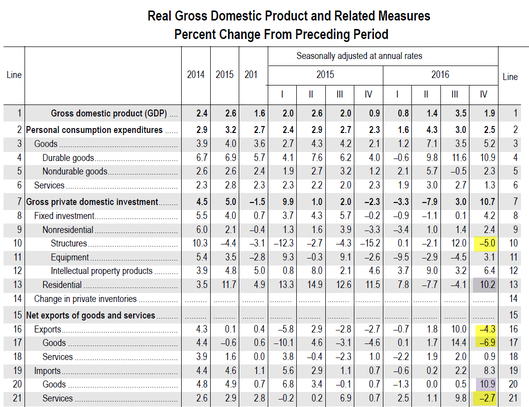

The BEA Advance GDP Report shows real GDP rose 1.9% in the fourth quarter, 1.6% for all of 2016.

The Atlanta Fed GDPNow Model missed the mark pretty badly. Its latest forecast, on January 26, was 2.9% for fourth quarter, a number I thought way too high.

The latest FRBNY Nowcast, from January 20, was close at 2.1%. Let’s take a look at what happened.

Troubling Areas

- Residential investment rose 10.2%. Is that going to last with home prices and interest rates both rising?

- Imports are up along with the price of oil.

- Nonresidential structures are down. With minimum wages rising and store saturation, what’s the incentive to build more stores?

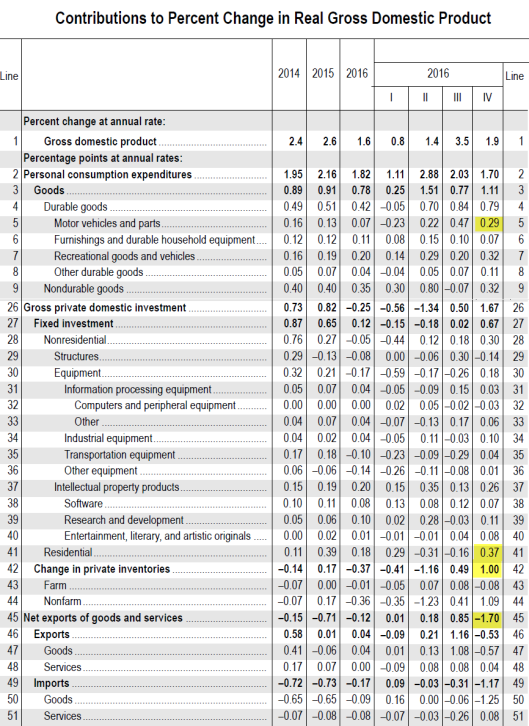

Contribution Troubling Areas

Private Inventories Added 1% to 4th Quarter GDP

- Private inventories added a full percentage point to GDP. That’s an inventory build that was not even needed.

- Motor vehicles and parts contributed 0.29 percentage points. Will that last?

- Residential investment added 0.37 percentage points. Will that last with interest rates rising?

- Net exports reflect rising oil prices, and a rising US dollar that has not hurt exports that much, yet.

Hike Three Times? Really?

Pundits believe the Fed will hike three times this year. In contrast, I have stated I doubt the Fed hikes at all.

With GDP at 1.6% for the full year, really think the Fed will hike thrice?

Global exports have collapsed. And we have not yet seen the effects of Trump’s seriously misguided protectionist trade policy.

This GDP report along with recent economic reports should be very troubling to the Fed. Let’s see what “soft patch” nonsense they spew in next week’s FOMC meeting.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI