Trump meets Zelenskiy, says Putin wants war to end, mulls trilateral talks

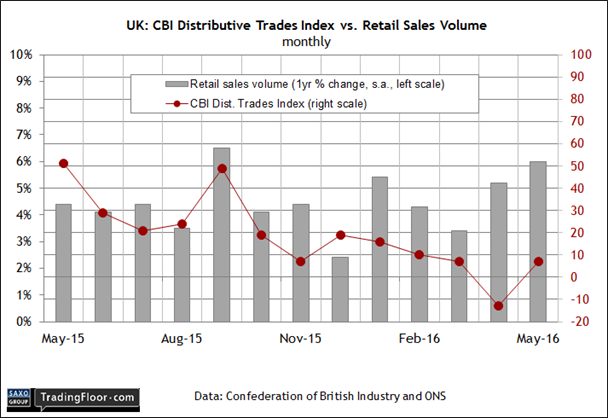

- Today’s Distributive Trades Survey offers a clue on UK retail sales in June

- But the figures will relate to before Brexit upended the outlook

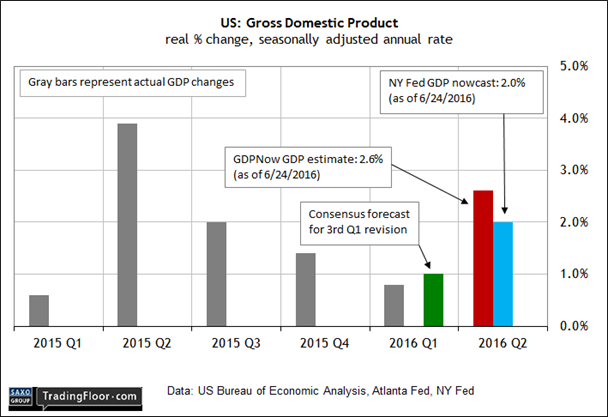

- US first quarter GDP growth is projected to rise slightly in today’s revision

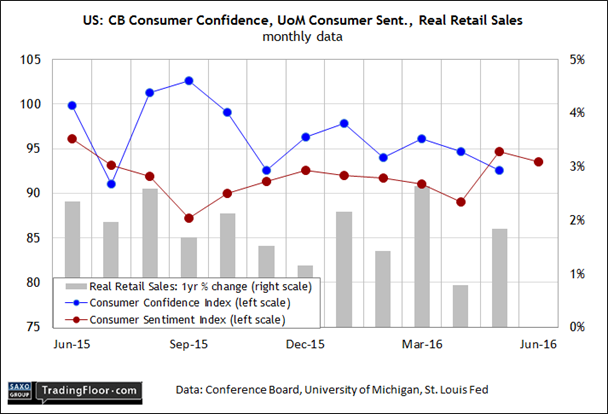

- Economists see modest gain for the US Consumer Confidence Index in June

Today’s schedule for economic releases heats up, but now that we’re in a new world order courtesy of last week’s Brexit vote, it's unclear if today’s numbers will be relevant.

Perhaps not, but the data still deserves close attention for evaluating the strength, or weakness, of economic activity before Friday’s UK referendum voting unleashed a tsunami of macro uncertainty.

Among the numbers du jour is this month's reading of the CBI Distributive Traders Survey for the UK, followed by a revised Q1 GDP report for the US, and the June data for the US Consumer Confidence Index.

UK: CBI Distributive Trades Survey (1000 GMT): Today’s survey data for the retail sector probably won’t offer much if any context for a post-Brexit world, but the numbers are still useful for evaluating momentum's direction before last Friday’s referendum upended the outlook for Britain’s economy.

A month ago the numbers for the sector looked encouraging. The volume of British retail sales growth picked up to a strong 6% year-on-year gain through May.

The CBI’s Distributive Trades Index, which is always published ahead of the government’s official retail data, had been hinting at a rebound for several months.

In April and May, this widely followed benchmark posted gains to a degree that seemed to mark a break with the previous deceleration that weighed on the first quarter.

But it’s a different world and the UK economy has become ground zero for macro uncertainty and what’s likely to be a haircut for growth, perhaps tipping the country into recession before the year is out.

Today’s CBI update won’t be terribly useful, but it will provide a bit of insight into how the retail sector was faring on the eve of the Brexit vote.

US: Q1 GDP Revision (1230 GMT): The crowd’s looking for a small upward revision in today’s third update for first-quarter GDP. The tepid 0.8% increase is expected to bump up to 1%, according to Econoday.com’s consensus forecast. That’s still a weak gain, but at least the projected change is positive.

The bigger question is how will Q2 compare? At the moment, there’s still widespread agreement that growth will bounce higher.

The Atlanta Federal Reserve's current GDP nowcast is looking for a 2.6% rise in Q2. The New York Fed’s latest estimate is lower at around 2.0%, but that’s still an encouraging rebound against Q1.

But with the uncertainty via Brexit fears still roiling markets, it’s an open question if the moderately firmer numbers for Q2 GDP growth will survive until July 29, when the government publishes the “advance” estimate for second-quarter economic activity.

Note that last week’s report for the Chicago Fed National Activity Index reflected a sharply weaker reading for the macro trend in May. In the wake of that worrisome news, a surprisingly weak revision in today’s Q1 GDP numbers will give the crowd another reason to wonder if the US economy is headed for trouble in Q2.

US: Consumer Confidence Index (1400 GMT): Last week’s revised data for the University of Michigan’s Consumer Sentiment Index showed that consumer attitudes cooled a bit in June.

“While no recession is anticipated, consumers increasingly expect a slower pace of economic growth in the year ahead,” said Richard Curtin, the survey’s chief economist.

Today’s release from the Conference Board (CB) will offer more perspective on the mood in June. Economists are looking for a mild uptick to 93.3 from 92.6 in May, according to Econoday.com. If the prediction holds, the news will help allay fears that the mood on Main Street is deteriorating.

But let’s not forget that the CB’s confidence benchmark has been trending lower since last year, albeit punctuated with temporary rebounds. Nonetheless, the May reading is moderately lower against the year-earlier level.

Even if today’s numbers reflect a firmer reading, it may be a temporary bounce as Brexit-related fears take a toll on confidence. “We expect some impact of Brexit via the stock market on consumer attitudes but it would depend on how long-lasting it is,” Curtin told Bloomberg last week.

But at this point, he acknowledged that downward bias “could be substantial”.

Disclosure: Originally published at Saxo Bank TradingFloor.com