After soaring 149%, this stock is back in our AI’s favor - & already +25% in July

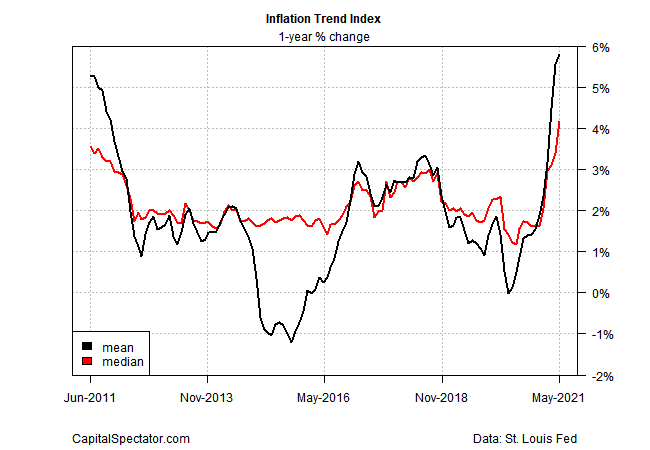

Inflation anxiety is rising, and not without reason. Several inflation indexes that are widely followed accelerated sharply in April, along with various price sentiment measures and key commodities. In an effort to extract more signal and less noise, CapitalSpectator.com introduces a seven-factor measure of inflation – the Inflation Trend Index (ITI).

The idea here is that every inflation index (or proxy) comes with its own unique set of issues. At the same time, aggregating a mix of data sets may provide a clearer picture of how inflationary pressures are evolving by pulling together numbers that are, to some degree, complimentary as a group. To that end, ITI is comprised of rolling one-year percentage changes for the following indicators:

- Consumer Price Index (headline)

- Core Consumer Price Index

- Average hourly earnings of private employees

- Import prices

- Inflation expectations (University of Michigan consumer survey)

- Producer prices for commodities

- Treasury market’s implied inflation forecast (yield spread on nominal 5-year maturity less 5-year TIPS rate)

The arrival of new data varies, depending on the indicator. For numbers published with a lag vs. the counterparts, the last data point is carried forward and so ITI is updated more frequently throughout each month than the standard inflation indexes. Next, the median and mean of the rolling one-year changes are calculated, as show in the chart below.

Not surprisingly, the results echo the sharp jump in inflation data shown elsewhere. The question is whether this surge is a temporary effect as the economy comes back to life or a sign of hotter inflation that endures? The answer awaits in the months ahead. Presumably, ITI will offer a relatively early clue ahead of the official inflation numbers.

As new results are published, ITI will be updated accordingly, offering a real-time measure of how the inflation trend is changing. In a future post, I’ll add forecasts, based on combination forecasting via eight models.

Meanwhile, the crowd is on high-alert for incoming signs of where inflation is headed. We’ll keep you posted by way of ITI’s spin on the trend.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI