Just ahead of the start of the Apple Worldwide Developers Conference (WWDC), I wrote that I was preparing for a change in Apple’s trading patterns that would impact the Apple Trading Model (ATM). My main interest was in the coming 7-to-1 stock split and the potential for retail traders leaving options alone to trade directly in Apple (NASDAQ:AAPL) stock. It turns out that large investors/traders may instead keep the options buzz very much alive in AAPL.

On Wednesday, June 4, 2014, CNBC reported that two huge trades crossed the tape in Apple options:

“In the second-straight day of heavily bullish options buying in Apple, one major investor appears to be betting nearly $60 million that Apple shares will rise above $700 by October.

In one of Wednesday morning’s largest options trades, 20,000 Apple 675-strike call options were traded for $21.30 per share…

…In addition, the same trader appeared to buy 10,000 October 700-strike calls for $14.75 each.”

These trades total a mind-boggling $58M bet on AAPL heading back to all-time highs. When I staked my claim on AAPL sentiment indicating the stock would eventually hit all-time highs, I did NOT have in mind such massive “big boy” bets on AAPL’s options!

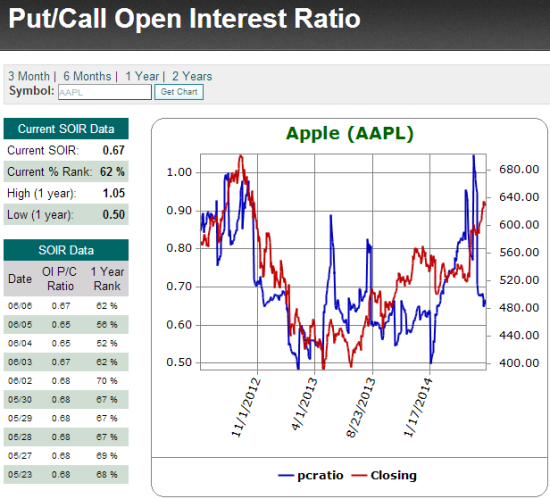

All this options buzz is part of a dramatic drop in the open interest put/call ratio and similarly a dramatic change in sentiment toward increasing bullishness:

If I am reading this chart correctly, this drop in the put/call ratio is the first time in at least the past two years where such a notable decline accompanied a ramp in AAPL’s stock price. In recent history, AAPL has had a tendency to trade inversely to big moves in the put/call ratio. Such a change in behavior will greatly buttress Apple’s uptrend. It will invalidate the ATM in a way that could make trading in AAPL a lot easier: just go long, very long…

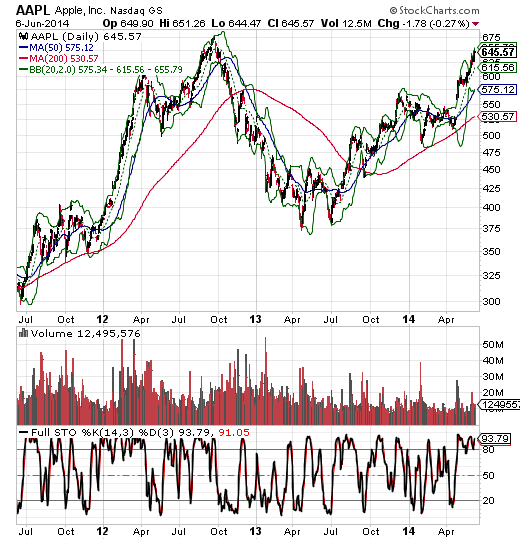

The march back to all-time high continues – note that stochastics have stayed aloft in over-bought territory for much of the breakout

Be careful out there!

Full disclosure: no positions