What’s wrong with the housing market?

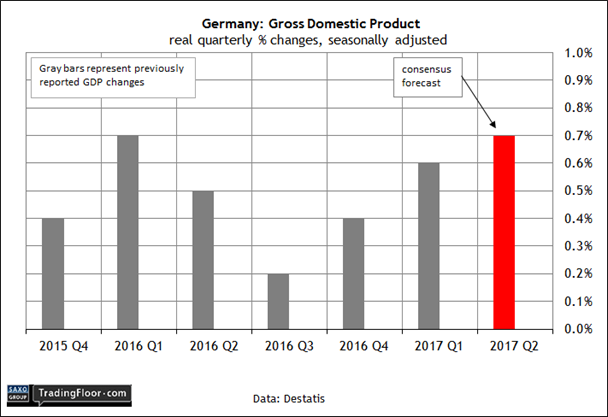

- Germany’s GDP growth projected to tick higher in first official Q2 data

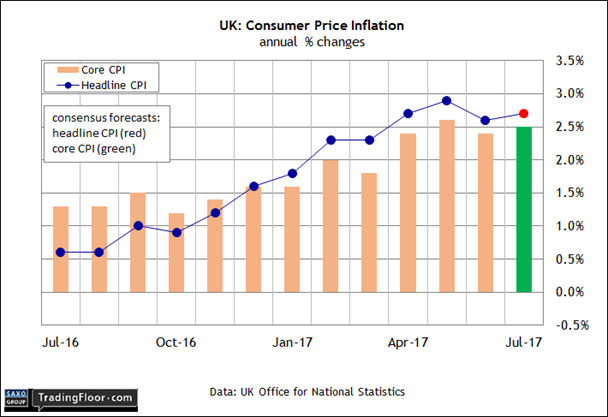

- Analysts are looking for a slightly faster pace of UK consumer price inflation

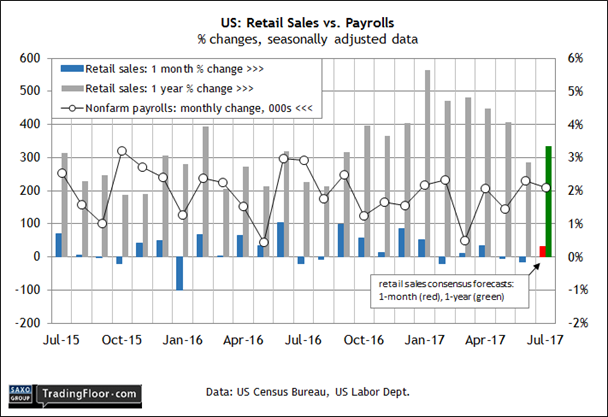

- US retail spending is expected to post its first monthly gain since April

Europe’s biggest economy is in the spotlight today, with the preliminary release of second-quarter GDP data. We’ll also see July numbers on UK consumer price inflation and US retail sales figures.

Germany: Q2 GDP (0600 GMT): Eurozone industrial production fell more than projected in yesterday’s update, but today’s preliminary estimate of Germany’s second-quarter gross domestic product (GDP) is expected to provide some upside relief for macro-related sentiment in the currency bloc.

Q2 growth for Europe’s largest economy is on track to tick higher, according to Econoday.com’s consensus forecast. Economists are looking for a 0.7% increase, slightly faster than Q1’s 0.6% rise and the strongest advance in more than a year. Note too that if the forecast is right, Germany’s output for Q1 and Q2 will deliver the strongest back-to-back quarterly growth rate since 2013.

In turn, upbeat economic news will bolster Chancellor Angela Merkel’s re-election prospects in next month’s elections. With just six weeks to go, she remains the favourite. “The polls show Martin Schulz’s SPD [the main opposition] trailing Merkel’s CDU/CSU alliance by about 14%, having been almost neck-and-neck just a few months ago,” The Guardian noted over the weekend.

To the extent that the broad macro trend in Germany is a factor in Merkel’s campaign, today’s data appears set to solidify her lead.

UK: Consumer Price Index (0830 GMT): Inflation eased in June after trending higher for months, but the upward bias is expected to resume in today’s July report for consumer prices.

The crowd’s looking for a 2.7% annual increase in the headline pace for the consumer price index (CPI) through last month, according to TradingEconomics.com’s consensus forecast. Although that’s still below the recent high of 2.9% in May, a firmer number will refocus attention on this year’s rebound in inflation. A year ago, in August 2016, CPI posted a weak 0.6% rise.

The head of European fixed income strategy at Scotiabank advised that higher food prices are a key part for hotter inflation readings. “Food price falls came to a fairly abrupt end in the aftermath of the Brexit vote, particularly on the back of the sharp fall in the exchange rate,” said Alan Clarke. “Overall, we view last month’s downward adjustment in inflation as temporary and the peak in inflation is yet to be reached.”

The Bank of England agrees, predicting that inflation will top out at 3% later this year – well above the central bank’s 2% target. For the moment, it’s unclear if faster inflation will trigger interest rate hikes in the near term. Although the BoE expects pricing pressure to rise further, the main catalyst is a weaker currency due to last year’s Brexit referendum, the bank explained in its August Inflation Report. “As the effect of rising import prices on inflation diminishes, domestic inflationary pressures gradually pick up over the forecast period.”

US: Retail Sales (1230 GMT): Consumer spending is expected to bounce back in July after edging lower in the previous two months.

Analysts see a moderate 0.3% advance for retail sales at the start of the third quarter, according to Econoday.com’s consensus forecast. The outlook will provide support for last week’s Reuters poll, which reflected a general outlook among economists that the US expansion will continue for at least another two years, albeit without accelerating.

“Expansions don't go on forever,” but “steady, moderate growth looks like it could stay in place for a while,” said a senior economist at Wells Fargo.

Today’s report could offer some marginal support for thinking so. In particular, watch the one-year trend in retail sales, which appears on track to strengthen to a 3.4% year-over-year rate, based on the implied change via the one-month forecast. If correct, the annual comparison through July will quicken for the first time since March.

One potential glitch: consumer confidence has weakened lately, due to a decline in the expectations data. Survey data tracking the current-conditions segment, however, is quite strong, rising to the highest level in more than a decade last month, according to the University of Michigan’s latest polling numbers. A key factor is the improvement in personal finances, noted the chief economist for the survey.

Based on expectations for today’s release, the hard data on spending for July is on track to reaffirm the upbeat consumer survey for current conditions.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI