Bitcoin price today: hits record high over $121k ahead of ’crypto week’

Over the past few months, I have been experimenting with a model using the ADP employment report to estimate the highly watched BLS employment report. At the beginning of October, I laid out the initial premise in "Survey Vs. Data - Employment Estimate 160k":

"ADP reported its employment estimate for September which showed an increase of 166,000. This was shy of the 180,000 consensus. Historically speaking, going back to 2001, the average difference between the numbers of jobs reported by ADP is 21,992 less than what is normally reported by BLS. For example, in August, ADP reported 113,926 jobs whereas BLS reported 136,133 for a difference of 22,206. Since the beginning of 2012, the average difference of the number of total employed between the two reports has been approximately 22,200,000.

Therefore, if we use this average, we can solve for what the September jobs report from the BLS will most likely be. In the month of September, ADP reported total employment of 114,092 million. If we add the 22,200, the recent tendency of the difference, then the BLS report should be close to 136,293 million which would equate to a monthly increase in payrolls of 160,000. The current consensus range is 155,000 to 240,000 - so a print of 160,000 would be well below consensus and a bit of a disappointment."

At the end of October, following the conclusion of the government shutdown I updated the analysis stating:

"While 141,000 jobs in October is the actual estimate due to the average historical difference between the two reports - there are two adjustments that could skew the actual report.

The first scenario is a downwards revision to the September data. As I discussed above, such a negative revision would boost the estimate closer to 153,000 jobs created in October.

The second scenario is due to seasonal adjustments. October has a mixed bag of seasonal adjustments that have been both positive and negative. However, since 2001, the difference between the ADP and BLS reports has narrowed to just 22,021,200 total jobs. If the normal October effect comes into play, the markets could be due for a real downside shocker of just a net 75,000 jobs created in the last month. However, such a downside surprise would be considered "good news" as it support the need for the Federal Reserve to continue its current pace of liquidity interventions.

One issue that may completely skew the model in October was the effect of the government shutdown that led to the furlough of 800,000+ workers. While those workers were rehired by the end of the month, the BLS only collects data during just one week of the month. That week fell during the furlough period. Therefore, it is possible the October jobs report could be skewed due to that temporary anomaly."

The subsequent BLS report showed a total of 136,554,000 jobs, which was an increase of 204,000 jobs in total for the month, which was substantially stronger than the 153,000 estimated increase using the ADP model. However, in the most recent ADP survey for November the October report was revised almost 50% higher to 184,000 jobs closing the differential to just 20,000.

Estimating The November BLS Employment Report

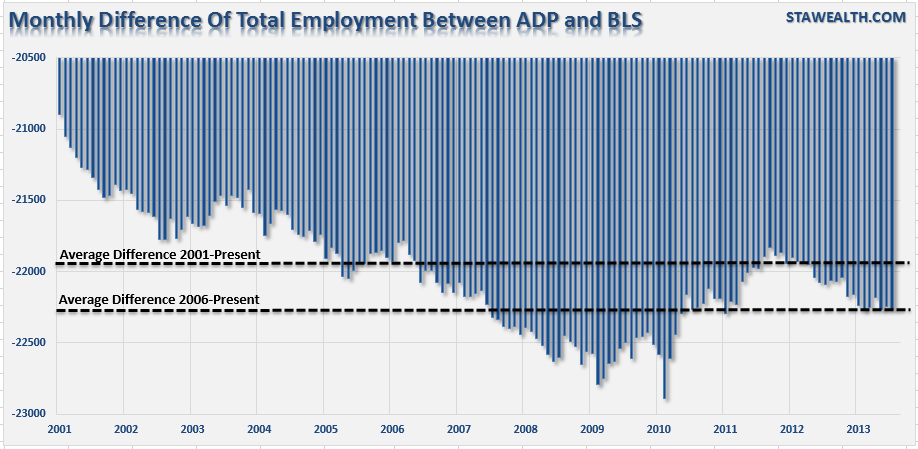

With the latest ADP report for November, the average difference of total employment between the ADP and BLS reports has run 21,996,300 since 2001. The chart below shows the monthly difference between the two reports.

The dashed lines are two different averages of the monthly net differences. The average difference between the two reports since 2001 has been 21,996,300 total jobs. However, since 2006 the average difference has increased to 22,237,900.

If we use the October BLS report of total employment of 136,554,000, and adjust that number using the average difference from 2006 to present, we should expect to see a November BLS employment report of 136,740,900. This would equate to roughly a 391,000 job increase from October to November. Such a surge will very likely jolt the markets as fears increase that the Fed will "taper" their current monetary policies sooner rather than later.

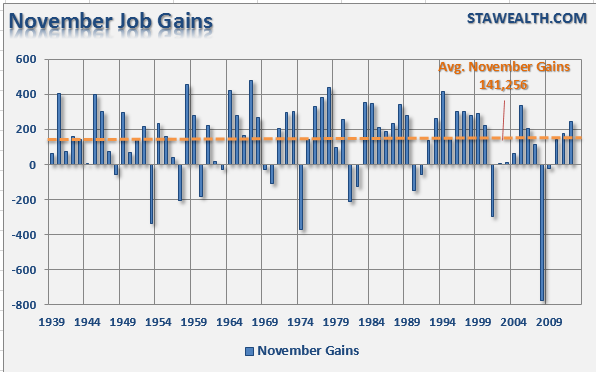

However, if we look at the average historical difference between the two reports for just November months, there has been an average difference of just 21,993,980. This would suggest that the BLS report for November would show an increase of just 147,000 which would fall towards the lower end of expectations which currently range from 140,000 to 200,000. Furthermore, a reading of 147,000 jobs in the November BLS report would fall within the historical average of November reports of 141,256 going back to 1939.

Estimating The Over/Under

There are two other factors that will skew the November jobs report which are the seasonal adjustments to account for the hiring of temporary help for the holiday shopping season and the monthly "birth/death adjustment" to account for the change of new businesses in the economy.

The average seasonal adjustment to the November payroll report is a reduction of 715,000 jobs to smooth out the surge in seasonal hiring for November. This will lower the topline estimate of a scorching 391,000 increase.

However, the upward adjustments to the previous ADP reports also indicate that very likely the October BLS report will likewise be adjusted upward as a more accurate accounting of the impact of the government shutdown is made. If we assume that the adjustments made by ADP, which was an average increase of 46,500 jobs over the previous two months, translate into the BLS report then we should expect a report on Friday of roughly 193,500.

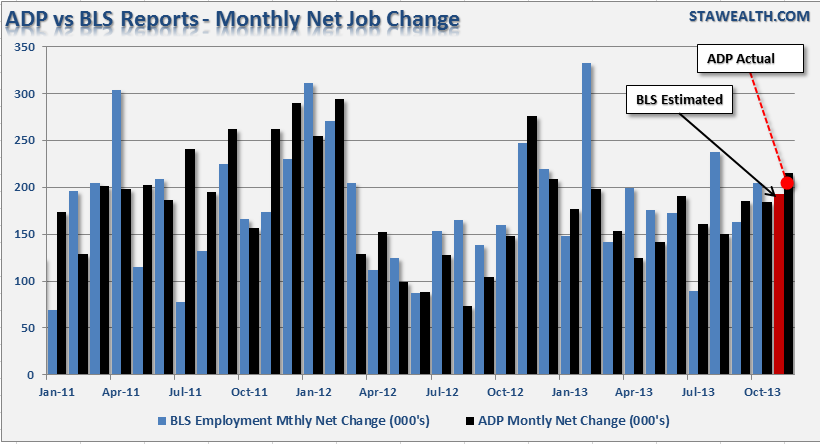

The chart below shows the history of the ADP and BLS reports. I have plugged in my estimate of 193,000 for the November BLS report.

Full-Time To Population

While a 193,000 job increase will certainly be a "good number" at the headline the reality is that it will likely be comprised of lower paying and temporary jobs, given the time of the year, rather than full-time employment. Furthermore, the issue of population growth is completely obscured by these employment reports. Each month the working age population has increased at a rate greater than employment. This implies that job growth has been a function of the incremental demand increases caused by population growth rather than increases in organic demand that would lead to higher rates of employment, and subsequently wages, that would increase the labor force participation rate.

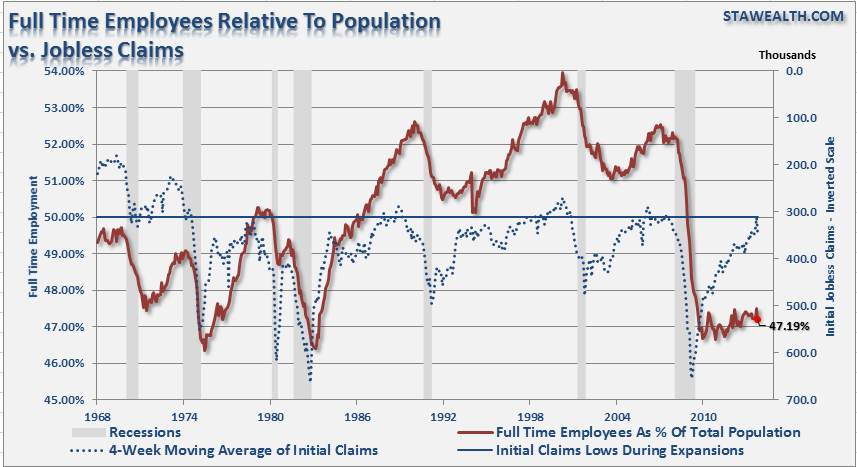

This is why the only real chart that matters with regards to employment, in my opinion, is full-time employment relative to the working age population.

Full-time employment is what leads to greater household formations, increased demand and organic economic growth. With full-time employment at the lowest levels since the early 80's it is really not so surprising "Main Street" is still struggling to make ends meet.

The BLS employment report for November is due out Friday morning at 8:30am EST.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.