Bitcoin price today: down to $117.9k as Fed, tariff caution offsets Strategy buy

Central banks will be front and centre in today’s economic news. The Bank of England unveils a new policy statement and publishes minutes from the last monetary meeting. The European Central Bank also releases minutes. Later, the crowd will be looking at the weekly report on jobless claims in the US for new data about the state of the labour market in the first week of 2016.

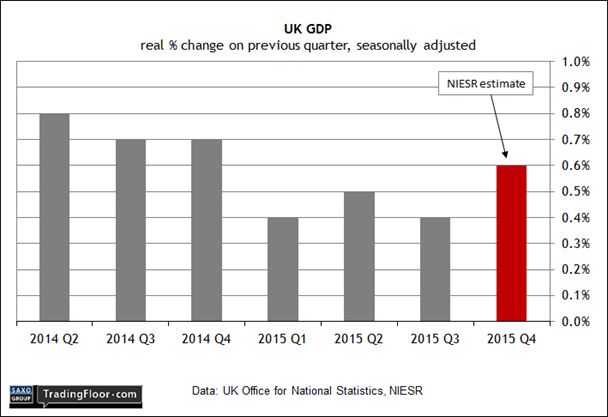

UK: Bank of England announcement and mInutes (1200 GMT): Industrial production posted a surprisingly sharp setback in November, the government reported on Tuesday. But if this is an omen for the UK’s broad trend, it’s not obvious in yesterday’s fourth-quarter GDP estimate via the National Institute of Economic and Social Research.

NIESR, a London think tank, advised that economic growth picked up in the final quarter of last year to 0.6% relative to Q3. “This implies the UK economy expanded by 2.2% in 2015,” the group explained. “Although this is a moderation compared to the 2.9% growth in 2014, it remains consistent with the economy growing at close to its long-run potential rate.”

Sluggish manufacturing means that Britain depends heavily on its services sector to serve up GDP growth. Photo: iStock

The monthly numbers for industrial activity, by contrast, paint a darker profile. Production slumped 0.7% in November against the previous month, a setback that left the annual pace of growth at a sluggish 0.9%. “With manufacturing on course for only modest output growth in Q4 and the other components of industrial production likely to have contracted, the economy is going to be almost wholly reliant on services to drive growth once again,” an economic adviser to the EY Item Club commented.

Meanwhile, wage growth in the UK slowed to 2% during the three months to October, the Office for National Statistics reported last month. That’s a significantly softer pace – a deceleration that some analysts think will convince the Bank of England to delay plans for a rate hike for the foreseeable future.

“I could see them pointing to more downside risks about the global growth outlook,” said Chris Hare, an Investec economist and former BoE official. “This fizzling in wage growth is a key thing that is starting to make the [Monetary Policy Committee] think that perhaps those all-important domestic inflation pressures aren’t there to the extent they thought.”

No surprise, then, that the crowd assumes the current policy rate of 0.5% will prevail in today’s announcement. Britain’s broad macro trend is still on track for moderate growth, but the case is still weak for tightening policy.

Eurozone: European Central Bank minutes (1230 GMT): Analysts at two investment banks this week issued new recommendations for taking monetary stimulus up a notch or two in the Eurozone. What's the latest reasoning for even stronger efforts to juice economic growth? Stumbling five-year forward inflation swap rates, Bloomberg reported yesterday.

The decline in the swap rate to its lowest level since last October strengthens the case for more action by the ECB. The head of rates strategy at Mizuho in London, for instance, thinks the softer outlook on inflation will result in a 0.4% point cut in the ECB’s negative 0.3% deposit rate.

The disinflationary winds were certainly blowing a bit harder in yesterday’s November update on industrial output in the euro area. Production was surprisingly weak, falling 0.7% in the monthly comparison – well below the consensus forecast for a 0.1% rise.

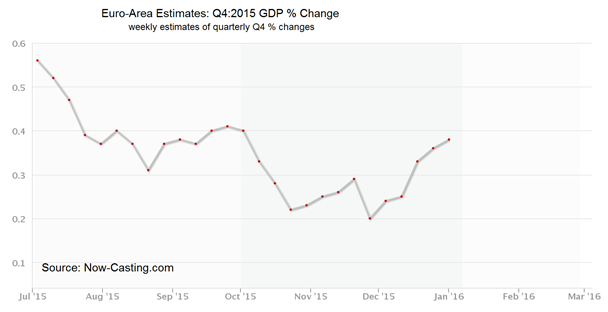

For the moment, however, headline estimates for GDP still look encouraging. Now-casting.com’s current projections for growth in last year’s fourth quarter (see chart below) and this year’s first quarter have picked up recently. The December EY Eurozone forecast is also anticipating that “the recovery is becoming broader-based and more self-sustaining.”

Is the optimism misplaced in the wake of the disappointing numbers for industrial production and falling expectations for inflation? If the answer is “yes” the next question is this: Is the European Central Bank recognising the change in macro conditions, with an eye on ramping up stimulus? There are few clues for expecting a change in policy. But an attitude adjustment may be coming, depending on the news in today’s release of ECB minutes from the last meeting.

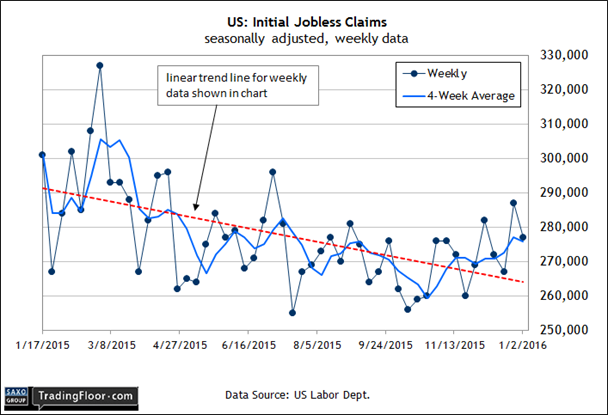

US: Initial Jobless Claims (1330 GMT): Last week’s surprisingly strong gain in nonfarm payrolls in December is an outlier in an otherwise mixed to disappointing field of economic reports these days. But as long as robust growth for the US labour market holds up, the outlook remains encouraging.

This week’s news on job openings looks upbeat as well. The government reported on Tuesday that openings ticked up to 5.431 million (seasonally adjusted annual rate) – slightly more than forecast and close to the record high of 5.668 million for last July.

Today’s release on jobless claims offers a fresh update on the job market – the first major release for US macro activity that unfolded in the new year. Economists think we’ll see more good news in this space, providing a bullish follow-up to the previous decline in new unemployment filings during the last week of December.

Econoday.com’s consensus forecast see claims dipping 2,000 to a seasonally adjusted 275,000 for the week through January 9. In that case, the labour market’s 2016 debut for data will be off to a positive start.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI