Asia stocks mixed amid tariff jitters; Japan tumbles on weak US jobs data

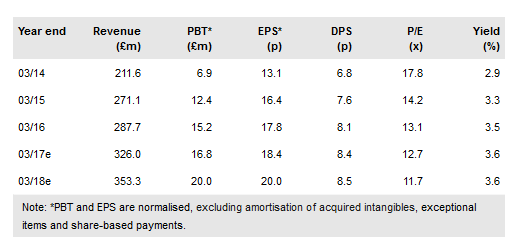

Acal's (LON:ACL) acquisition of Variohm adds the first specialist sensor business to Design & Manufacturing and moves the company closer to its mid-term target of generating 75% of revenues from the division. The acquisition, costing up to £13.85m in cash, is being funded by the recent placing of 6.42m shares at 220p per share. Management expects the deal, together with the placing, to be earnings enhancing in FY18 and we lift our normalized FY18e EPS forecast by 3.4%. The stock is trading at a c 30% discount to its peer group, representing a good entry point in our view.

Design & Manufacturing acquisition; fund raising

Acal has acquired Variohm Holdings for an initial cash consideration of £12m and a contingent cash consideration of up to £1.85m. It funded the deal from its syndicated debt facility, which it will repay with the £13.6m in net proceeds from the recent placing of 6.42m shares at 220p per share. Variohm is a UK-based designer, manufacturer and distributor of specialist electronic sensors, switches and motion measurement systems, with c 50% of sales from France, Germany and the US.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.