Street Calls of the Week

- Revised data for Eurozone consumer inflation in March should match the flash estimate

- The ECB believes the upturn in inflation doesn’t warrant a change in monetary policy

- The slide in the 10-year Treasury yield raises questions about the outlook for Fed hikes

- FTSE 100 took a nosedive after Prime Minister May called a snap election

Revised inflation data for March is the main event for scheduled economic news in Europe today. Meanwhile, traders will be watching the US 10-year Treasury yield, which yesterday fell to its lowest level in more than five months. Meanwhile, keep your eye on the FTSE 100 Stock Index, which tumbled on Tuesday after Prime Minister Theresa May announced an early election due to political complications related to Brexit.

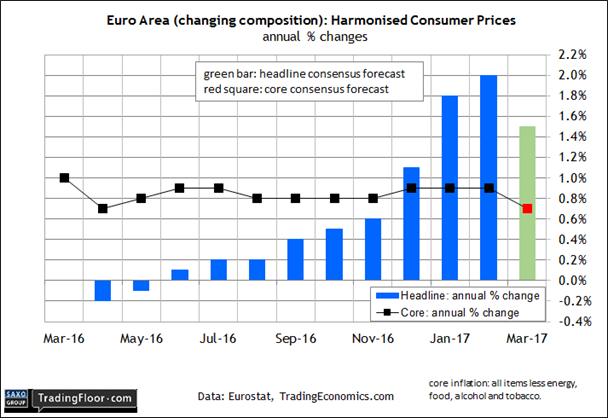

Eurozone: Consumer Price Index (0900 GMT): Today’s revised inflation data for March is expected to reaffirm the European Central Bank’s preference for maintaining a dovish monetary policy for the near term.

Recall that pricing pressure has been rising in recent months, sparking expectations that the ECB would be forced to start tightening policy to head off a strong run of reflation. Mild deflation as recently as May 2016 rebounded to a 2.0% annual increase for the headline reading of the Consumer Price Index in February.

But the flash data for March shows a moderate pullback to 1.5% and today’s update is expected to confirm that pace, based on the consensus forecast via TradingEconomics.com.

Core inflation, which is considered a more reliable measure of the inflation trend, posted a softer rise in March’s flash estimate, providing the ECB with more cover for delaying policy tightening. The 1.5% annual increase through last month dipped below the 2.0% gain in February.

Today’s revision for core inflation in March is expected to hold steady at 1.5%, matching the flash data. If the forecast is accurate, this crucial benchmark of the pricing trend will remain comfortably below the ECB’s inflation target of just below 2%.

In short, the crowd is expecting that today’s update will strengthen the ECB’s argument that the recent upturn in inflation doesn’t warrant a change in monetary policy.

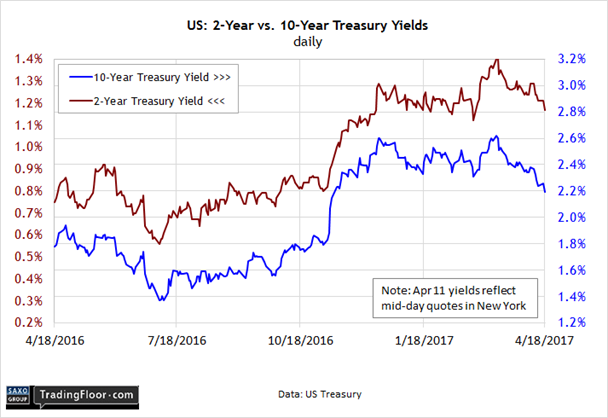

US: 10-Year Treasury Yield: The reflation trade continues to unwind, based on the 10-year Treasury yield.

Some (most?) of the unwinding may be driven by heightened anxiety in the wake of tit-for-tat military threats between North Korea and the US. Whatever the reason, the benchmark 10-year rate continues to slide as the appetite for safety ramps up.

In midday trading on Tuesday in New York, the 10-year Note was trading at just under the 2.19% mark – the lowest since November 10. In other words, the Trump bump that convinced investors to sell bonds (and thereby lift rates) is close to fully reversing.

Note, however, that the latest drop in yields has convinced some strategists that the slide has gone too far.

“We wrote last week that near levels of 2.20%, 10-year yields are fundamentally too low, and these are good levels for tactical selling of bonds,” an analyst at Macquarie Group advised on Monday in a research note.

Part of the reasoning for thinking that the latest yield dip may have run its course is the expectation that the Federal Reserve will continue to raise interest rates. If policy is set to tighten further, Treasury yields will probably bounce higher at some point. Although the market doesn’t expect that the central bank will squeeze policy at next month’s Federal Open Market Committee meeting, the probability of a rate hike is currently priced at roughly 40%, based on Fed funds futures on Tuesday.

The wild card is next week’s first-quarter GDP report, which by some accounts is expected to decelerate. The Atlanta Fed’s GDPNow estimate is particularly bearish, forecasting that Q1 growth will stumble to just 0.5% -- well below the modest 2.1% advance in the final quarter of last year.

Estimates from other sources are higher – the New York Fed’s nowcast, for instance, sees growth picking up to 2.6%.

But at the moment there’s a fair amount of uncertainty about the US economy’s forward momentum, which suggests that any rebound in the 10-year yield won’t start, if at all, until after next week’s GDP release.

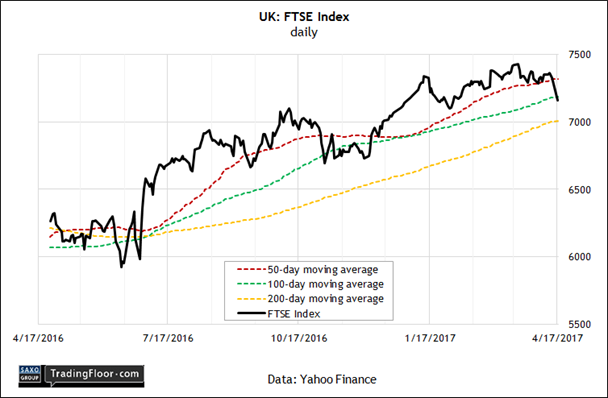

UK: FTSE 100 Stock Index: Brexit risk reasserted itself yesterday with the announcement by Prime Minister Theresa May for an early election in June. Hanging in the balance: the messy details of the risky negotiations for Britain’s exit from the European Union.

Investors reacted by dumping UK shares. The FTSE 100 Index dropped more than 2% yesterday, leaving the index at its lowest level since early February.

It’s unclear if the slide is a one-off event or the start of a prolonged decline that will reflect the market’s demand for a bigger discount in the face of a higher degree of uncertainty about how the Brexit negotiations will proceed.

May’s announcement certainly surprised markets – she previously said that she wouldn’t call for an early election. But the fractious politics of Brexit (and a fragile majority in Parliament) forced her hand. “The country is coming together, but Westminster is not,” she conceded on Tuesday.

The announcement leaves investors with the challenge of deciding how to reprice equities based on expectations for the June election. Although May and the Conservatives are expected to prevail, the contentious topic of Brexit leaves plenty of room for doubt.

"If we have a stronger government pushing for a ‘hard’ Brexit, markets won't like that,” noted a global market strategist at JP Morgan Asset Management. “But on the positive side, you would have more stable government for the UK.”

This much is clear: political risk has jumped significantly, again, for the UK. The equity market has decided to sell first and ask questions later.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.