A quartet of commodities have all seen identical price action on the day, and are now approaching key levels as a result. For gold bearish momentum is now accelerating as we approach the $1175 per ounce level on rising volume, and if this level is taken out, then $1147 per ounce is the next pause point in the longer term bear trend.

For silver it’s the platform of price support at $16.15 per ounce which is now being pierced at the time of writing, and with the trend monitor now firmly red, $15.60 per ounce looks to be the next logical stopping point for the industrial metal with $15.30 per ounce to follow in due course.

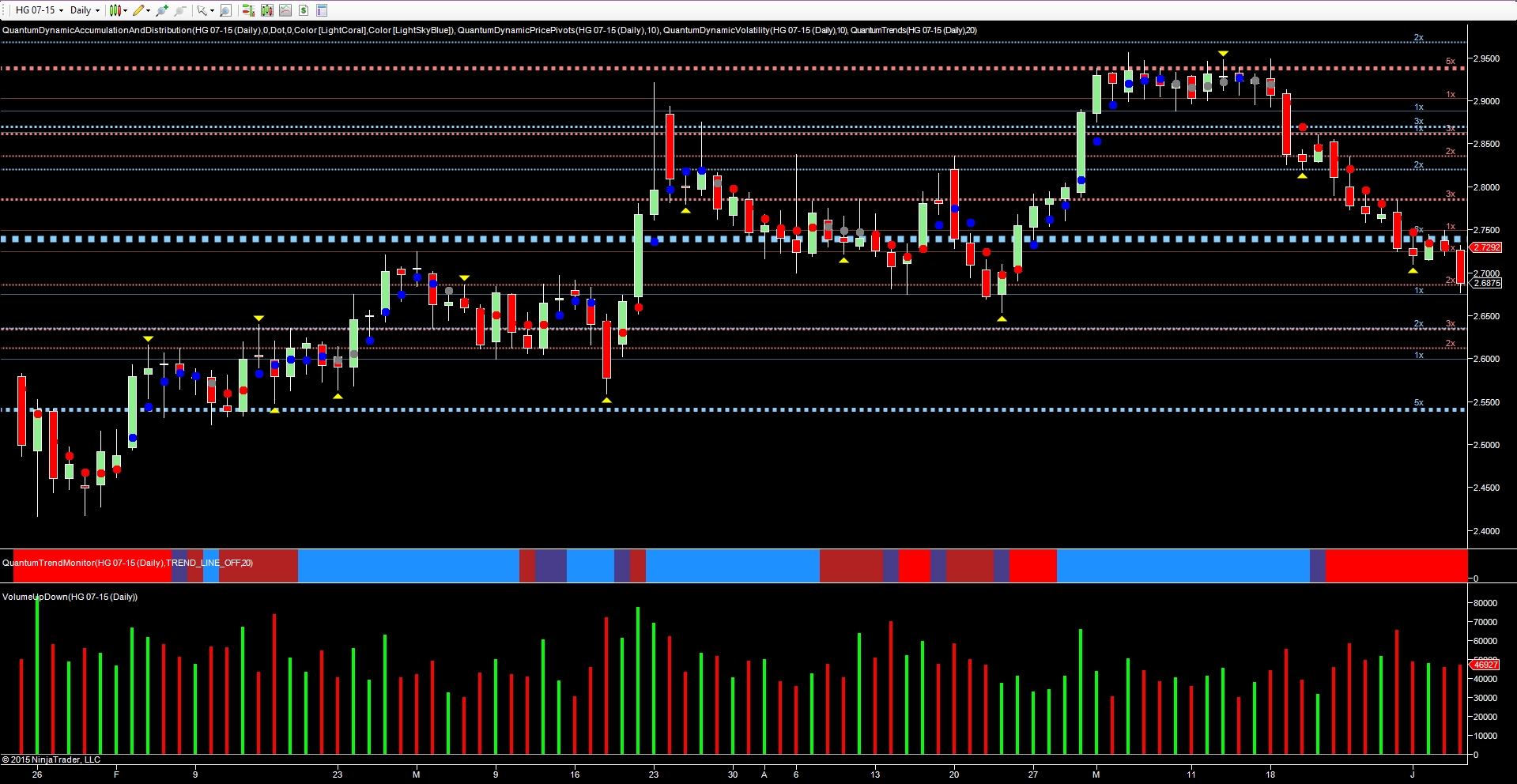

For copper, the break lower has already begun, with the deep resistance level now in place overhead in the $2.74 per lb. The next level below awaits at $2.63 per lb and from there a move to test the next level of potential support at $2.54 per ounce now on the horizon.

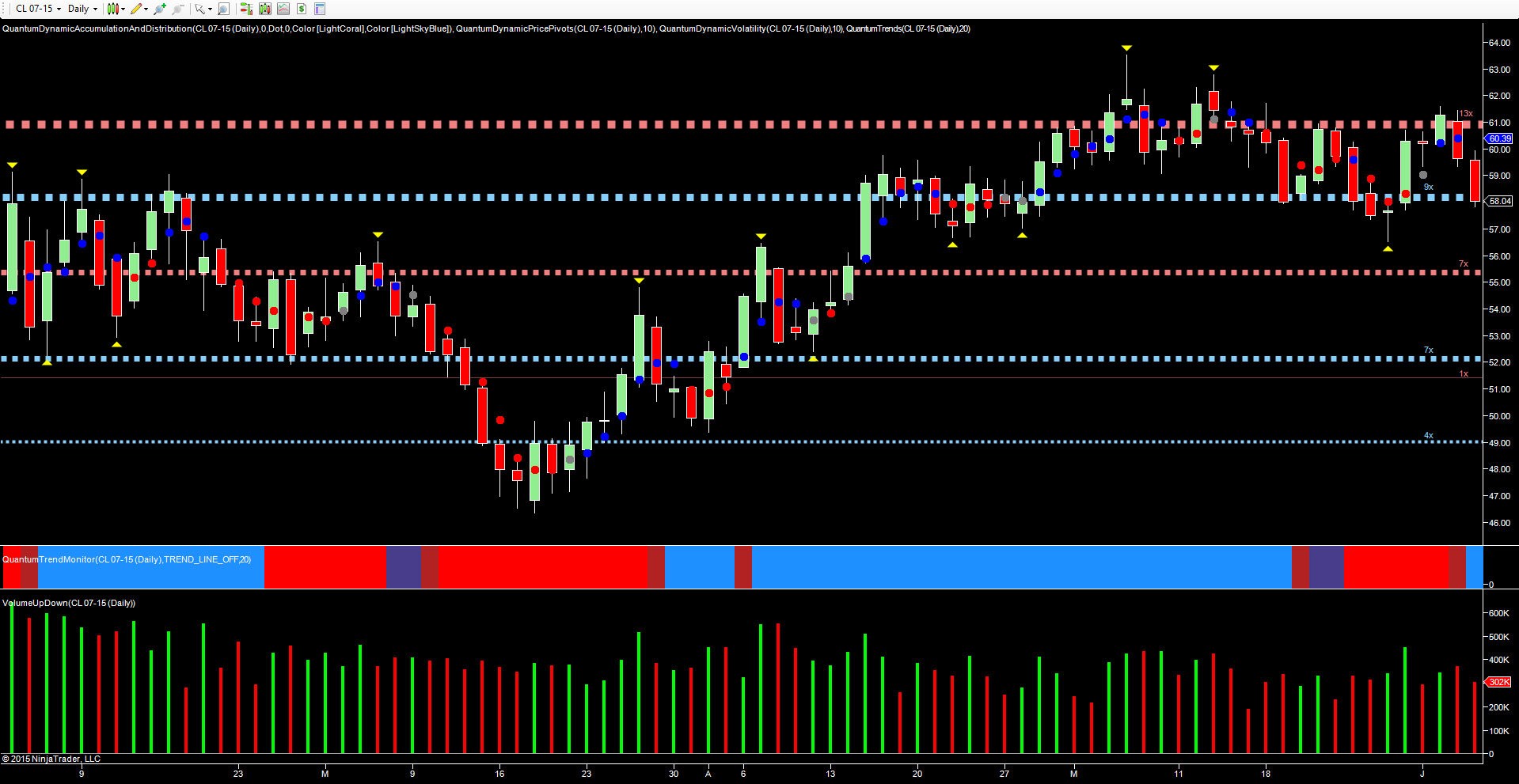

Finally to oil, which failed to break through resistance in the $61 per barrel level, holding in yesterday’s trading session and adding further downwards pressure today ahead of tomorrows key OPEC meeting in Vienna. It seems unlikely there will be any change in policy with increasing supply keeping a cap on prices as the price war for black gold continues.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.