With so much focus on equity markets at present, and with many analysts suggesting that we are now coming to the end of the current bull trend, and starting a long bear trend, its time to consult the oracle of market sentiment, the VIX which will hopefully provide a more balanced view.

Indeed it was interesting to note in Friday’s price action in the futures market, that while the YM opened weaker on overnight selling, before recovering in the US session, both the ES and the NQ displayed more bullish sentiment, with the NQ in fact closing higher than the previous day. Both these indices closed with deep lower wicks to the candles, suggesting a modicum of buying and certainly far removed from the bear top now being forecast. Indeed, it is also interesting to note, once again, that despite the sharp sell of on the Nikkei overnight, this has yet to be replicated in the futures market, which appears to be taking a more sanguine view of world events at present.

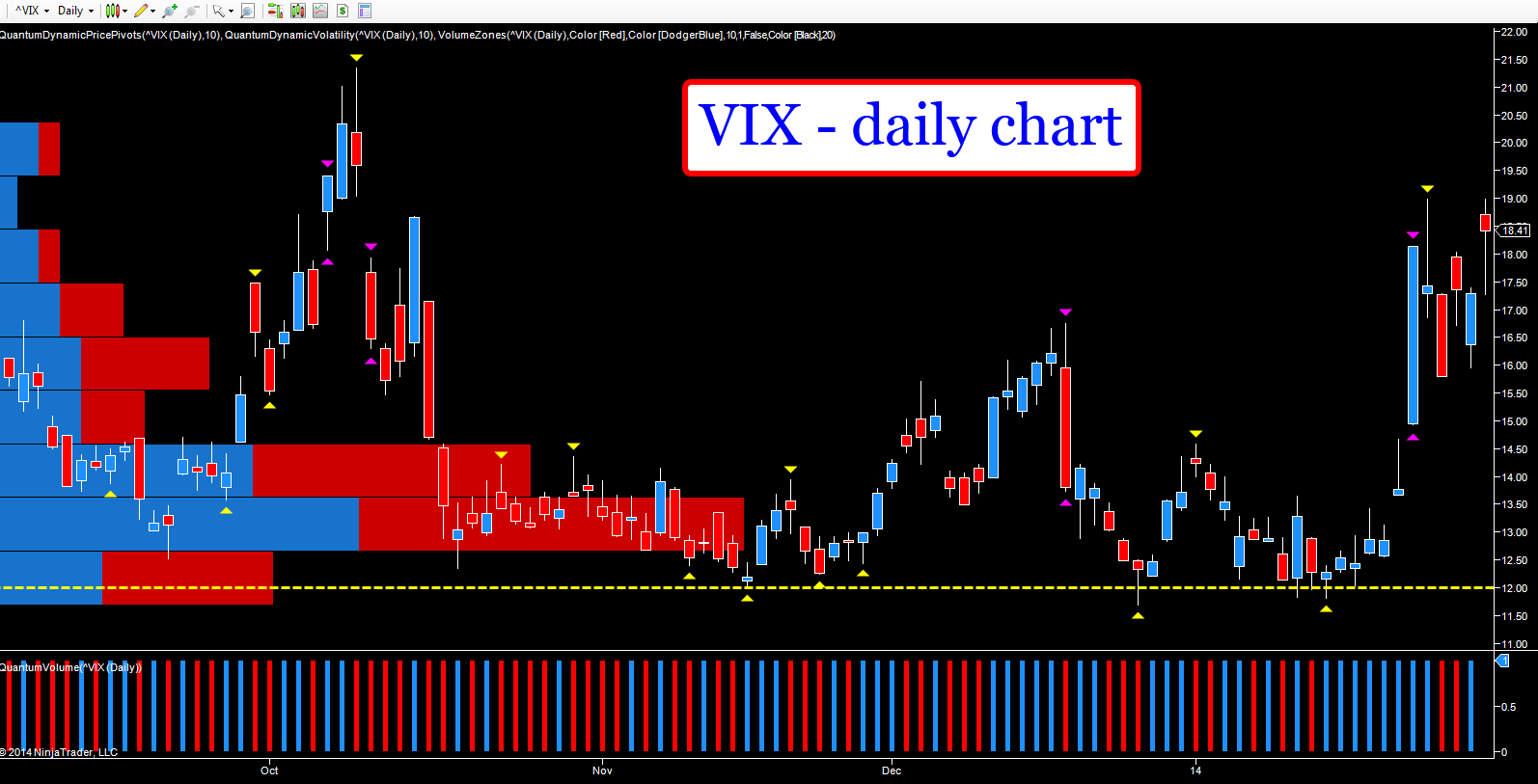

And so to the VIX which spent last week trading in a relatively narrow range, between 16 to the downside and 19.00 to the upside – hardly suggestive of panic! Indeed Monday’s shooting star candle was topped off with a pivot high on the daily chart, with the index moving lower on Tuesday, before moving back to test the 19.00 region once again on Friday. However, Friday’s candle was also a hanging man, and coupled with the shooting star of Monday, suggests a possible top at this level and only a firm move beyond the high of October at 21.50 will signal any possible longer term change in trend. For any further bullish momentum, the floor of support in the 12.00 region remains the defining level, and remains the trigger point, for longer term bullish momentum.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.