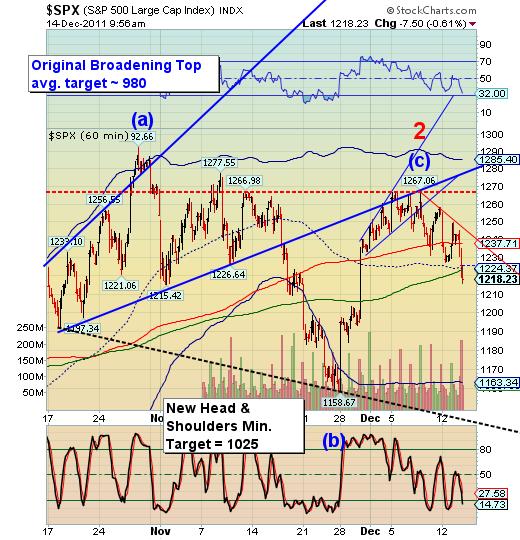

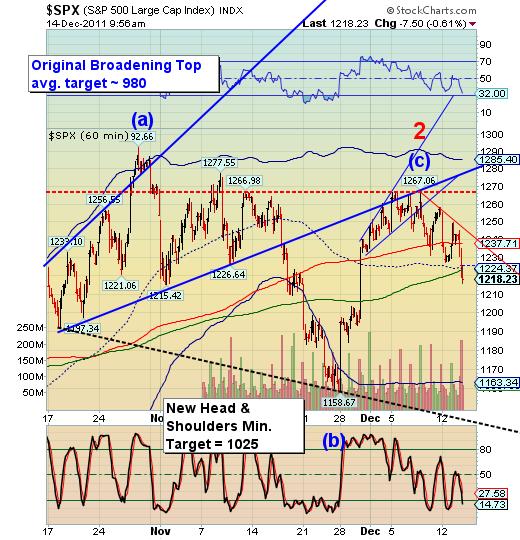

The SPX has broken through its supports and is ready to reach escape velocity. The next target is cycle bottom support at 1163.34, but that is a soft target and may only produce a small bounce, if at all. The real targets are either the new Head And Shoulders minimum target of 1025.00 or the original Broadening Top average target of 980.00.

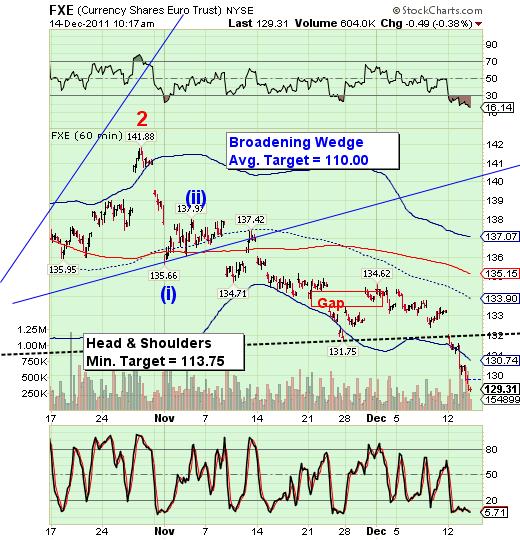

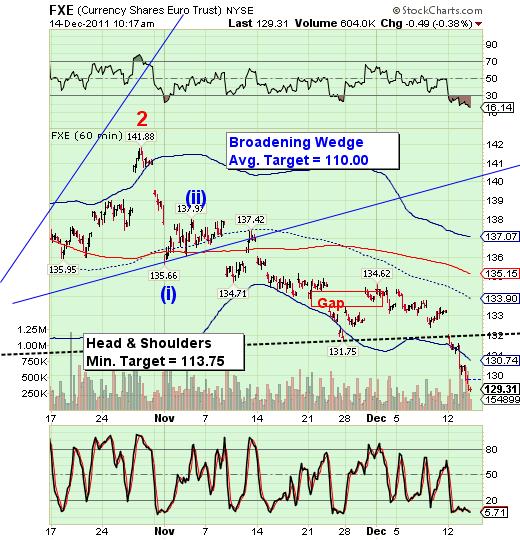

The euro is now in its second day below the Head and Shoulders neckline at 132.00. The mainstream press finally realizes that something is wrong the euro, but offers no course of action. Meanwhile, we have been short the euro since it slipped below the broadening wedge trendline at 137.42.

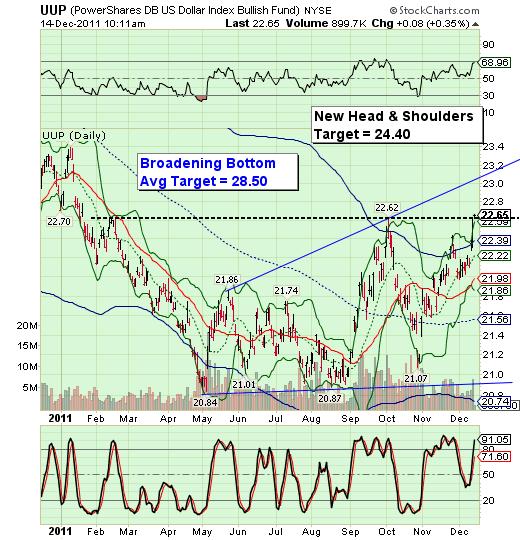

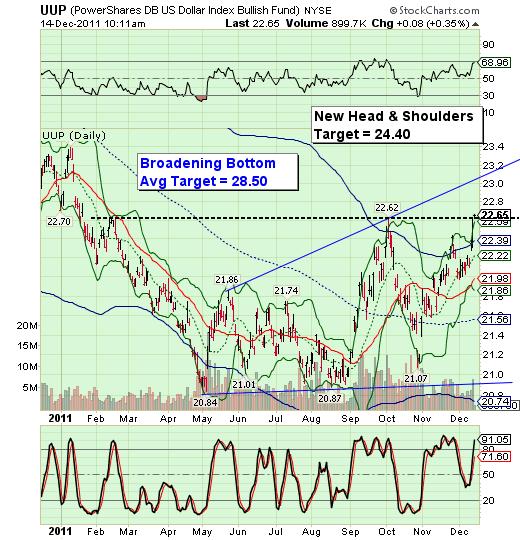

Meanwhile the US dollar is now popping its head above its head and shoulders neckline at 22.62. The new minimum head shoulders target of 24.40 lends credence and support to the broadening bottom average target of 28.50. In the meantime, the strengthening in the dollar will hasten the unwind of the US dollar carry trade and the massive leverage in the markets.

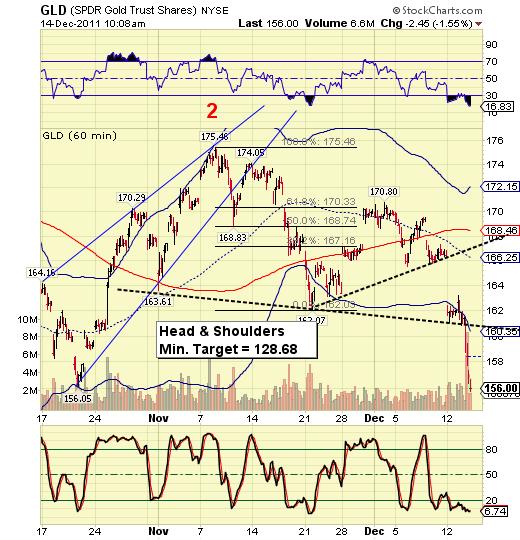

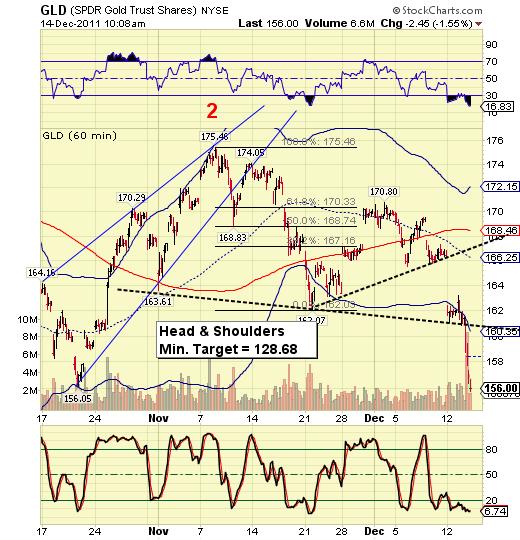

Depending on how you wish to drive necklines, GLD has slipped through a more bearish, down sloping neckline near 161.00. The minimum target on both necklines is the same, 128.68. The daily and weekly charts support this claim as you will see below.

The weekly chart GLD shows that to the half year trendline being broken this week. As you can see, the head and shoulders target of 128.68 is pretty insignificant in the greater scheme of things. Elliott Wave guidelines suggest that a minimum decline could take GLD down to its wave four low as a more probable target.

I hope your seatbelts are buckled.

The euro is now in its second day below the Head and Shoulders neckline at 132.00. The mainstream press finally realizes that something is wrong the euro, but offers no course of action. Meanwhile, we have been short the euro since it slipped below the broadening wedge trendline at 137.42.

Meanwhile the US dollar is now popping its head above its head and shoulders neckline at 22.62. The new minimum head shoulders target of 24.40 lends credence and support to the broadening bottom average target of 28.50. In the meantime, the strengthening in the dollar will hasten the unwind of the US dollar carry trade and the massive leverage in the markets.

Depending on how you wish to drive necklines, GLD has slipped through a more bearish, down sloping neckline near 161.00. The minimum target on both necklines is the same, 128.68. The daily and weekly charts support this claim as you will see below.

The weekly chart GLD shows that to the half year trendline being broken this week. As you can see, the head and shoulders target of 128.68 is pretty insignificant in the greater scheme of things. Elliott Wave guidelines suggest that a minimum decline could take GLD down to its wave four low as a more probable target.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

I hope your seatbelts are buckled.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.