Goldman Sachs speculative trading indicator hits record high

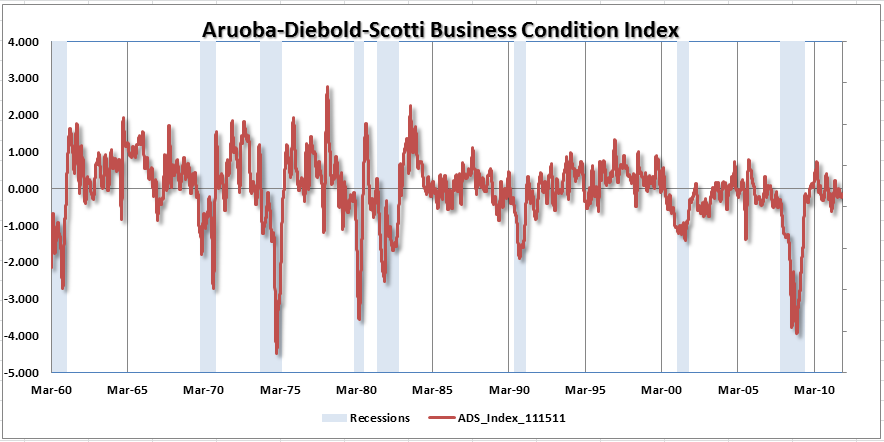

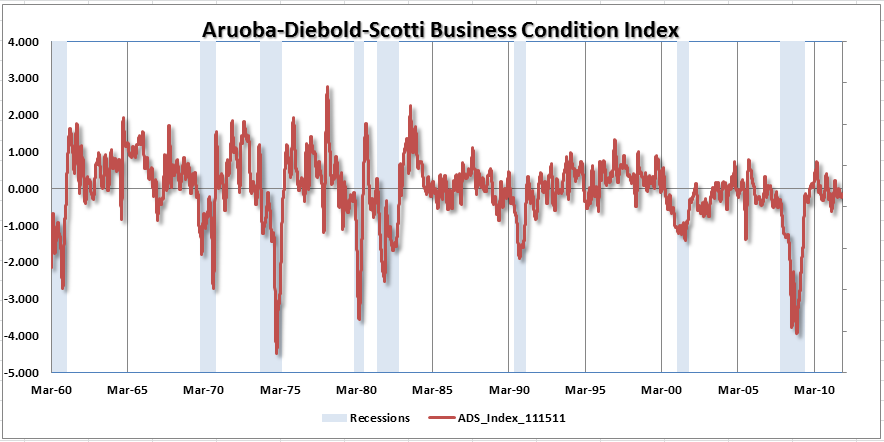

Everyday we are bombarded by a inflow of economic data from which we try and make assessments about the future direction of the economy. One indicator that doesn't get much attention at all from the press is the Aruoba-Diebold-Scotti Business Condition Index.

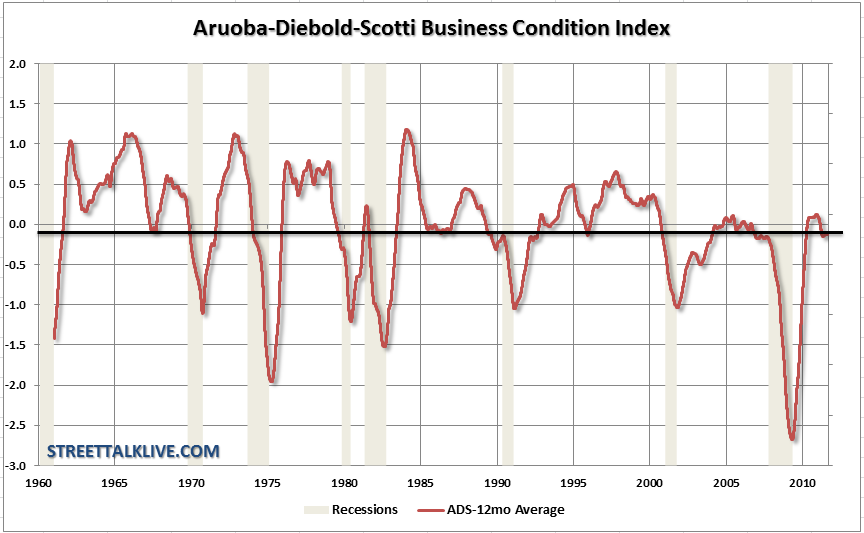

The Aruoba-Diebold-Scotti business conditions index is designed to track real business conditions at high frequency. Its underlying (seasonally adjusted) economic indicators (weekly initial jobless claims; monthly payroll employment, industrial production, personal income less transfer payments, manufacturing and trade sales; and quarterly real GDP) blend high- and low-frequency information and stock and flow data. Both the ADS index and this web page are updated as data on the index's underlying components are released.

The average value of the ADS index is zero. Progressively bigger positive values indicate progressively better-than-average conditions, whereas progressively more negative values indicate progressively worse-than-average conditions. The ADS index may be used to compare business conditions at different times. A value of -3.0, for example, would indicate business conditions significantly worse than at any time in either the 1990-91 or the 2001 recession, during which the ADS index never dropped below -2.0"

As opposed to many of the other economic indicators that are used to try and distinguish the trend of the economy - this is a composite index of stock data and economic indicators that are observed at mixed frequencies and compiled on a DAILY basis for the purposes of creating a "real-time" read on the economy. Of course, because of the real-time nature of the index it is quite noisy and volatile and hard to immediately garner any significant indications about the overall direction of the economy.

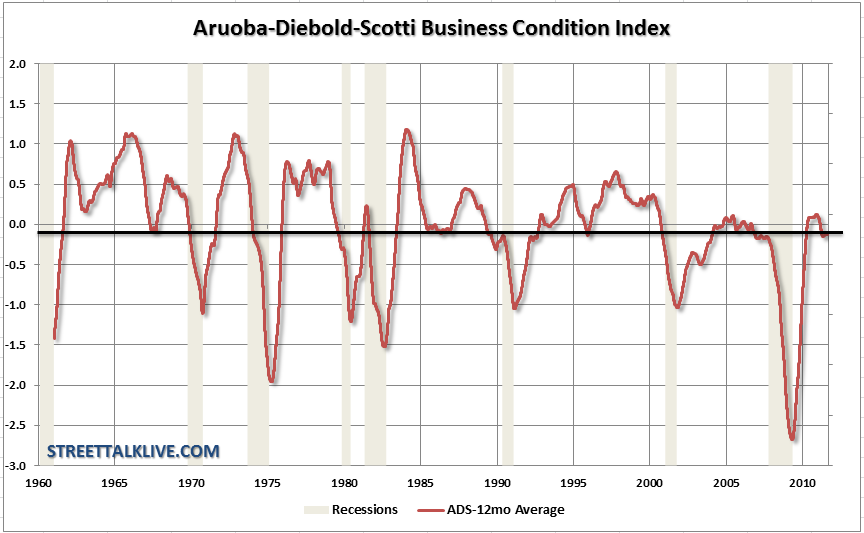

For that reason I smooth the data with a 12-month average so we can more clearly see indications of weakness and the trend of the index overall. The recession indication provided by the ADS index has been fairly accurate with very few false signals along the way.

As the most recent example shows in August of 2007 the smoothed index dropped into recessionary territory even as the mainstream media continued to bleat about a "soft landing" scenario. The economy soon turned dramatically south in 2008 as the financial crisis took hold. Then, as the markets were hitting lows in March of 2009, ad the government scrambled to keep the economy from sliding off into the abyss with massive stimulus injections, the ADS index bottomed and turned up.

It wasn't until December of 2008 that the National Bureau of Economic Research stated that the recession had "officially" started in December of 2007 - fairly close to the time that the ADS index indicated. The NBER later announced the recession ended in June of 2009 - just two months after the ADS smoothed index had bottomed and turned up.

That leads us to today. That specific recovery. which started in April of 2009, has now peaked and turned down. The most recent peak also coincides with the peaks of post 2001-2002 recession recovery. One interesting data point here in reference to the economy of the entire 21st century is that the economic strength has been substantially weaker than that of the past. This is even with the massive amounts of stimulus, liquidity, credit and housing bubble. In the past economic recoveries post recession generally reached a positive 0.5 reading or better before the next decline. In the past two cycles the index has barely been above zero.

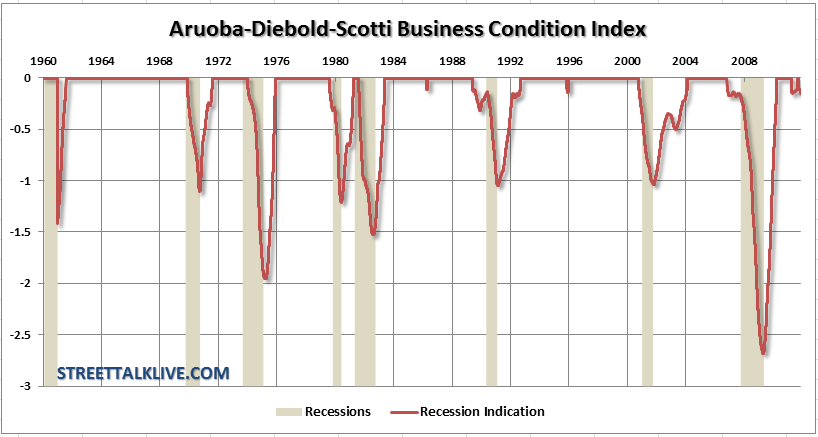

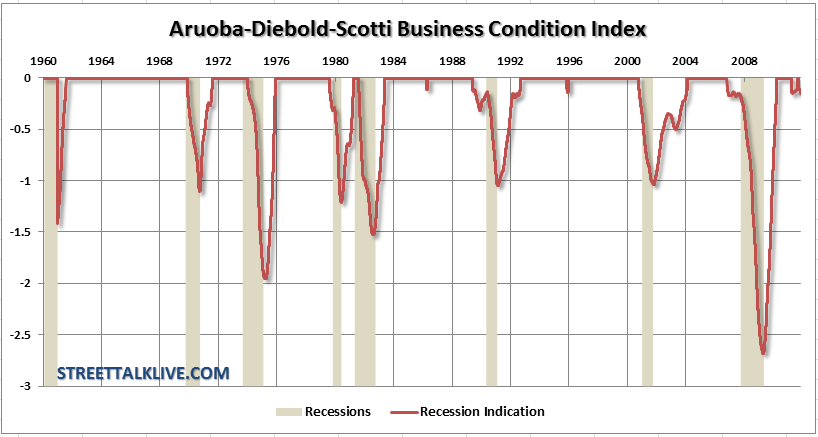

However, there is still some subjectivity as to the accuracy of the index and the start and end of recessions. Therefore, to turn the ADS into a recession indicator I removed all of the values that are greater than negative 0.1 from the smoothed index. In this way we can get a better view of the accuracy of the index as a recessionary indicator. Whenever the ADS Business Conditions Index falls below -0.1 the economy has generally either been in, or was about to be in, a recession. With the current reading, as of December 10th, of -0.124 the index is beginning to push levels that have normally been associated with a weaker economy going forward.

Since stocks are affected by a weaker economy through declining profit margins and earnings, which is why the stock market corrects by 30% on average during a recession, investors would have been well served to pay attention to this index in the past. It will be important in the coming weeks ahead that the ADS index turns back up above zero, otherwise, we may be talking about a much weaker economy in the coming new year. The general consensus between the media, economists and the Federal Reserve, is that we are just in a "soft patch" currently and things will strengthen in the coming year. Of course, this is what we heard just before the last recession as the ADS index said differently. Maybe that is reason enough to be concerned.

The Aruoba-Diebold-Scotti business conditions index is designed to track real business conditions at high frequency. Its underlying (seasonally adjusted) economic indicators (weekly initial jobless claims; monthly payroll employment, industrial production, personal income less transfer payments, manufacturing and trade sales; and quarterly real GDP) blend high- and low-frequency information and stock and flow data. Both the ADS index and this web page are updated as data on the index's underlying components are released.

The average value of the ADS index is zero. Progressively bigger positive values indicate progressively better-than-average conditions, whereas progressively more negative values indicate progressively worse-than-average conditions. The ADS index may be used to compare business conditions at different times. A value of -3.0, for example, would indicate business conditions significantly worse than at any time in either the 1990-91 or the 2001 recession, during which the ADS index never dropped below -2.0"

As opposed to many of the other economic indicators that are used to try and distinguish the trend of the economy - this is a composite index of stock data and economic indicators that are observed at mixed frequencies and compiled on a DAILY basis for the purposes of creating a "real-time" read on the economy. Of course, because of the real-time nature of the index it is quite noisy and volatile and hard to immediately garner any significant indications about the overall direction of the economy.

For that reason I smooth the data with a 12-month average so we can more clearly see indications of weakness and the trend of the index overall. The recession indication provided by the ADS index has been fairly accurate with very few false signals along the way.

As the most recent example shows in August of 2007 the smoothed index dropped into recessionary territory even as the mainstream media continued to bleat about a "soft landing" scenario. The economy soon turned dramatically south in 2008 as the financial crisis took hold. Then, as the markets were hitting lows in March of 2009, ad the government scrambled to keep the economy from sliding off into the abyss with massive stimulus injections, the ADS index bottomed and turned up.

It wasn't until December of 2008 that the National Bureau of Economic Research stated that the recession had "officially" started in December of 2007 - fairly close to the time that the ADS index indicated. The NBER later announced the recession ended in June of 2009 - just two months after the ADS smoothed index had bottomed and turned up.

That leads us to today. That specific recovery. which started in April of 2009, has now peaked and turned down. The most recent peak also coincides with the peaks of post 2001-2002 recession recovery. One interesting data point here in reference to the economy of the entire 21st century is that the economic strength has been substantially weaker than that of the past. This is even with the massive amounts of stimulus, liquidity, credit and housing bubble. In the past economic recoveries post recession generally reached a positive 0.5 reading or better before the next decline. In the past two cycles the index has barely been above zero.

However, there is still some subjectivity as to the accuracy of the index and the start and end of recessions. Therefore, to turn the ADS into a recession indicator I removed all of the values that are greater than negative 0.1 from the smoothed index. In this way we can get a better view of the accuracy of the index as a recessionary indicator. Whenever the ADS Business Conditions Index falls below -0.1 the economy has generally either been in, or was about to be in, a recession. With the current reading, as of December 10th, of -0.124 the index is beginning to push levels that have normally been associated with a weaker economy going forward.

Since stocks are affected by a weaker economy through declining profit margins and earnings, which is why the stock market corrects by 30% on average during a recession, investors would have been well served to pay attention to this index in the past. It will be important in the coming weeks ahead that the ADS index turns back up above zero, otherwise, we may be talking about a much weaker economy in the coming new year. The general consensus between the media, economists and the Federal Reserve, is that we are just in a "soft patch" currently and things will strengthen in the coming year. Of course, this is what we heard just before the last recession as the ADS index said differently. Maybe that is reason enough to be concerned.