When I was growing up, my parents told me the stories of chicken little and the boy who cried wolf. Both parables are intended to teach the lesson that if you repeatedly make a big fuss about something that is not really happening, when it does finally happen no one will be listening to you at that point. You will have been proven wrong so many times that no one cares what you say and the opportunity--when it finally arrives--will be ignored.

It's too bad that no one in the financial media seems to have payed attention to these lessons. Every day we are told that the sky is falling in the market. And every day for six years, it has not happened. So why is it going to happen now? I do not need to give any analysis on that. You already hear it 24/7.

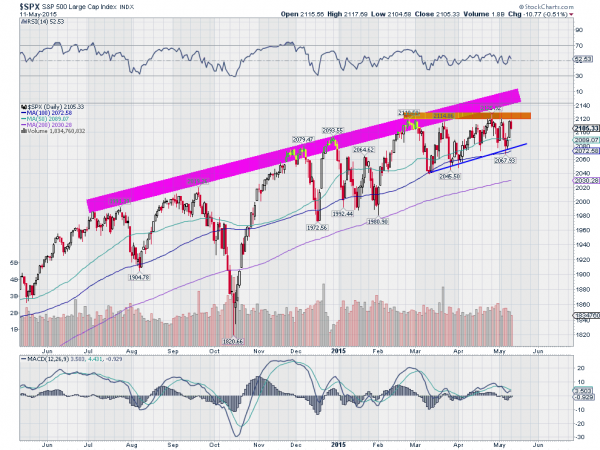

What I would rather do is remind you that the market is still in a long term uptrend. The chart above is even more interesting in that regard. It does not show the long term uptrend but rather just the last 12 months. And within it there are several signs that the trend is healthy and will continue.

First, the purple trend resistance. It is resistance yes, but it is rising. Next, the SMAs are all rising, and nearly in a parallel fashion. This is a good sign of a strong market. Third are the momentum indicators. The RSI is in the bullish range and the MACD has reset, remains positive and is near a cross up. Finally the price action since the February consolidation break-out has been one of higher lows against flat resistance. This is known as an ascending triangle and is bullish, targeting a move to 2210 on a break higher.

This is not rocket science. Just look at the chart of price action. It is going up, not down or even sideways.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.