Trump announces trade deal with EU following months of negotiations

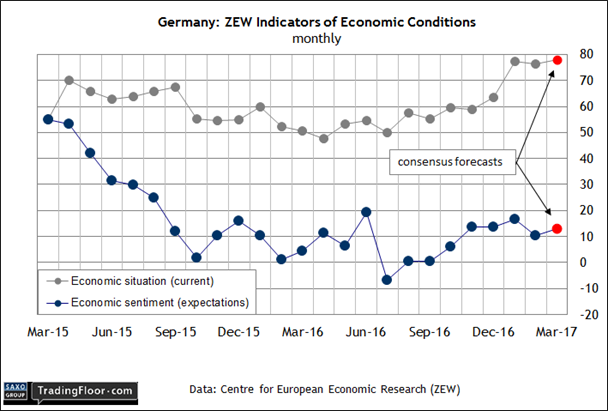

- Economists expect ZEW’s economic sentiment indices for Germany to rise

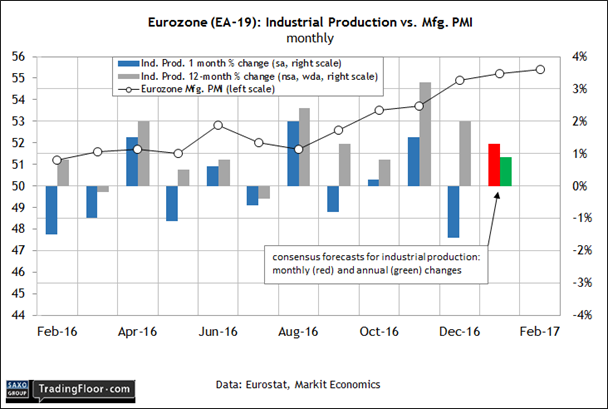

- Eurozone industrial output projected to rebound after a sharp slide in December

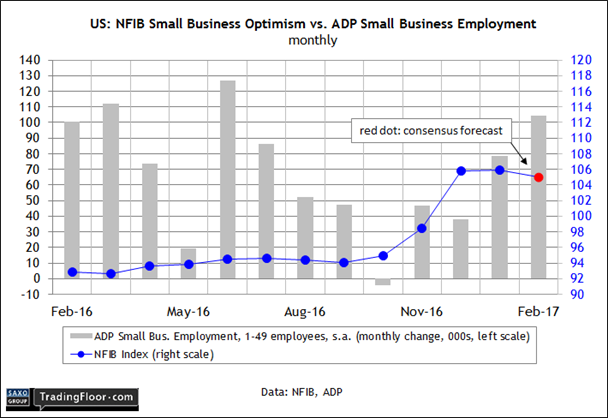

- Upbeat mood expected to remain in February's US Small Business Optimism Index

The mood among German financial analysts is in focus today via ZEW’s monthly survey report. We’ll also see the January numbers for Eurozone industrial production and the February release of the Small Business Optimism Index for the US. Note that all three releases are scheduled for release simultaneously at 1000 GMT.

Fear is nowhere on the horizon as today's release of March sentiment among German financial professions is set to reaffirm the upbeat outlook for the economy.

Germany: ZEW Economic Survey (1000 GMT): The chief economist at High Frequency Economics thinks that Europe’s biggest economy is at risk of stumbling.

The widely read economist, Carl Weinberg, advised in a note to clients last week:

As domestic demand is imploding, so is foreign demand ... exports are flat year-on-year. This is not to say that net exports are not rising. However, the flat gross exports mean industrial output to make goods for export is not growing.

But if there’s reason to worry, fear is nowhere on the horizon in terms of this month’s sentiment data for Germany’s manufacturing sector. The Markit/BME Germany Manufacturing PMI reached its highest level in six years in February. “The survey results suggest that manufacturing will contribute to a strengthening in overall economic growth in the first quarter,” said a senior economist at IHS Markit, earlier this month.

Today’s release of March sentiment among German financial professions is expected to reaffirm the upbeat outlook. Econoday.com’s consensus forecast sees ZEW’s benchmarks ticking higher this month. The current situation index in particular has climbed sharply in recent months, reaching its highest level in February since 2011. Today’s projected increase to 77.9 for March anticipates an even higher level. The expectations data has been relatively middling by comparison, but a modest rise is on track on this front too.

Nonetheless, Weinberg’s concerns aren’t easily dismissed, courtesy of the slide in retail spending in January, which took economists by surprise. But exports increased by a healthy 2.7% in the kick-off to 2017.

Does one number have greater relevance than the other for considering what’s in store for Germany in the months ahead? The market will be looking at today’s update on sentiment for a fresh clue.

Eurozone: Industrial Production (1000 GMT): Output is expected to rebound in today’s January release, reversing most of December’s sharp decline.

Analysts are looking for a 1.3% increase in production for January following December’s hefty 1.6% slide. But while the revival in the monthly comparison will be welcome news, the year-on-year growth trend is on track to decelerate again. Output is still expected to remain positive, but Econoday.com’s consensus forecast sees the annual change dipping for the third month in a row, settling at 0.9%.

The good news is that the annual comparison is headed for its sixth positive reading and Markit’s sentiment data suggests that the upbeat numbers will roll on in the months ahead. The Eurozone Manufacturing PMI increased to a 70-month high last month.

“Euro area manufacturers are reporting the strongest production and order book growth for almost six years, in what’s looking like an increasingly robust upturn,” Chris Williamson, the chief business economist at IHS Markit, said earlier this month.

Today’s hard data on industrial activity is expected to provide support for Williamson’s outlook, particularly from the vantage of the monthly comparison.

U.S.: NFIB Small Business Optimism Index (1000 GMT): The revival in small-business sentiment in recent months has been a reliable forecasting tool (so far) for anticipating job growth in companies with fewer than 50 employees.

The Small Business Optimism Index (SBOI) shot higher in December, following Donald Trump’s election victory, and the benchmark has been holding at comparable levels ever since. Hiring has followed. ADP’s estimate of U.S. employment among small firms has picked up substantially. In February, companies in this corner of the economy added nearly 106,000 workers, an eight-month high.

What’s driving the change? The new occupant of the White House, according to some small-business owners.

The president of a local car dealership told The New York Times this week:

My gut just feels better ... With Obama, you felt it was personal, like he just didn’t want you to make money. Now we have a guy who is cutting regulations and taxes. And when I see my taxes going down every quarter, well, that means I am going to start investing again.

Whatever the explanation, the mood in the small-business sector has improved markedly and today’s data for March is expected to reaffirm the upward shift. The SBOI is on track to tick lower for February, but only slightly. The projected 105 reading for this month represents a third month of sharply higher index values compared to the numbers before last November’s election.

“The stunning climb in optimism after the election was significantly improved in December and confirmed in January,” the president and CEO of the National Federation of Independent Business, the group that publishes today’s figure, explained last month. “Small-business owners like what they see so far from Washington.”

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.