Street Calls of the Week

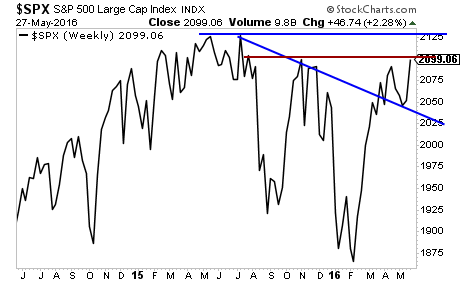

Traders gunned the market higher last week thanks to extremely low volume (most of Wall Street left early for the holiday weekend) and the usual performance (many funds have to record results at month end).

The S&P 500 has now slammed up against overhead resistance (red line). We are once again within spitting distance of the all-time highs.

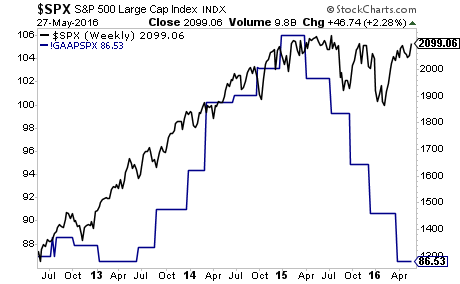

Against this backdrop, earnings are in a free-fall. EPS are back at 2012 levels, while the S&P 500 is 70% higher than then:

This divergence is only getting worse. Of the 111 companies that have issued guidance for 2Q16, an incredible 80% are NEGATIVE.

More and more this environment feels like late 2007/ early 2008: when the economy was in collapse but stocks held up on hopes that the Fed could maintain the bubble.

The time to prepare for this bubble to burst is now. Imagine if you’d prepared for the 2008 Crash back in late 2007? We did, and our clients made triple digit returns when the markets imploded.

We’re currently preparing for a similar situation today.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.