Nvidia to resume H20 chip sales in China, announces new processor

Well it happened. A 1% down day on the S&P 500 SPDR’s, SPY. And perhaps we'll get more. The crowd calling for a correction must be getting fidgety in their seats with excitement. Anther day of this will see social media and the interwebs crawling with bearish prognosticators. Take it from me, you are already too late to call it lower. You have all been slammed to the curb. Robert Prechter called for a 100 year bear market on this move. You know you cannot top that with your 3, 5 or 10% corrections. Don’t even try. So maybe it is time to come over to the light. The side which is full of optimism and goodness - the bull case. I can erect a case for the SPY that just might help you save face as well. Take a look at the daily chart for the SPY below:

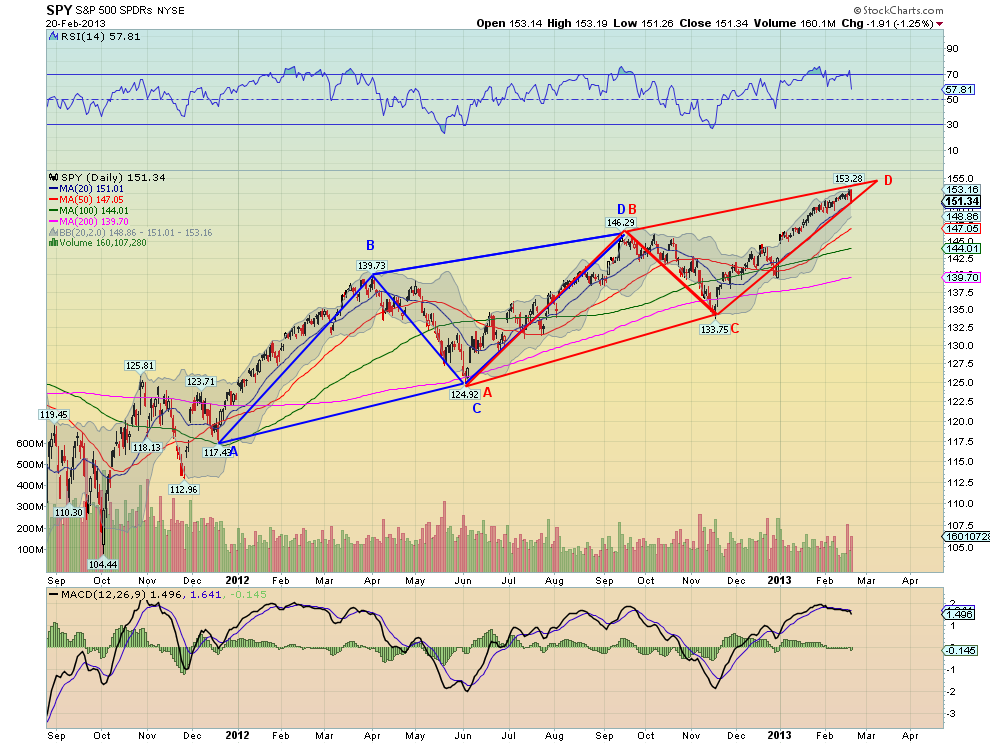

Since Christmas 2011 the SPY has has been repeating ABCD patterns in what looks like the crane you built with your erector set as a kid. There is a lot of symmetry in the price action over the last 14 months. The up legs have each measured 22 points. The leg from December 2011 to April 2012, and the leg from June 2012 to September 2012 also took about 3 and a half months to build. Extending both of these to the current leg gives a target of 155 around the first week of March. This would also complete a Three Drives pattern. Can it go lower before reaching 155 in March? Yes. Nothing prohibits that. So that is your out. Or if you want more than that, the period after early March is wide open for the next BC leg lower in this uptrend to 140-142. Wait, maybe I am turning around. No, I’m still bullish, but lets just watch the price action.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post