- Italy's industrial production expected to rise in today’s update for June

- US labour costs for the second quarter are projected to decelerate

- Is this year’s GBPUSD rally wilting?

Italy’s surprisingly resilient run of encouraging economic news of late is expected to continue with today’s June report on industrial production. Later, a second quarter update on US labour costs will be widely read in the wake of a Federal Reserve official's forecast that low inflation will persist.

Meanwhile, all eyes in forex trading will stay focused on GBP/USD, which has weakened since last week’s dovish policy statement from the Bank of England.

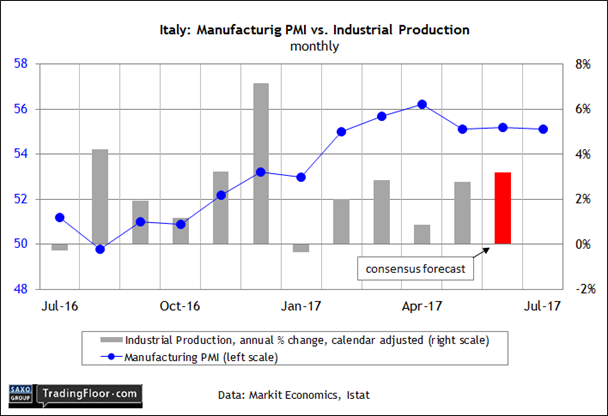

Steady move ... Italy's industrial activity for June is expected to record monthly output rising 0.2%.

Italy: Industrial Production (0800 GMT) The crowd will be eager to learn if today’s hard data on industrial activity brings another round of upbeat economic news for Europe’s third-largest economy.

Optimism and Italy’s economy have been in conflict for many years, but this year’s rally in the country’s stock market, supported by a run of upbeat data in recent weeks, suggests that recovery is finally taking root. The country’s growth overall continues to lag the pace in Germany, France, and Spain, but next week’s second-quarter GDP report is expected to deliver another positive number. If so, the news will reaffirm that Italy’s performance is enjoying its best run since the financial crisis.

Sentiment data certainly looks encouraging these days. The Italy Services PMI rose to a 10-year high last month and the Manufacturing PMI held steady in July, close to its strongest reading since 2011.

“The manufacturing sector made a bright start to the second half of the year, continuing its recent spell of solid growth with substantial gains in output, new orders and exports,” an economist at IHS Markit said last week. “The immediate prospects for the sector look secure, with growing backlogs pointing to capacity pressures and scope for further expansions in output and employment.”

Today’s hard data on industrial activity for June isn’t expected to derail the positive momentum. TradingEconomics.com’s consensus forecast sees monthly output rising 0.2% and the year-on-year pace picking up to a 3.2% gain.

“I’m not sure Italy can be called an over-performer, but it is keeping the pace and benefiting from the improved external environment,” the chief Italian economist at UniCredit in Milan told the FT this week.

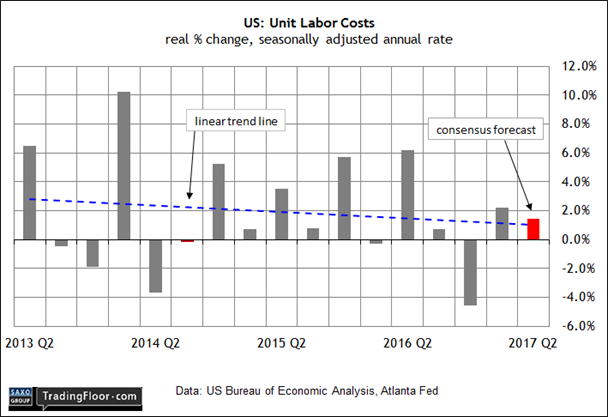

US: Unit Labor Costs (1230 GMT) St. Louis Fed President James Bullard asserted that low inflation in the US is here to stay, which suggests that the central bank's recent efforts to tighten monetary policy is misguided.

"Recent inflation data have surprised to the downside and call into question the idea that US inflation is reliably returning toward target,” he said in speech on Monday. “The current level of the policy rate is likely to remain appropriate over the near term."

Fed Chair Janet Yellen and most of her colleagues on the Federal Open Market Committee don’t necessarily agree. Nonetheless, it’ll be interesting to see if Bullard’s view resonates in today’s quarterly update of labour costs, a key input for inflation.

Econoday.com’s consensus forecast sees wage inflation slipping to a 1.4% annual rate for the second quarter from 2.2% in Q1. If the forecast is accurate, Bullard’s observation will ring a bit truer.

“Even if the US unemployment rate declines substantially further, the effects on US inflation are likely to be small,” he said.

Perhaps, although Friday’s July report on consumer inflation is expected to tick up slightly, touching 1.7% year-on-year for the headline measure. Nonetheless, Bullard’s analysis isn’t easily dismissed – as long as inflation holds below the Fed’s 2.0% target.

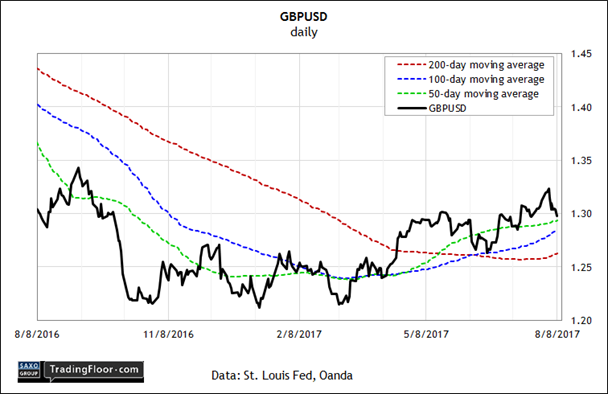

GDPUSD The Bank of England’s decision to keep rates steady last week appears to be weighing on the pound. Although sterling’s still sitting on handsome year-to-date gains against the US dollar, GBPUSD’s been weak since the BoE’s dovish verdict on August 3.

Leaving monetary policy unchanged wasn’t a surprise, but the news appeared to give GBPUSD bears a new reason to sell. As of midday trading on Tuesday, the GBPUSD had lost 2.5% since touching a 2017 peak of just above 1.325 on an intraday basis on August 3, the day of the BoE announcement.

On a longer-term basis, the pound’s technical profile remains bullish. But GBPUSD appears vulnerable to slipping below its 50-day average for a third time since June.

The question is whether GBPUSD will soon find support via firmer economic data. Tomorrow’s June report on industrial production may bring some relief. Economists expect a rebound in output after a mild decline in May. A downside surprise, on the other hand, will hand the bears with another incentive to short the pound.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.