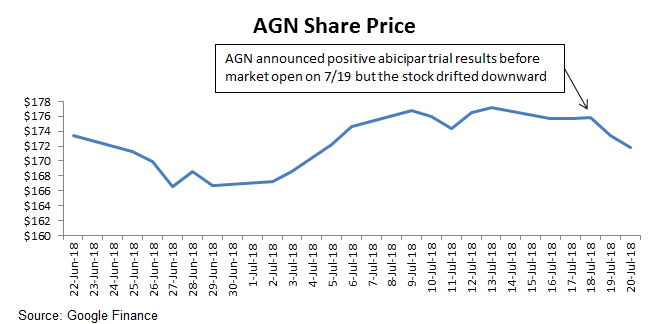

Abicipar Results Appeared Positive But Stock Did Not React Well

On July 19th, Allergan (NYSE:AGN) announced (seemingly) positive top line results from its two phase 3 trials for abicipar. Recall that abicipar is for patients with neovascular (wet) age-related macular degeneration (AMD). Wet AMD is a condition in which abnormal blood vessels grow underneath the retina and macula, causing the retina and macula to bulge or lift. The bulging leads to significant vision distortion.

As I wrote recently, the abicipar readout was one of the key catalysts for the company over the next 6-9 months. Despite the seemingly positive results, the stock has actually moved down slightly over the last several days of trading. Why?

Investors are Worried about Ocular Inflammation

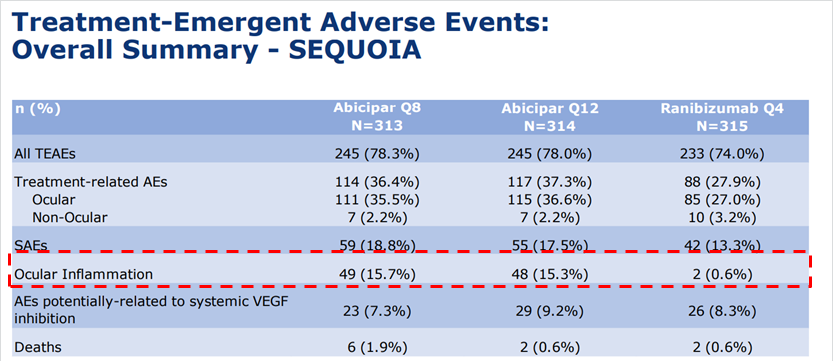

As I noted in that article, investors were worried about a prior inflammation signal in one of the phase 2 trials, and needed to see a lower inflammation signal to turn more positive on the drug. Ocular inflammation showed a 15% incident rate in both trials, which was actually higher than many investors anticipated.

Source: Allergan abicipar presentation

The drug will likely receive approval despite the inflammation, but the investor concern is focused primarily on commercialization. Recall that one of the key points of differentiation from competitor drugs Eylea and Lucentis is that abicipar could be the only drug approved for 12 week dosing (vs. 4 weeks for Lucentis and 4/8 weeks for Eylea). This is a key point of differentiation given that the treatment is delivered via nasty ocular injections. But to many physicians, signs of inflammation would represent a significant risk to the patient, and would not outweigh the longer duration. This is especially true given that both Eylea and Lucentis show little to no inflammation (today).

As a result, attention now shifts to its phase 2 MAPLE study, which is examining a new reformulation that may reduce the inflammation rate. Management believes that they've identified and removed the contaminating proteins that were leading to the inflammation. Some investors have voiced concerns that the study may require further clinical trials to receive approval, even with a reduce inflammation signal. The study has no comparator arm and consists of only 100 patients in an open label trial, all of which could potentially present issues with the FDA. The MAPLE study will have a readout in 1H19, and will be included in the company's BLA filing.

Note that on a conference call after the announcement, Allergan management stated that Lucentis had actually followed a somewhat similar path in reducing inflammation rates. According to Allergan, Lucentis saw higher inflammation rates during its phase 2 trial (>30%), slightly lower inflammation rates during its phase 3 trial (~13%), and then improved on its formulation and inflammation rate over time after launch. If true, these comments should lend credence to Allergan's approach and increase the odds of positive results from the MAPLE study. Regeneron responded by stating that Eylea's trials never saw inflammation rates as high as abicipar's. We will get a more definitive answer in 1H19.

Upcoming Competition Could Present Another Headwind

Even if the drug is approved and the reformulation is successful at reducing inflammation, there are still other competitive concerns on the horizon.

The first and most urgent concern is that Eylea, the market leader in wet AMD, has an upcoming PDUFA date of August 11 for a 12 week dosing schedule. With market leading traction, low rates of inflammation, and a potential 1 year advantage on abicipar, the drug could make it significantly harder for abicipar to take share within the market.

The second set of competition could come indirectly from biosimilars. Lucentis's US patent will expire in 2020, and several competitors are already in phase 3 trials. Competition here could come to market by 2020 in the US, and in Europe by 2022.

Abicipar Revenue Opportunity A Key Question; Will Need to Show Lower Inflammation Rates to be Competitive

As I detailed in my prior overview, Allergan is more broadly facing several headwinds in key franchises, including Botox and Restasis. With activist shareholder pressure mounting, the company has a number of catalysts that could determine whether the shareholders push harder for more drastic changes or stay the course with the current strategy.

Abicipar is one such catalyst. Abicipar's inflammation rates in the most recent readout did little to quell investor concerns, and focus will now shift to its MAPLE study readout, which should determine whether the company can achieve larger commercial success or not. This readout is expected in 1H19.

Note that even if the drug is able to show lower inflammation, there are still a number of other investor concerns, including whether they would need to have an additional phase 3 trial for approval, and upcoming competition (with Eylea's Aug. 11 PDUFA date the most important date to watch).

However, given that the market for wet AMD is significant at $6 billion and growing, abicipar could still potentially turn into a $1+ billion drug for Allergan if they are able to show safety levels in line with current drugs. Current estimates from analysts for abicipar range from $100 million to $500 million due to this key issue, but could turn higher on a positive readout from the MAPLE study.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI