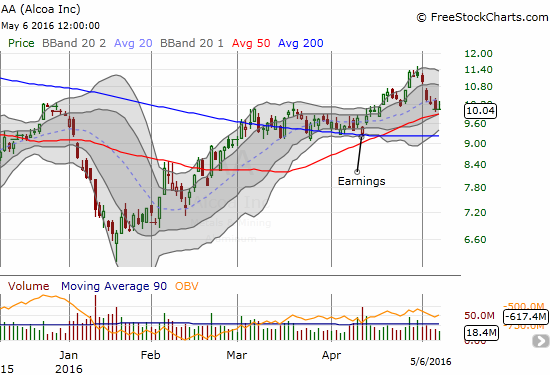

At the end of April I lamented that I managed to miss the next post-earnings buying point for Alcoa (NYSE:AA). A second chance has appeared in the form of a retest of support at AA’s 50-day moving average (DMA).

Alcoa (AA) has completely reversed its breakout and now tests 50DMA support. The stock still holds a positive post-earnings gain.

AA broke out in late April, but the gains all came in a single one-day burst. The entire breakout reversed quickly. The good news on the pullback is that volume declined throughout the selling. This moderating volume implies sellers are less and less inclined to dump AA which means buyers may more easily take control at this 50DMA support.

Since my trading call recently switched to “cautiously bearish”, I hesitate to jump right into this buying opportunity. So, I will wait for a confirmation of support, like a solid up day with a close above 50DMA support. AA drops into bearish territory if it breaks down below support at its 200DMA. Such a move would completely reverse all post-earnings gains. (Note that the market’s initial reaction to earnings was negative, featuring a small gap down).

Be careful out there!

Full disclosure: no positions

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI