Oracle (ORCL) just posted huge earnings after the close. Oracle, an American multinational computer technology company specializing in computer hardware and enterprise software released their quarterly earnings on Wednesday beating Wall Street expectations on both the top and bottom lines. These numbers crushed the Wall Street consensus but how do they compare to Buy Side and Independent analysts’ expectations and what does that mean we can expect from the stock over the next few days?

The following information is derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors.

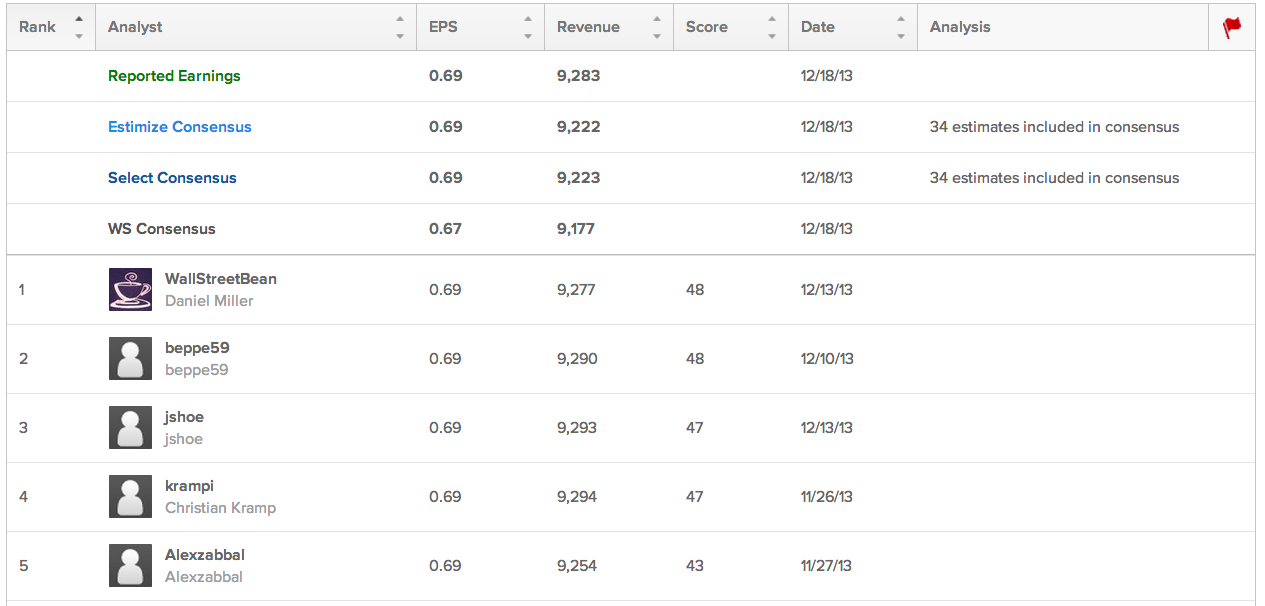

As laid out in our pre-earnings coverage last week, the Estimize community was projecting 69c EPS and $9.222B revenue. Wednesday after the close Oracle reported 69c EPS and $9.283B revenue. These huge numbers crushed the Wall Street expectations of 67c EPS and $9.177B. but they were in-line with the Estimize consensus for EPS and only exceeded on revenue.

The Estimize consensus is more accurate than Wall Street 69.5% of the time because it represents unbiased market expectations. By tapping into a wider distribution of contributors, including hedge fund analysts, asset management firm analysts, industry experts, and students Estimize is better able to capture the true market outlook.

Confidence ratings for each user are calculated through algorithms developed by our deep quantitative research which look at correlations between analyst track records and tendencies as they relate to future accuracy. We believe that everyone’s opinion matters, regardless of who they are, where they’re from, or what it says on their business card.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. Going into Wednesday’s report we saw a big differential between the two sets of expectations.

This chart taken from ChartIQ-Visual Earnings shows the price of Oracle surging going into the report as the market closed, each candle represents 1 day. The height of the very large green candle all the way to the right represents Wednesday’s gains. A positive differential between the Estimize consensus and Wall Street expectations has been shown by our quantitative research to be associated with an upward drift in stock price over the 3 days going into the report. Between 2 and 4pm the stock price surged as analysts were expecting big earnings.

While Wednesday was a great day for Oracle shareholders, what can we expect from ORCL over the next few days? Based on our post-earnings quantitative research we have found that if you benchmark against the market on average when a firm beats the Estimize EPS consensus the stock price tends to drift upward over the next 3 trading days after the market reopens. The stock price may change between when the market closes before the report and when it reopens the next day but that gap is not associated with our post earnings drift in any way. In this case although Oracle crushed Wall Street, they reported in-line with our EPS consensus and only exceeded on revenue. For that reason quant. funds who made money by using our pre-earnings drift strategy would not necessarily be interested in purchasing shares of Oracle after the market reopens tomorrow.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI