Summary

- USD – Dollar rally continues as optimism grows on the trade front

- Shutdown – Likely to go down to the wire again

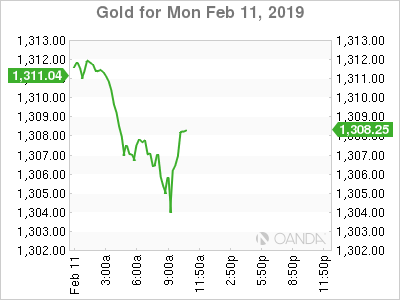

- Gold – Sinks on strong dollar and upbeat trade talks

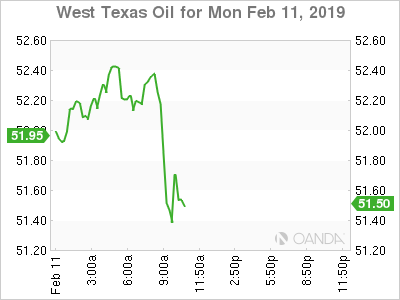

- Oil – Supply worries are building, WTI $50 level at risk

- Apple – Huawei continues to take market share in China

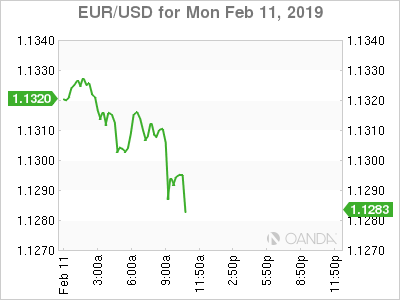

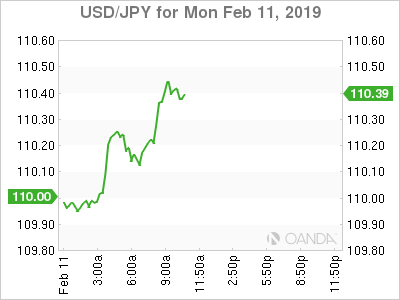

USD

The dollar continues to ascend as global bond yields rise and optimism grows that we will see positive steps this week with the China and U.S. trade negotiations, potentially leading up to a meeting in mid-March with Trump and Xi. With the exception of Wednesday’s U.S. inflation reading, economic data is fairly light and the focus will remain on political developments with trade and government funding.

Shutdown

Over the weekend, talks fell apart between Democrats and Republicans on border security, potentially signaling we could see another shutdown if no agreement passed by the February 15th deadline. The roadblock to a deal remains the level of funding for border barriers, funding increases for facilities and personnel. The President could be forced to accept funding that comes well below his $5.7 billion demand in order to avoid further political damage for another government shutdown.

Gold

The precious metal declined as the strong dollar sank commodities across the board. Gold has been on a tear recently, rising for a fourth consecutive month, but has appeared to have seen some profit-taking after failing to rise above $1,335. The yellow metal appears to have some key support from China, the PBOC raised their holdings for a second consecutive month, this follows a 2-year break from any changes. Uncertainty on how the trade war will unfold and concerns over China’s credit markets could remain key catalysts for Chinese gold purchases. Overnight, two Chinese borrowers reportedly miss two bond payments, a sign Chinese credit markets are sensitive and will likely need further efforts from the Chinese government to support it.

Oil

West Texas Intermediate crude trades lower on the strong dollar and global growth concerns, but the next wave of selling could come from oversupply concerns when we see the OPEC monthly report tomorrow, the IEA report will come the day after. Concerns of trade talks falling apart between the U.S. and China will likely remain short-term risks for oil, but the worries of oversupply stemming from the U.S. will likely remain a dominant theme as we approach the warmer months. Last month, Saudi Arabia over-delivered on production cuts, but that is not likely to be a continuing trend for them. Compliance will closely be watched from the OPEC + group and, despite Venezuelan crude’s expected decline, we could see oil decline if other members fail to hold up their end of cuts.

Apple

According to research firm IDC, Apple Inc (NASDAQ:AAPL) reportedly lost 19.9% in iPhone shipments in China, while Huawei saw 23.3% gain. Apple moved up one spot to fourth place, passing Xiamoi, but still behind Huawei, Oppo, and Vivo, respectively. Apple price cuts are heavily expected in China, but they may not see significant improvement in sales as authorized retailers have already begun offering discounts.

Disclaimer: This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.