Abercrombie & Fitch Co. (NYSE:ANF) is set to report FQ1 2015 earnings before the market opens on Thursday, May 29th. Abercrombie and Fitch is a casual clothing retailer that focuses on selling products to a younger audience. This quarter Wall Street is expecting the apparel company’s sales to fall 3.6% compared to FQ1 of last year while the FQ1 quarterly loss doubles from -9c to -18c per share. Abercrombie & Fitch has slashed prices to remain competitive in a challenging retail environment and analysts have correspondingly set the earnings bar low for ANF on Thursday. Here’s what investors are expecting from Abercrombie & Fitch’s earnings release before the opening bell.

The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors.

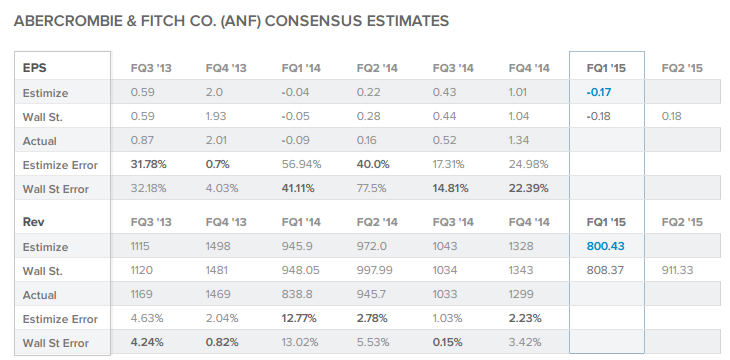

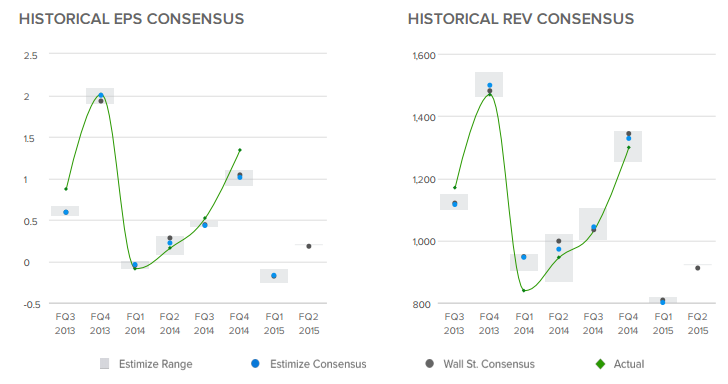

The current Wall Street consensus expectation is for Abercrombie & Fitch to report -18c EPS and $808.37M revenue while the current Estimize.com consensus from 11 Buy Side and Independent contributing analysts is -17c EPS and $800.43M in revenue. This quarter the buy-side as represented by the Estimize.com community is expecting Abercrombie & Fitch to beat Wall Street’s earnings estimate by 1c per share but come up $8 million shy on revenue.

Over the previous 6 quarters the consensus from Estimize.com has been more accurate than Wall Street in forecasting Abercrombie & Fitch’s EPS and revenue 3 times each. By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is more accurate than Wall Street up to 69.5% of the time.

More importantly, it does a better job of representing the market’s actual expectations. It has been confirmed by Deutsche Bank (NYSE:DB) Quant. Research and an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. Here we are seeing a smaller differential than usual between expectations from the two groups.

The distribution of earnings estimates published by analysts on the Estimize.com platform range from -26c to -10c per share and from $738.00M to $817.84M in revenues. This quarter we’re seeing a wide range of estimates for Abercrombie & Fitch, especially on revenue.

The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A wide range of estimates signals less agreement in the market, which could mean greater volatility post earnings.

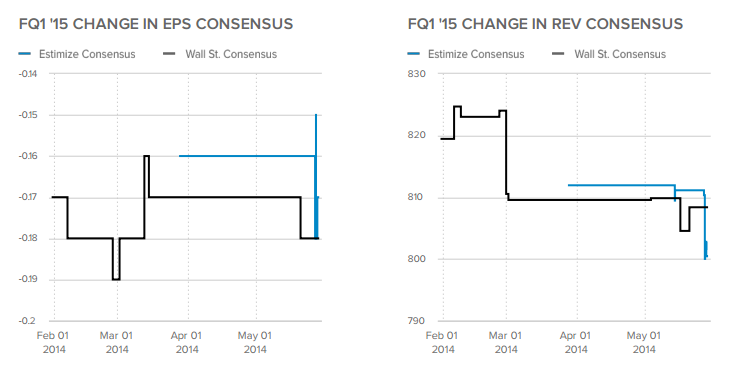

Throughout the quarter the Wall Street EPS consensus slipped from -17c to -18c while the Estimize consensus bounced around starting at -16c and ending the period at -17c. Meanwhile the Wall Street revenue consensus decreased from $819.45M to $808.37M while the Estimize consensus sank at the end of the quarter from $811.93M to $800.43M. Timeliness is correlated with accuracy and downward analyst estimate revisions going into the report are often a bearish indicator.

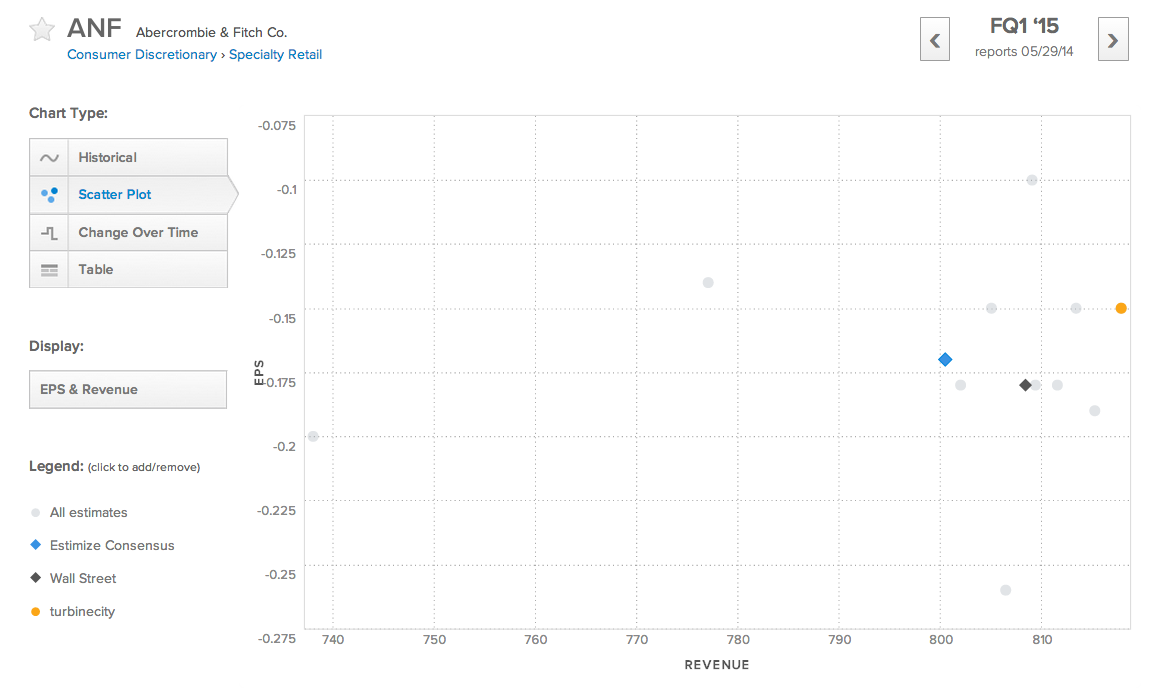

The analyst with the highest estimate confidence rating this quarter is turbinecity who projects -15c EPS and $817.84M in revenue. turbinecity was our Winter 2014 season winner and is ranked 2nd overall among over 4,500 contributing analysts. Over the past 2 years turbinecity has been more accurate than Wall Street in forecasting EPS and revenue 60% and 54% of the time respectively throughout a massive 2,706 estimates.

Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case turbinecity is making a relatively bullish call expecting Abercrombie & Fitch to beat the consensus from both Wall Street and Estimize.

So far this earnings season retail sales have generally been weak as they were last season with the exception of a few notable high end fashion companies such as Michael Kors. The poor weather excuse is getting old and if Abercrombie & Fitch can’t meet the low expectations from investors, management will have some explaining to do. This quarter contributing analysts on the Estimize.com platform are only looking for a loss of 17c per share and revenue of $800.43M compared to $838.8M in revenue 1 year ago.