Are DOGE layoffs set to resume?

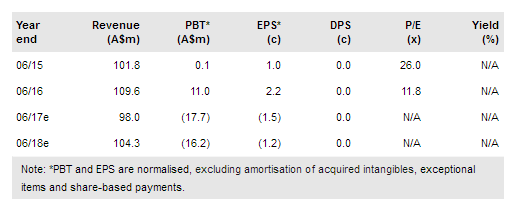

After a testing H117 at the Tomingley Gold Operation (TGO) due to high levels of rainfall that affected gold production, Alkane Resources Ltd’s (AX:ALK) third quarter results show a return to profitable operations, with net cash flow from operations of A$6.5m reducing after delayed December 2016 payments to a net A$2.0m at quarter’s end. As weather conditions improved in NSW, Q317 gold production recorded a q-o-q increase of 59%, with 18,721ozs Au produced at AISC costs of A$1,201/oz. Sales of 16,303ozs Au at an average realised gold price of A$1,694/oz resulted.

TGO exploration eyes further UG resources

Following a review of the underground (UG) resource and proposed mine plan for the TGO, Alkane has stated that it will revise its overall plan for the transition to UG mining. Previously, we assumed c 84koz would be recovered from an UG operation at Wyoming One from FY18 to FY24, supplementing ounces derived from ongoing surface mining. For now, we keep this Wyoming One UG mining schedule intact until official guidance is announced, but advise that the amount and, more importantly, the schedule for ore extraction, is likely to change as exploratory drilling completes and, so far, very favourable assay results are incorporated into a new resource and mine plan. Concerning Alkane’s broader exploration focus, drilling completed over a number of non-TGO exploration targets has so far revealed promising stratigraphic and lithological signals which, in some instances, are the same as some of the largest gold mines in the region.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.