As we enter the week of September 16th, 2013, everything appears to be hinging on the FOMC announcement Wednesday at 2pm EST. Chairman Bernanke will hold a press conference at 2:30pm EST which will be heavily parsed, to say the least. For a Fed which has had a major communication problem in recent months, the economic forecasts and forward guidance from Bernanke himself will be absolutely crucial.

Back in June I wrote that the Fed would need to “boil the frog slowly” as it began the journey toward ‘normalizing policy’. With the yield on the 10-year note knocking on the 3% door it will be interesting to see what, if anything, Bernanke does to walk back market expectations of Fed tightening.

Another surge higher in yields would almost certainly sink the stock market and the nascent recovery in housing, whereas a stabilization near current yield levels could set the stage for another all-time high in equities over the coming weeks.

Without further ado let’s examine the 3 most important macro-market charts as we enter a crucial week for global financial markets:

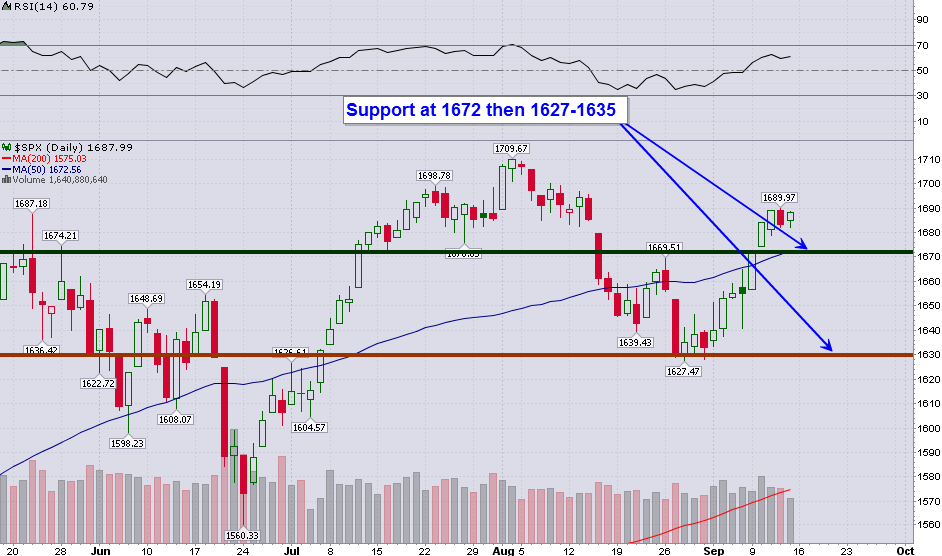

S&P 500

1672 is the first support of significance, which also happens to now coincide with the rising 50-day simple moving average.

10-Year Note Yield

3% is an absolutely massive technical and psychological level for the yield on the 10-year note. Meanwhile, any pullback in yields (rally in bond prices) is likely to find support near the rising 50-day simple moving average (2.70-2.75%).

Gold

Gold printed a potential bullish reversal candlestick on Friday which will need to be ‘confirmed’ higher today – $1350 is now resistance with support below near $1300. If gold is able to recover back above $1350 over the coming days, the door will be opened for a massive potential bottoming formation with a target of $1650+.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.