There are numerous risks to the US economy ranging from China's potential hard landing and the eurozone crisis to the so-called Fiscal Cliff. However it is the exogenous factors that are often the most damaging. As discussed earlier (see post), a large spike in gasoline prices could do a great deal of damage.

Unlike many emerging markets nations, Americans can in fact afford higher gas prices (as painful as it is for the consumer), but the psychology of having to shell out 30-50% more than they paid just a few months ago will clearly inhibit spending across the board. Gasoline price is one economic indicator that most Americans track daily. And the shock to gasoline futures today will do a great deal of damage if it propagates to the gas pump.

The explanation for the spike this time is that someone was covering a large short position. It's almost as good an explanation as the hurricane Isaac causing prices to climb long after the hurricane was gone (see discussion).

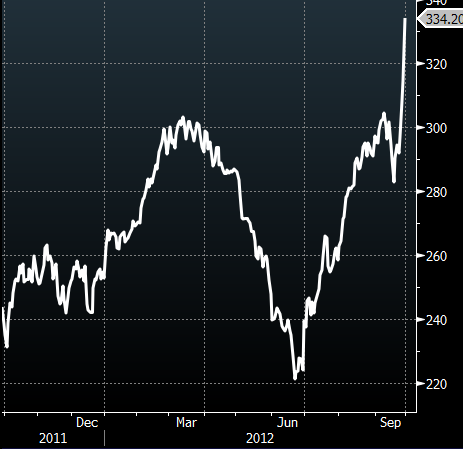

WSJ: Gasoline futures soared 6.3% Friday--a jump some traders attributed to investors covering bets on lower prices as the current futures contract expired.

Reformulated gasoline for October delivery rose 19.8 cents to settle at $3.3420 a gallon, as the front-month contract came to an end on the New York Mercantile Exchange. By contrast, the next contract, November, finished the session at only $2.9167 a gallon.

Traders and analysts said the jump in the October contract likely was caused by investors who had bet the contract's prices would be lower, known as being caught short, and had to rush to buy futures to cover those positions.

If prices at the pump continue to climb, US consumer spending (70% of the US economy) could be in real trouble. As it is, high prices in August already put a damper on spending. October could be far worse.

Reuters: U.S. households stretched to pay for costlier gasoline on meager income growth in August, undercutting spending on other items and pointing to lackluster economic growth.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.