Nvidia, AMD to pay 15% of China chip sales revenue to US govt- FT

- Gfk’s Consumer Climate Indicator is expected to hold steady at a 16-year high

- Economists expect US Consumer Confidence to remain near year-to-date high

- Will the bullish run for the euro continue? If so, will it pinch Eurozone exports?

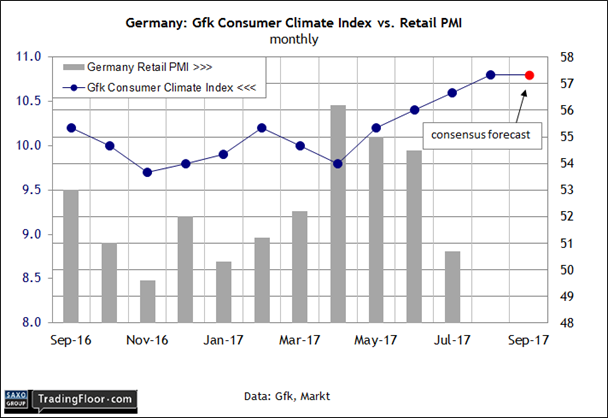

Consumer sentiment in Germany is in focus today with the monthly update of the Gfk Consumer Climate Indicator.

We’ll also see the August release of the US Consumer Confidence Index. Meantime, analysts are keeping an eye on the EUR, which continues to strengthen, raising questions about the outlook for Eurozone exports.

Germany: Gfk Consumer Climate Indicator (0600 GMT): Today’s update on consumer sentiment is expected to provide an upbeat profile for Germany’s economy.

Gfk’s Consumer Climate Indicator (CCI) has increased to the highest levels in more than a decade and the reading for what’s billed as a September forecast is on track to hold steady.

German consumers were in a “very positive mood,” Gfk reported last month. “Based on the estimations of German consumers, the German economy will develop positively over the further course of the remaining year.”

CCI’s 10.8 reading for August - a 16-year high - is expected to hold steady in today’s update, according to TradingEconomics.com’s consensus forecast.

Sentiment data from IHS Markit, however, suggests there may downside risk lurking. The Germany Retail PMI slumped sharply in June, falling to the lowest level since January.

Consumer spending is still expected to trend positive for the near term, but the rate of growth looks set to decelerate.

Perhaps, but today’s CCI release will offer some context for managing expectations. If the crowd is right and consumer sentiment more or less holds steady, the odds will remain low for anything more than a mild slowdown in spending.

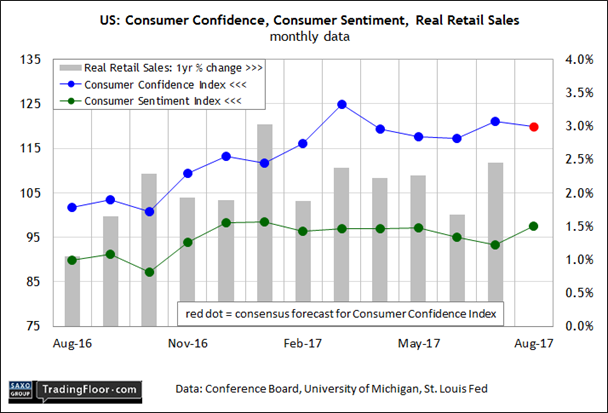

US: Consumer Confidence Index (1400 GMT): The outlook for consumer spending in the US is expected to receive a boost in today’s monthly update from the Conference Board.

Econoday.com’s consensus forecast calls for a slight decline in the Consumer Confidence Index (CCI) to 120.0 for August, down from last month’s 121.1. The forecast suggests that the benchmark will hold on to the lion’s share of recent gains.

“Consumers foresee the current economic expansion continuing well into the second half of this year,” the Conference Board’s director of economic indicators said in July.

Support for thinking that CCI will more or less hold steady can be found in the August data for the University of Michigan’s Consumer Sentiment Index (CSI), which perked up to a seven-month high for this month’s preliminary estimate.

“Consumer confidence rose in the first half of August to its highest level since January due to a more positive outlook for the overall economy as well as more favourable personal financial prospects,” said CSI’s chief economist.

The hard data trend looks encouraging too. Real retail sales rebounded to a 2.5% year-over-year rate in July, the most since January.

It all adds up to a compelling case for projecting another upbeat round of CCI data for August.

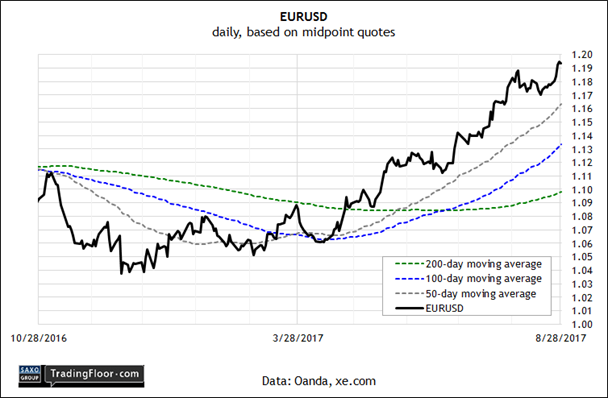

EUR/USD: Europe’s main economy continues to chug along at a healthy pace, but the ongoing rise of the EUR poses a headwind in the months ahead.

Touching a two-and-a-half-year high this week, EUR/USD’s strength, if it continues, could pinch Eurozone exports, which are a key component of economic activity.

By some estimates, the EUR’s long-run equilibrium rate against the USD is 1.25. Economic theory suggests that if the single currency rises above that level on a sustained basis, the euro area trade could suffer.

By that yardstick, the near term outlook remains productive with EUR/USD trading at just below 1.20 at midday on Monday.

The currency’s momentum profile, however, remains bullish. Reviewing EUR/USD’s trend via daily data suggests there’s still more upside bubbling.

Indeed, the 50 day moving average is still well above its 100-day counterpart, which is substantially higher than the 200-day average.

Meanwhile, European Central Bank President Mario Draghi’s speech over the weekend inspired buyers. “Draghi didn’t repress the euro bulls at his Jackson Hole speech on Friday,” advised the senior market analyst at London Capital Group.

“This has been perceived as a green light for speculation that the ECB may announce the much-expected quantitative easing tapering plans [at the bank’s] September 7 policy meeting.”

Short of a run of surprisingly weak economic data for the Eurozone in the days and weeks ahead, EUR/USD's positive bias is expected to hold firm.

The next date for an attitude adjustment via key macro figures arrives this Thursday, when Eurostat publishes new inflation and unemployment data for the euro area.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI