5 big analyst AI moves: Amazon PT hike, Apple lagging in GenAI race

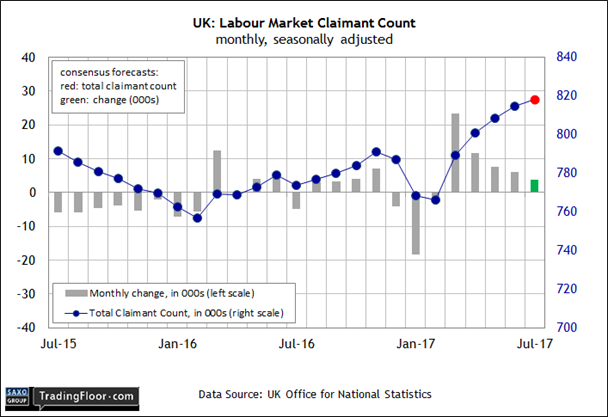

- Filings for jobless benefits in the UK are projected to rise again for July

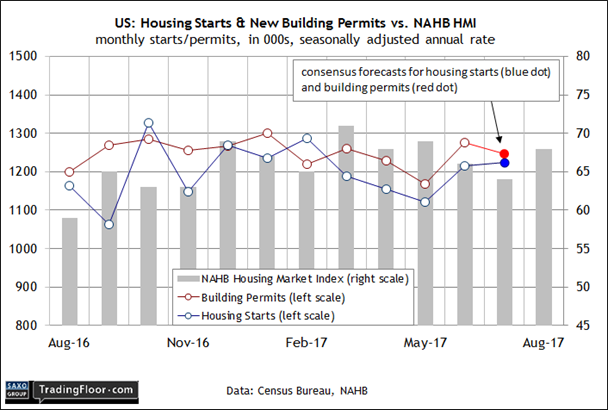

- US housing starts for last month are on track to post a modest uptick

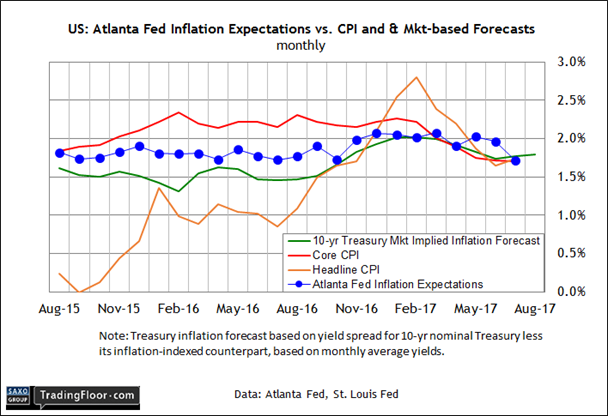

- Treasury yields point to tame inflation expectations in the Atlanta Fed survey

The British labour market is under scrutiny today with the government’s monthly report on jobs, wages, and related data. Later, the markets will focus on the US economy via monthly updates on new residential construction activity and the Atlanta Fed’s inflation survey via the business sector.

UK: Labour Market Report (0830 GMT)

Inflation held steady in July. The news surprised analysts, who projected a slight rise. Stable pricing, however, provides a degree of relief for the economic outlook by suggesting that the Bank of England can continue to delay rate hikes and thereby provide a high degree of monetary stimulus.

Growth hits home ... US housing construction may pick up later in the year if upbeat GDP estimates for the third quarter are accurate.

“We doubt that there will be any interest rate hike until at least late on in 2018 and it could well be delayed,” said an economic adviser at EY ITEM Club.

Steady inflation comes at a time of managing expectations down for the consumer sector, however “We see a modest recovery in the second half of this year in response to strengthening global growth and a weaker currency, but on the flip side, consumer spending is likely to be weighed down by weak wage growth and investment spending held back by Brexit-related uncertainty,” advised the head of UK macroeconomic forecasting at the National Institute of Economic and Social Research last week.

Today’s update on the jobless rate for July is expected to provide some upbeat news. Economists expect that unemployment will hold at 4.5% for a second month, marking the lowest level since 1975. But the claimant count is on track to rise for a fifth month, increasing by 3,700, according to TradingEconomics.com’s consensus forecast.

Wages growth could be the key number in today’s release. A softer pace may renew concern that consumer spending will suffer in the months ahead. But a degree of good news is expected: analysts see the annual rate for average weekly earnings including bonuses holding steady at 1.8%.

That’s still the weakest gain since late 2014 and well below the 2.6% inflation rate. But if wages growth stops falling, the news will provide a counterpoint to some forecasters who see trouble brewing for the UK economy in the months ahead.

US: Housing Starts (1230 GMT)

Confidence among executives in the home-building industry bounced back in August, providing support for thinking that construction activity may soon break out of this year’s range-bound trend.

The Housing Market Index (HMI) jumped to 68 this month, the highest since May. “The fact that builder confidence has returned to the healthy levels we saw this spring is consistent with our forecast for a gradual strengthening in the housing market,” said the chief economist at the National Association of Home Builders, which publishes HMI. “GDP growth improved in the second quarter, which helped sustain housing demand."

Estimates for today’s hard data on residential construction, however, look mixed. Econoday.com’s consensus forecast sees housing starts rising to 1.225 million units (seasonally adjusted annual rate) for July, a mild improvement over June’s 1.215 million. But both numbers continue reflect a middling run of building activity, relative to the data published year to date.

Construction activity may pick up later in the year, however, if upbeat GDP estimates for the third quarter are accurate. Among the firmer projections is the Atlanta Fed's GDPNow model, which is currently anticipating that growth will accelerate to a strong 3.5% pace in Q3 (as of August 9) from 2.6% in Q2.

By that standard, the upbeat outlook for the housing market may be reasonable after all.

US: Atlanta Fed Business Inflation Expectations (1400 GMT)

Low inflation is set to pick up by early next year, according to some analysts.

“We expect inflation to rebound in early 2018 for several reasons – this year’s depreciation of the dollar; a faster rise in wages as the labour market tightens; and the fading influence of transitory factors,” an economist at Capital Economics said this week.

If the prediction is right, firmer pricing will soon give the Federal Reserve more confidence to continue raising interest rates. The Treasury market appears to be embracing that possibility, if only tentatively.

In mid-day trading on Tuesday, the benchmark 10-year yield continued to rebound this week, rising to 2.26%. That compares with last week's close below 2.20%, the first dip below that round number since June. Although the latest pop follows weeks of trending lower, the reversal suggests that the crowd may be willing to re-evaluate the recent run of low-inflation forecasts.

Will today’s monthly update of business inflation expectations via the Atlanta Fed play along? Perhaps not, at least not yet. The implied inflation outlook via the yield spread on the nominal 10-year Note less its inflation-indexed counterpart continues to hold at roughly 1.8%, which is more or less in line with the last several months.

A 1.8% estimate of future inflation is just slightly above the 1.7% annual rate for consumer prices through July – a pace that’s below the Fed’s 2.0% target.

Inflation may be on track to firm up in the months ahead, but market data suggests that pricing pressure will remain relatively tame in today’s survey results from the Atlanta Fed.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.