Stock market today: Nasdaq closes above 23,000 for first time as tech rebounds

Wish you could discover an investment strategy that was defensive against down markets but carried an incredible upside during bull markets? The Herculean Healthcare model attempts to do just that. Why might this be a good strategy to use and what sort of gains are we talking about?

The Healthcare Sector is Defensive

The beauty about sectors, or the market in general, is that it moves in packs. When enough stocks rise a vacuum is created pulling up other stocks that have no real reason to go up other than a ‘me too’ response. A bear market will typically punish all stocks regardless of their fundamental differences. You may have a winning stock in a depressed sector but no amount of yelling will bring investors to the table. Industries, sectors and markets move like mobs.

This is good news for those investing in the healthcare industry as you can take advantage of its defensive properties. People need doctors and medicine in all economies thus smoothing out the earnings volatility as it relates to market cycles. The perk here is that by focusing on healthcare stocks, you should benefit – at least partially – from the defensive nature of this entire sector. Sometimes it is good not to stand out as different.

The Healthcare Sector has High Growth

Not all healthcare stocks are big, lumbering defensive giants. Within this broad category are smaller companies developing novel therapies, niche markets such as pet diagnostics with a large untapped market potential and other companies that are ripe for a lucrative buyout. Within the broad field of defensive healthcare you can also find tiny rockets that really soar.

Just how do you go about finding suitable healthcare companies with these properties? Isn’t this like finding needles in a haystack? True enough, it can be challenging to comb through hundreds of small-cap stocks to find suitable candidates. But by purchasing a basket of 10 stocks through a rigorous mechanical screening process you can save time and increase your odds of having multiple winners in the portfolio.

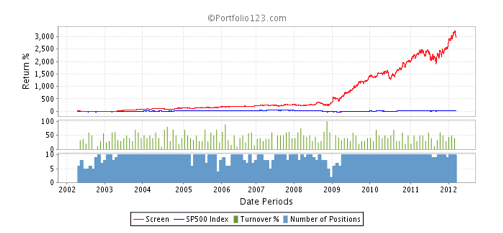

The screening rules I use in the Herculean Healthcare model includes looking for deep value metrics, American companies, and small market-cap. Simply investing in small healthcare companies over the past 10 years would have resulted in a compound annual growth rate of over 15%, which is more than 13% higher than the S&P 500. Once you add in the value ranking rules the annual return pops over 24%.

But aren’t these tiny stocks carrying higher risk, especially in light of recent healthcare reforms? Is this still a sound strategy in light of new developments? This leads me to my final trading rule that will protect you against a sector with souring sentiments.

Buying Stocks in the Recovery Room

Nobody likes to buy a stock with a terminal illness that is one step away from the delisting graveyard. What preventative medicine can you take when the entire sector is coming down with a severe case of the chills? The answer lies in singling out companies with a high chance of recovery – upgraded earnings.

My final rule looks for firms that have improved their financial outlook. If the firm goes 8 weeks and no further earnings upgrades are released – the company is cut free. How will this help keep your portfolio healthy?

The negative sentiment in healthcare stocks helps create and maintain deep value. If a firm is expected to suffer due to the healthcare reforms, this will be reflected in the analyst estimate. You will not be buying stocks that have a bad prognosis which lowers your risk. Companies with upwards revised earnings have some sort of competitive edge and a reason for prices to go up as well. Or it could be that a healthcare stock slashes its forecast (you are not invested in it) and prices drop hard. After a while analysts realize that the situation is not as dire as first thought. This firm with deep value is upgraded and this is your entry signal. It all sounds good in theory but how has it turned out in the past in our clinical trials?

Over the past 10 years this strategic investment style with rebalancing every 4 weeks has resulted in a 41% compound annual growth rate!

Get Your Check-up Now

The bottom line is that the nervousness over the healthcare sector is once again creating a great opportunity for investors. We are not marrying these companies or forecasting years down the road. Instead we look for small firms with large upside potential in a defensive sector that have just received a clean bill of health. We hold these companies as long as they keep improving and get stronger still. The Herculean Healthcare strategy is an incredibly robust system that takes the best of defensive and high-growth firms in a potion that tastes good and keeps your portfolio growing healthy and strong.

The Healthcare Sector is Defensive

The beauty about sectors, or the market in general, is that it moves in packs. When enough stocks rise a vacuum is created pulling up other stocks that have no real reason to go up other than a ‘me too’ response. A bear market will typically punish all stocks regardless of their fundamental differences. You may have a winning stock in a depressed sector but no amount of yelling will bring investors to the table. Industries, sectors and markets move like mobs.

This is good news for those investing in the healthcare industry as you can take advantage of its defensive properties. People need doctors and medicine in all economies thus smoothing out the earnings volatility as it relates to market cycles. The perk here is that by focusing on healthcare stocks, you should benefit – at least partially – from the defensive nature of this entire sector. Sometimes it is good not to stand out as different.

The Healthcare Sector has High Growth

Not all healthcare stocks are big, lumbering defensive giants. Within this broad category are smaller companies developing novel therapies, niche markets such as pet diagnostics with a large untapped market potential and other companies that are ripe for a lucrative buyout. Within the broad field of defensive healthcare you can also find tiny rockets that really soar.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Just how do you go about finding suitable healthcare companies with these properties? Isn’t this like finding needles in a haystack? True enough, it can be challenging to comb through hundreds of small-cap stocks to find suitable candidates. But by purchasing a basket of 10 stocks through a rigorous mechanical screening process you can save time and increase your odds of having multiple winners in the portfolio.

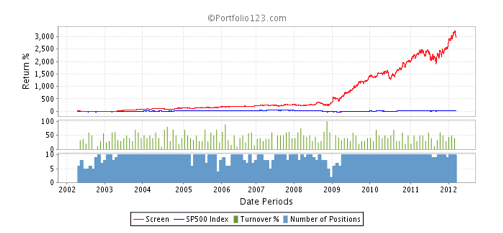

The screening rules I use in the Herculean Healthcare model includes looking for deep value metrics, American companies, and small market-cap. Simply investing in small healthcare companies over the past 10 years would have resulted in a compound annual growth rate of over 15%, which is more than 13% higher than the S&P 500. Once you add in the value ranking rules the annual return pops over 24%.

But aren’t these tiny stocks carrying higher risk, especially in light of recent healthcare reforms? Is this still a sound strategy in light of new developments? This leads me to my final trading rule that will protect you against a sector with souring sentiments.

Buying Stocks in the Recovery Room

Nobody likes to buy a stock with a terminal illness that is one step away from the delisting graveyard. What preventative medicine can you take when the entire sector is coming down with a severe case of the chills? The answer lies in singling out companies with a high chance of recovery – upgraded earnings.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

My final rule looks for firms that have improved their financial outlook. If the firm goes 8 weeks and no further earnings upgrades are released – the company is cut free. How will this help keep your portfolio healthy?

The negative sentiment in healthcare stocks helps create and maintain deep value. If a firm is expected to suffer due to the healthcare reforms, this will be reflected in the analyst estimate. You will not be buying stocks that have a bad prognosis which lowers your risk. Companies with upwards revised earnings have some sort of competitive edge and a reason for prices to go up as well. Or it could be that a healthcare stock slashes its forecast (you are not invested in it) and prices drop hard. After a while analysts realize that the situation is not as dire as first thought. This firm with deep value is upgraded and this is your entry signal. It all sounds good in theory but how has it turned out in the past in our clinical trials?

Over the past 10 years this strategic investment style with rebalancing every 4 weeks has resulted in a 41% compound annual growth rate!

Get Your Check-up Now

The bottom line is that the nervousness over the healthcare sector is once again creating a great opportunity for investors. We are not marrying these companies or forecasting years down the road. Instead we look for small firms with large upside potential in a defensive sector that have just received a clean bill of health. We hold these companies as long as they keep improving and get stronger still. The Herculean Healthcare strategy is an incredibly robust system that takes the best of defensive and high-growth firms in a potion that tastes good and keeps your portfolio growing healthy and strong.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 3 out of 4 global portfolios are beating their benchmark indexes, with 98% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?