Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

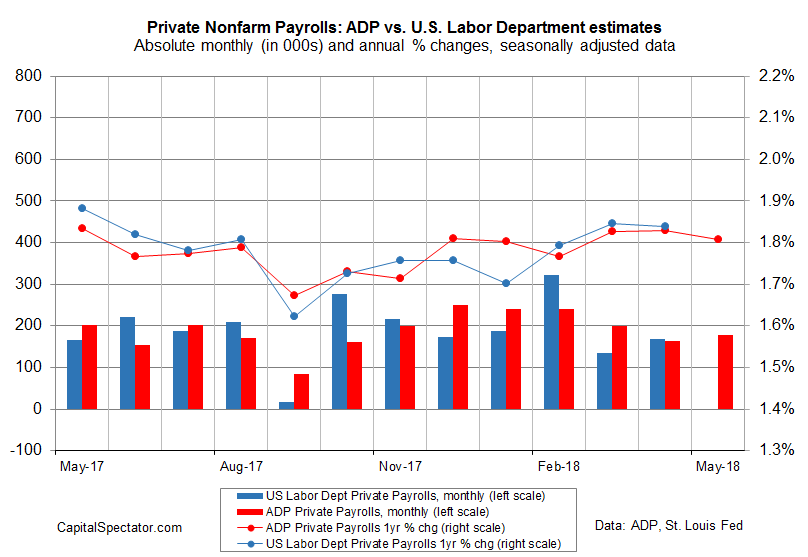

US companies continued to add workers at a moderately healthy pace in May, according to yesterday’s update of the ADP Employment Report. Private employment increased 178,000 last month, slightly above the 163,000 gain in April. Meanwhile, the one-year gain held at roughly 1.8% — a pace that’s been endured so far in 2018.

“Job growth is strong, but slowing, as businesses are unable to fill a record number of open positions,” notes Mark Zandi, chief economist of Moody’s Analytics, which co-produces the employment numbers with ADP. “Wage growth is accelerating in response, most notably for young, new entrants and those changing jobs. Finding workers is increasingly becoming businesses number-one problem.”

The steady, moderate trend for private-sector employment suggests that economic risk for the US overall will remain low for the near term. Although the year-over-year growth trend for the labor market has slowed considerably from the 2.6% post-recession peak in 2015, the latest ADP results suggest that a moderate annual pace of 1.8%, give or take, will persist for the foreseeable future.

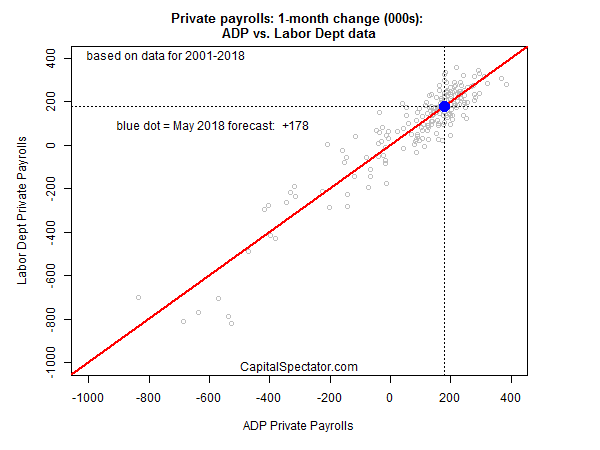

Using ADP’s May numbers as a guide signals a 178,000 gain for private employment in tomorrow’s (June 1) official report for this month from the Labor Department. If correct, the government’s update will show a pickup in new-job growth from the 168,000 gain in April. The prediction translates to a 1.9% annual gain. (The forecast is based on analyzing the relationship between the two data sets with a linear regression model. The model’s projected monthly gain in Friday’s release, by the way, is slightly below the 184,000 advance for May expected via Econoday.com’s consensus forecast.)

In sum, tomorrow’s numbers from Washington are on track to reaffirm the low-risk economic profile that’s persisted recently for the US macro trend. As The Capital Spectator reported earlier this month, recession risk has been virtually nil lately and Friday’s employment report looks set to provide fresh support for that assessment through May.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.