Just ahead of the start of the Apple Worldwide Developers Conference (WWDC), I wrote that I was preparing for a change in Apple’s trading patterns that would impact the Apple Trading Model (ATM). My main interest was in the coming 7-to-1 stock split and the potential for retail traders leaving options alone to trade directly in Apple (NASDAQ:AAPL) stock. It turns out that large investors/traders may instead keep the options buzz very much alive in AAPL.

On Wednesday, June 4, 2014, CNBC reported that two huge trades crossed the tape in Apple options:

“In the second-straight day of heavily bullish options buying in Apple, one major investor appears to be betting nearly $60 million that Apple shares will rise above $700 by October.

In one of Wednesday morning’s largest options trades, 20,000 Apple 675-strike call options were traded for $21.30 per share…

…In addition, the same trader appeared to buy 10,000 October 700-strike calls for $14.75 each.”

These trades total a mind-boggling $58M bet on AAPL heading back to all-time highs. When I staked my claim on AAPL sentiment indicating the stock would eventually hit all-time highs, I did NOT have in mind such massive “big boy” bets on AAPL’s options!

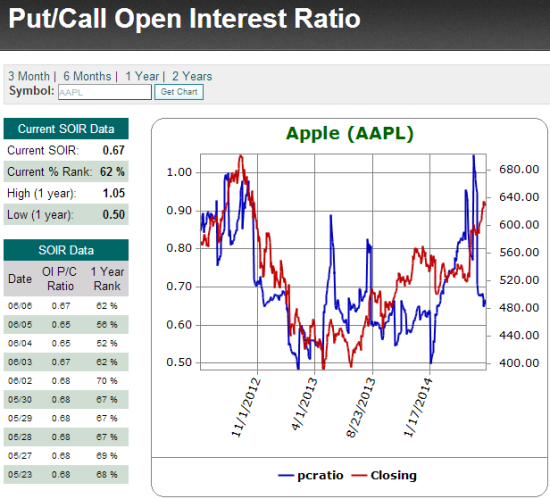

All this options buzz is part of a dramatic drop in the open interest put/call ratio and similarly a dramatic change in sentiment toward increasing bullishness:

If I am reading this chart correctly, this drop in the put/call ratio is the first time in at least the past two years where such a notable decline accompanied a ramp in AAPL’s stock price. In recent history, AAPL has had a tendency to trade inversely to big moves in the put/call ratio. Such a change in behavior will greatly buttress Apple’s uptrend. It will invalidate the ATM in a way that could make trading in AAPL a lot easier: just go long, very long…

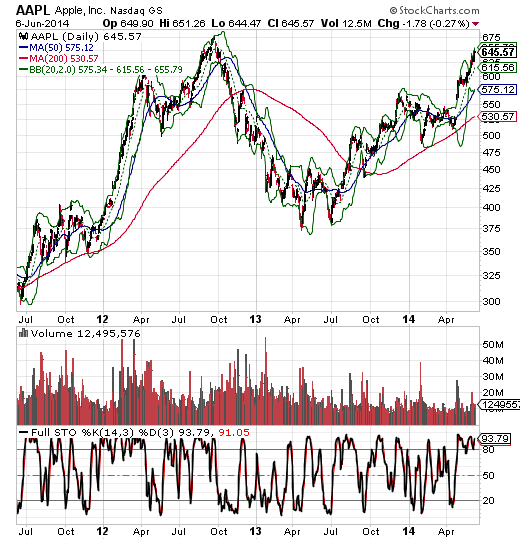

The march back to all-time high continues – note that stochastics have stayed aloft in over-bought territory for much of the breakout

Be careful out there!

Full disclosure: no positions

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.