Global aluminum demand is more robust than most expected. Chinese stimulus measures boosted demand for aluminum in the auto and real estate industries. In addition, the U.S. is expected to demand more aluminum amid Donald Trump’s plans to inject one trillion dollars in U.S. infrastructure.

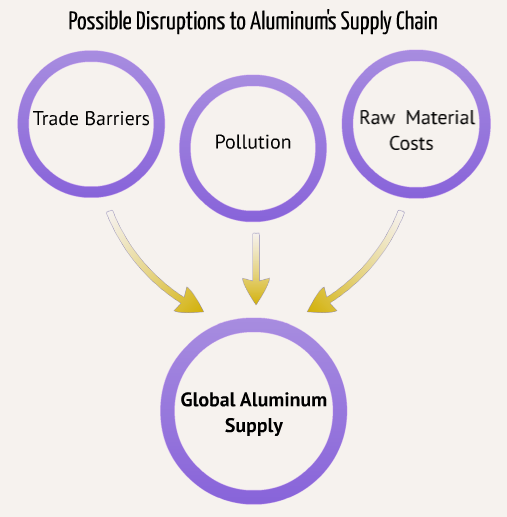

Strong demand is supportive for aluminum prices this year. However, in this piece we are going to focus on the supply side. We believe three factors are going to disrupt global aluminum supply. As a result, we’ll see higher aluminum prices this year:

Graphic: Raul de Frutos, MetalMiner.

Trade Barriers

Last week, U.S. customs officials seized $25 million worth of aluminum linked to a Chinese billionaire accused of stockpiling the metal across the world. The move is the most potent action yet by federal authorities probing whether U.S. companies connected to Chinese magnate Liu Zhongtian illegally avoided nearly 400% tariffs by routing the metal through other countries. Currently, Homeland Security is conducting laboratory tests on the aluminum to determine whether the metal is restricted under U.S. law.

Amid Donald Trump’s pro-American policies, driven by what he sees as the U.S. losing to China in terms of trade, this new complaint may heighten trade-related tensions between the two countries. Higher trade barriers can turn into supply supply disruptions as international producers lose profitability in their export business. We believe aluminum exporters, particularly in China, will have to cut production as they lose business.

Source: MetalMiner analysis of fastmarkets.com data.

We’ve previously reported that the aluminum stockpile debate would have bullish repercussions on aluminum prices. Aluminum investors seem to agree with us. Aluminum prices recently hit a 20-month high following the news that the aluminum stockpile was seized.

Pollution In China

Another disruptive factor to the global aluminum supply chain is the ongoing pollution problems in China. For years, Chinese cities have been choking on the smog spewing from China’s industrial production sector but things have recently gotten much worse. Last month, authorities asked 23 cities in northern China to issue red alerts as inspection teams scoured the country. The scale of the red alert measure shows that the Chinese government is taking air pollution seriously. Given that coal burning is the biggest contributor to air pollution in China, industrial metals supply could shrink this year, particularly steel and aluminum.

Rising Raw Material Costs

One of the factors supporting higher aluminum prices has been that there were fewer smelter restarts than expected smelter in China. In 2017, the increase in production costs will limit additional restarts.

First, alumina seems headed for a supply deficit this year following Chinese curtailments. Second, coal prices have surged since China reduced the hours for workers in its coal sector, supposedly in a bid to control pollution and curtail its excess industrial capacity. Truth be told, though, China really relaxed the mining day norm simply to control skyrocketing — some would say artificially high — prices. However, we expect the maneuvers will keep China’s supply of coal and aluminum in check this year.

What This Means For Aluminum Prices

We’ve been calling for higher aluminum prices for months. The reasons to expect higher prices continue to pile up. Aluminum prices rising back to $2,000/metric ton as more aluminum buyers should minimize their price risk exposure if they haven’t done it yet.