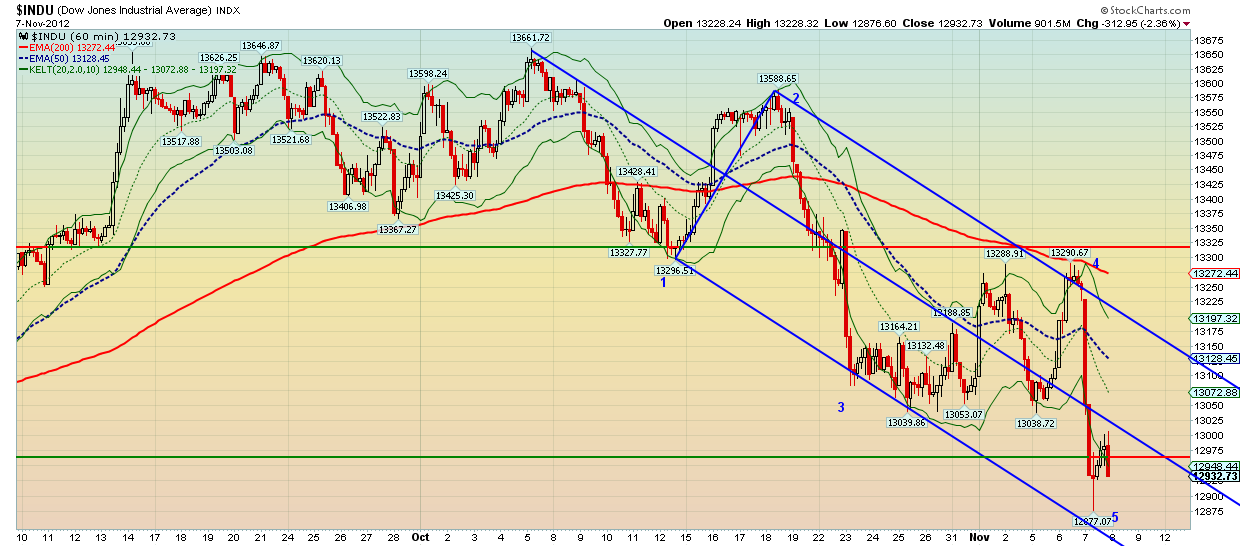

The DJIA hit a new low yesterday and the entire move from 13661 could have probably finished 5 waves down. However, the time it took for wave 5 to unfold relative to the others is too small.

Therefore my analysis gives more chance to the scanrio that only wave 1 of 5 is finished. Even if the entire wave 5 downward move is finished, wave 2 is expected to last several weeks since this downward wave took almost a month to unfold. The trend is down and a small pull back for a minor corrective wave is expected to be seen during today's session.

As mentioned in a previous post, it was essential that wave 4 would not overlap wave 1. While it came close, It didn't overlap 13296. Blog followers who contacted me at the time placed sell orders with very close stops at those levels and took this low risk opportunity. That's what we are after -- low risk opportunities. Riding the trend is good too, but snatching a profit of 300 points in the Dow in such a small time frame makes you feel great.

Hope we keep up the same pace. And never forget to place stops.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.