Michael Burry buys puts on Nvidia, Palantir

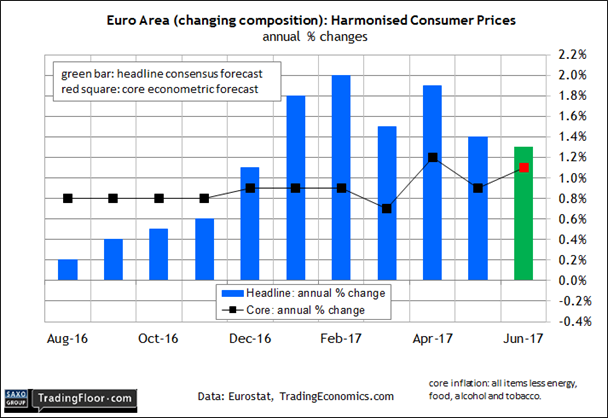

- Eurozone inflation should match the flash estimate in revised data for June

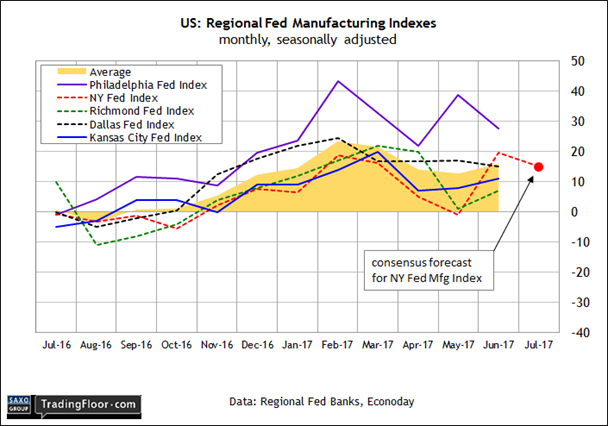

- The NY Fed Manufacturing Index is expected to reflect softer growth for July

- However a rival sentiment index for the sector paints a divergent outlook

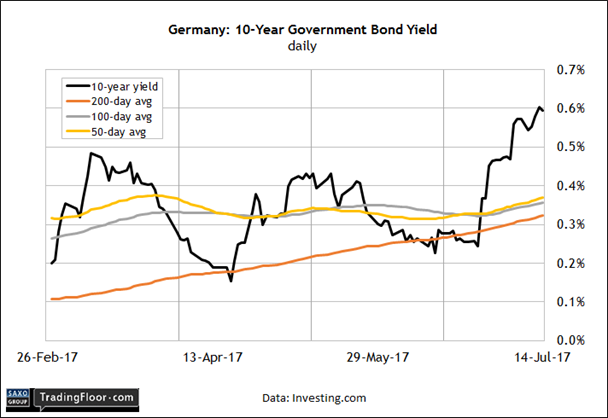

- The German 10-year yield is near a 19-month high ahead of ECB announcement

Revised June inflation data for the Eurozone will be published today, followed by an early look at US manufacturing activity in July via the New York Fed. Meantime, keep your eye on the German 10-year yield, which is close to a 19-month high ahead of Thursday’s European Central Bank policy announcement and press conference.

Eurozone: Consumer Price Index (0900 GMT)

No major announcements for monetary policy are expected on Thursday from the European Central Bank. Today’s revised data on consumer inflation will probably reaffirm the forecast for a relatively uneventful monthly policy announcement.

Divergent data ... In a sign of a bright future for US manufacturing, the ISM Index jumped to a three-year high last month, but the trend looks weaker in PMI data. Photo: Shutterstock

Economists are looking for headline inflation to hold steady at a 1.3% year-over-year rate for June, unchanged from the flash estimate, according to TradingFloor.com’s consensus forecast. Although that’s a firmer rate compared with numbers published for most of 2016, a 1.3% increase is at the low end of the range for this year so far. In January, headline inflation was running at 2.0%, roughly matching the ECB's target rate for inflation, which is just below 2%.

Core inflation, which is arguably a more reliable benchmark to follow, is on track to tick higher in June, albeit at a rate that’s softer than the headline’s trend. The crowd’s looking for a 1.1% advance in consumer prices excluding energy, food, alcohol, and tobacco – close to the strongest gain year to date.

Bottom line: today’s inflation data will probably give the ECB an excuse to keep policy on hold. If the recent improvement in economic growth is sustainable, as it appears to be, the central bank will soon be forced to begin the process of tightening. ECB President Mario Draghi may discuss that outlook in Thursday’s press conference, but any hints at policy changes are expected to focus on a gradual shift in the months ahead.

“So far the ECB has had an implicit bias towards increasing the size of the asset-purchase program, but this stance could change to a more neutral one, as the ECB will try to smooth the communication path towards the next tapering announcement in the fall,” analysts at Nordea wrote last week.

US: New York Fed Manufacturing Index (1230 GMT)

Manufacturing activity continued to expand in June, but a pair of sentiment indexes for the sector still paint diverging outlooks.

On the upside, the ISM Manufacturing Index jumped to a three-year high last month. The increase “provides further evidence that the prospects for the manufacturing sector remain bright,” noted an economist at Capital Economics.

The trend looks weaker via the Manufacturing PMI data. Although the index remained above the neutral 50 mark in June, the PMI fell to a 10-month low, signalling a “subdued” expansion. “Manufacturers reported a disappointing end to the second quarter, with few signs of growth picking up any time soon,” advised the chief business economist at IHS Markit.

Today’s update from the New York Federal Reserve will be widely read for an early clue on how the July profile for manufacturing is shaping up. The crowd’s looking for a modest pullback in growth: the bank’s benchmark is on track to edge down to 15.0 from 19.8 in June, according to TradingEconomics.com’s consensus forecast. But that’s still strong enough to suggest that the sector’s growth rate is firmer than the PMI figures suggest.

Late last month, European Central Bank President Mario Draghi gave bond markets a fright when he said that deflation was giving way to reflation. The comment triggered a selloff in bonds, driving the German 10-year rate up to nearly 0.5% in late-June – the highest in a year. Last week’s trading suggests that the market remains convinced that Draghi’s comment marks a regime shift.

The ECB has subsequently tried to ease anxiety among the fixed-income crowd, emphasizing that any tightening isn’t imminent and when it does begin the shift in policy will be gradual. In other words, Draghi and company will likely follow the Federal Reserve’s playbook for a kinder, gentler round of rate hikes.

Meantime, Draghi has emphasized that monetary stimulus will continue for now and any changes in the near term will be on the margins. But Europe’s benchmark 10-year rate is holding at just below 0.6%, the highest since December 2015.

Traders will be monitoring the German 10-year rate closely ahead of Thursday’s ECB policy announcement and the press conference that follows. For the moment, the crowd is expecting that the central bank will do little more than gently talk about policy changes to come. A persistent rise in the 10-year yield in the days ahead, however, would suggest that a hawkish surprise may be near.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 3 out of 4 global portfolios are beating their benchmark indexes, with 98% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?