This week’s bond review looks to the healthcare sector. DJO Global is a designer and manufacturer of products designed to help patients move – hip and knee replacement / implants, braces for rehabilitation, products to assist in pain management and physical therapy products, just to name a few. Since the beginning of 2017, DJO has began a transformation, focusing on reducing costs and increasing efficiencies, across the board. A year into this process, DJO’s first quarter 2018 results look promising.

- Operating income increased by 501.9% to 33.5 million from $6.7 million in the prior year period.

- Adjusted EBITDA increased by 13.2% year-over-year, to $64.8 million.

- Business transformation objectives are tracking to deliver 7-10% in annual cost reductions by the end of 2018.

- DJO’s International segment’s revenues grew 13.3% in the first quarter.

- Surgical Implant segment’s revenues grew 8.1%.

DJO management expects to build revenue momentum as the year progresses, with several new products planned in upcoming quarters. With healthcare being an essential service, companies within the healthcare industry tend to be less reactive to overall economic cycles. For this reason, diversification into the healthcare industry makes sense. DJO Global’s 2020 bonds offer diversification into the essential healthcare industry and make an ideal addition to Durig Capital’s Fixed Income 2 (FX2) Managed Income Portfolio.

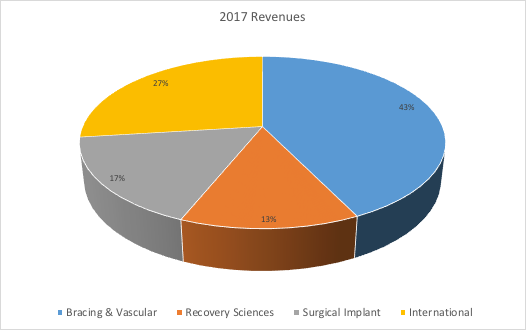

For its most recent fiscal year ending December 31, 2017, DJO’s revenues were broken down as follows:

Interest Coverage And Liquidity

DJO Global had operating income in its latest quarter of $ 61.1 million ( without the effect of depreciation /amortization). In Q1, DJO had $43.9 million of interest expense. Interest coverage for the most recent quarter was 1.4x. Although this ratio is on the lower end, DJO Global has good growth prospects and a good chance to improve their financials moving forward. Another issuer reviewed in the healthcare sector with similar risks and levels of interest coverage was Aurora Diagnostics in “14% YTM with Aurora Diagnostics..”. Historically, Q1 is the slowest quarter of the year for DJO, but investors should see increasing revenues as the year progresses.

As of March 31, 2018, DJO’s cash on hand was $34.6 million with $68.8 million available from DJO’s revolving credit facility, for total liquidity of $103.4 million.

Risks

The default risk for bondholders is whether DJO can fulfill its Business Transformation goals of cost reductions, new product revenue growth, and improved efficiencies in customer service and operations. DJO has stated that it is tracking toward producing 7-10% in annual cost reductions by year-end. The year over year increases in Q1 of adjusted EBITDA and operating income are positive signs. The seven new product launches for the Surgical segment in 2018 should continue to drive interest and sales in DJO’s products. DJO continues to streamline processes in ordering and distribution systems to better serve its customers. With the large, aging population in the United States and increasing obesity rates, demand for products produced by DJO Global should continue to increase. Therefore, the over 11.5% yield-to-maturity on DJO’s 2020 bonds appears to outweigh the risks identified.

Summary

DJO is in the midst of a Business Transformation. Results from first quarter 2018 look promising, with massive increases in operating income, along with double digit increases in adjusted EBITDA and international sales. DJO states it is on track to deliver annual cost reductions of 7-10% by year-end. Additionally, the surgical implant division has nearly tripled as a percentage of total net sales over past years and should continue to show healthy gains as the number of hip, shoulder, and knee replacements increase in the American population. With an aging population and increases in obesity rates, the market for DJO’s products is growing. These short 22-month bonds have a healthy yield-to-maturity of over 11.5% and include diversification into the thriving healthcare products industry. As such, these 2020 bonds, couponed at 10.75%, are an ideal addition to Durig Capital’s FX2 Portfolio.

- Issuer: DJO Finance LLC

- Coupon: 10.750%

- Maturity: 04/15/2020

- Ratings: Caa3 / CCC

- Pays: Semiannually

- Price: ~98.5

- Yield to Maturity: ~11.67%

Disclosure: Durig Capital and certain clients may hold positions in DJO’s April 2020 bonds.