TSMC Q2 sales jump 39% on robust AI-driven chip demand

Apple (NASDAQ:AAPL) longs hate it when I say something negative about their stock.

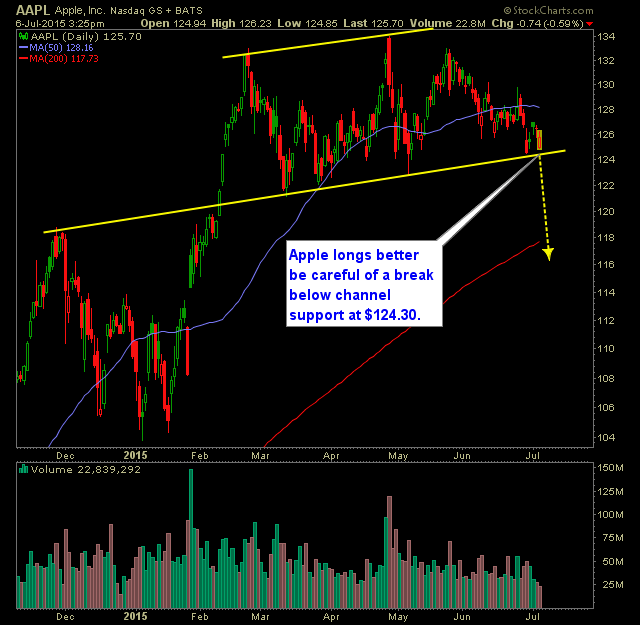

I don't have anything against the company; I don't have a position in the stock either. I'm simply observing a key support level that the bulls will need to hold onto in the coming days or the $120's might be a thing of the past.

Of course, a lot of that will have to do with what the market does in the days ahead, but if support is broken, the level of selling that might have otherwise been experienced in the stock will be accelerated below key support in the $124.30's.

The support is actually part of a larger channel pattern that the stock has been stuck in going back to February of this year, while the support underneath the stock goes back to late November/early December.

I'm not too fond of this market right now, and I'm looking for it to go lower from here. With that being said, I expect AAPL to follow suit and break the key support along the way.

Here's the technical analysis for Apple (AAPL):

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.